USD/JPY

The USD/JPY pair broke down significantly during the course of the session on Friday, breaking the bottom of the shooting star that formed on Thursday. That of course is a negative sign, but we did bounce enough towards the end of the day to suggest that we will continue to find buyers in this market. The 104 level above is resistance that I think extends all the way to the 105 level. Ultimately I do think that we get above there, but it’s going to take several attempts. Pullbacks and show signs of support will more than likely continue to be buying opportunities. Because what happens you can probably anticipate quite a bit of volatility though.

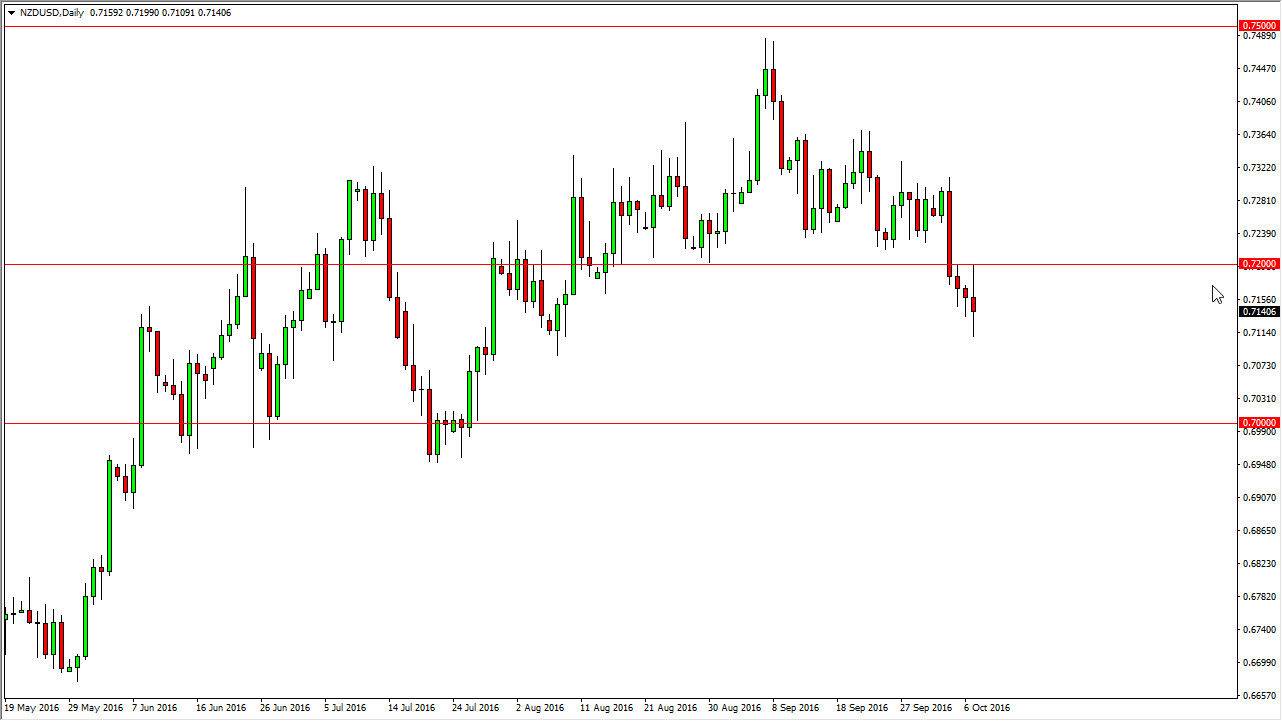

NZD/USD

The NZD/USD pair had a very volatile session during the day on Friday, crashing into the 0.72 level above. This is an area that had previously been supportive in the past, and it should now be resistive. The long wicks on both sides shows just how much volatility there is in this market place, and as a result I feel that the market should continue to drop from here but I think that it will be very difficult to hang onto all of this volatility.

Ultimately, I believe that the market should then go down to the 0.70 level below, and as a result I feel that the market will not be able to get above the 0.72 level, and if it does it would very likely signal a significant move higher but at this point in time it’s unlikely that we will do so. Ultimately, this is a market that I think continues to fall a bit due to the lack of risk appetite at the moment. The less than anticipated jobs number certainly won’t help that situation either, and of course you have to keep an eye on the commodity markets as the New Zealand dollar tends to be a bit of a “barometer” when it comes to those environments.