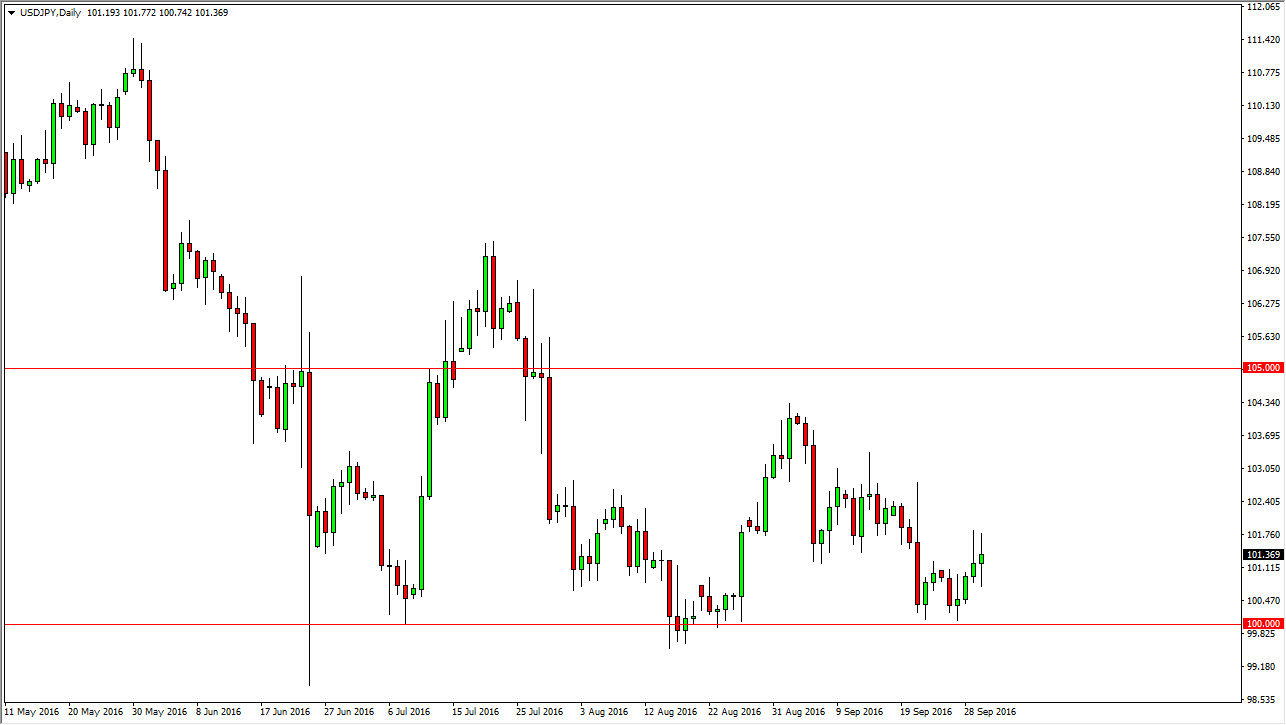

USD/JPY

The USD/JPY pair went back and forth on Friday as we continue to see quite a bit of volatility. The candle is somewhat neutral, but at this point in time the one thing that I am paying the most attention to is the 100 handle which seems to be a bit of a “line in the sand” when it comes to the Bank of Japan. I believe that they are going to defend that area through various moves and vocalizations, so it’s only pullback I’m looking at it as a potential buying opportunity. I recognize that there is a lot of noise above, so truthfully are going to have to be able to deal with some type of volatility if you’re planning on making money in this market.

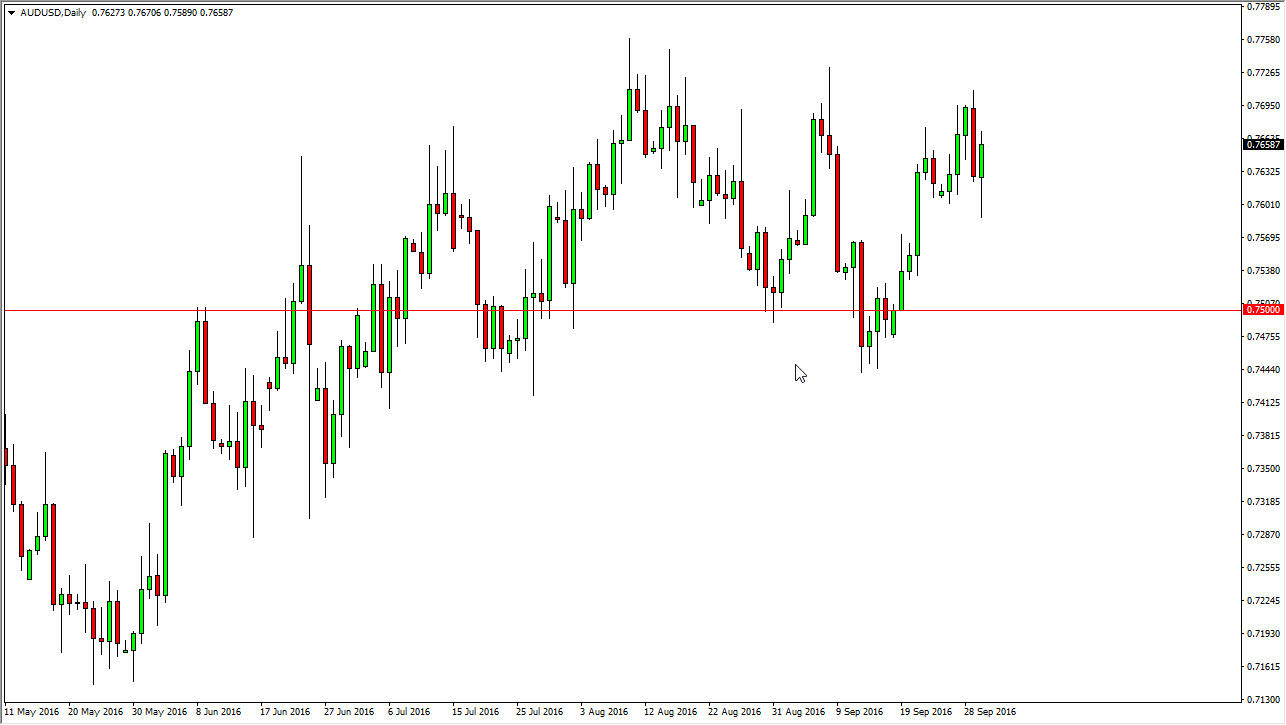

AUD/USD

The Australian dollar fell initially during the course of the day on Friday, but turned around to form a bit of a hammer. This is a nice turnaround as it appears the 0.76 level is offering some type of support. Ultimately, I believe that the market will run into a lot of trouble above, and as a result I’m not necessarily interested in buying this market. Every time we pullback, I believe there will be enough buying pressure underneath to continue to list this market, but a break down below the hammer could have us dropping down to the 0.75 level where there is much more support.

At this point in time, I think that this is going to be far too choppy of the market to be involved in, and as a result I don’t necessarily have a position that I want to take. I think that overall we have a little bit more positive bias, but we also have a massive amount of resistance to get above before we can take any serious trade for any real length of time. The easiest trade is probably buying pullbacks are short-term pops.