USD/JPY

The USD/JPY pair rallied during the day on Thursday, showing real strength yet again. However, we do get the Nonfarm Payroll Numbers coming out today, and this pair is highly sensitive to that announcement. I think that we are starting to get a bit overextended, so pullback is not only practical, it’s probably necessary. Those pullbacks that come, perhaps in the form of a knee-jerk reaction to the numbers, will be buying opportunities as far as I can see. With that being the case, I have no interest in selling this market and recognize that there is a lot of support below, especially near the 103 handle. I recognize that the 105 level above is massively resistive, so if we can break above there for some reason, this market will take off to the upside.

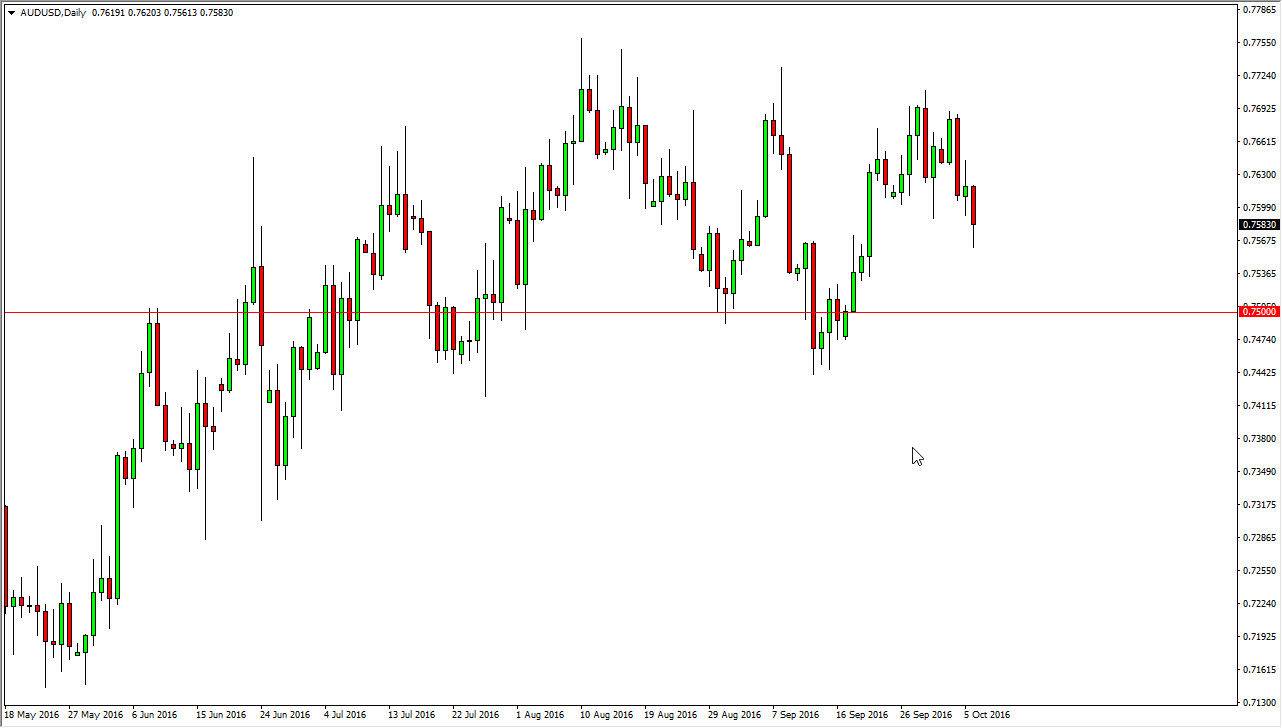

AUD/USD

The AUD/USD pair fell significantly during the day but did get a little bit of a bounce at the lows during the Thursday session. I believe that this market is going to continue to grind a little bit lower though, and perhaps reach down to the 0.75 level below which is a much more significant level than where we are at right now. I believe that short-term rallies will more than likely offer selling opportunities, and on signs of exhaustion, I am more than willing to start selling again, and I believe there is simply far too much in the way of noise above. On top of that, the gold markets of been melting down, so it’s hard to imagine that the Australian dollars can again any significant bullishness at this point.

If we can break down below the 0.75 level, this market will break down rather significantly just below there. With this, I feel that the market would then come completely undone, so that would be not only a selling signal, but it would be time to get overly aggressive.