USD/JPY

The USD/JPY pair initially rallied during the day on Tuesday but found the 105 level be far too resistive yet again. However, we did reach higher this time so we ended up forming a shooting star which tells us that the market could very well pullback. I believe that this pullback is simply an opportunity to start buying at lower levels, but I see quite a bit of support also that can get me interested in going long as well, as the 100-day exponential moving averages just below, and of course the 103 level continues to offer quite a bit of support. The alternate scenario would be to break above the 105 level, which at that point in time would be reason enough to go long as we would have cleared a significant resistance area.

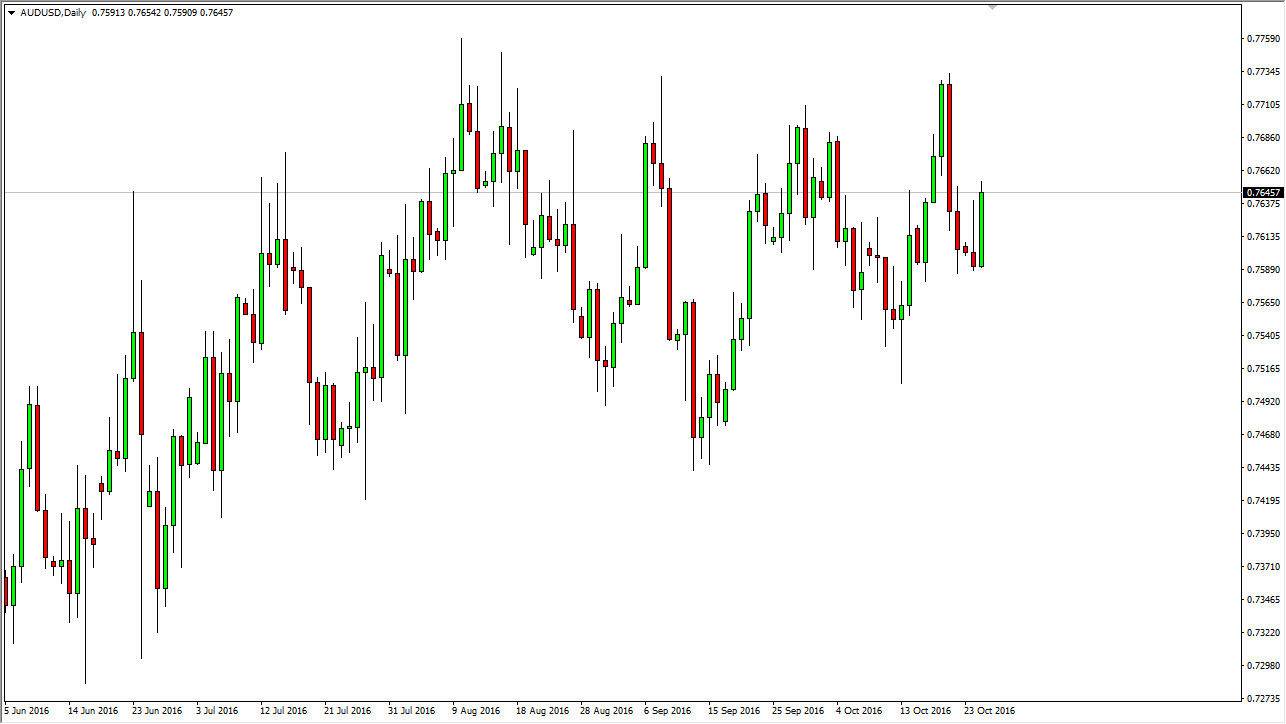

AUD/USD

The AUD/USD pair broke higher during the course of the day on Tuesday, clearing the top of the shooting star from the session on Monday. With that being the case, the market should continue to go higher, perhaps reaching towards the 0.7725 level above which has been so resistive. Ultimately, this is a market that has been grinding higher over the longer term, but at this point in time you have to recognize that it has been extraordinarily volatile. Ultimately, I do think that we go higher but I also recognize that the market is very choppy. With this, I believe that the market will eventually reach to the 0.80 level above, and with that if you are patient enough you might be able to pick up quite a bit of profit.

In the meantime, simply buying this market on short-term dips might be the way going forward, but at the end of the day I think that the commodity currencies, especially the Pacific currencies, will be difficult to trade as the volatility continues to cause problems.