USD/JPY

The USD/JPY pair initially dipped on Monday, but broke higher and then now looks as if it is trying to reach towards the 105 level. That is a significant amount of resistance, and as a result it’s likely that we will continue to bang up against that area, and if we can break above that level I believe that we will continue to reach towards the 107 handle. On the other hand, we could pull back and at this point in time I believe that the 103 level below will continue to be the “floor” in this market. Ultimately, this is a market that should continue to see plenty of bullish pressure due to the Bank of Japan’s stance, and of course the fact that the United States should have at least one interest-rate hike relatively soon.

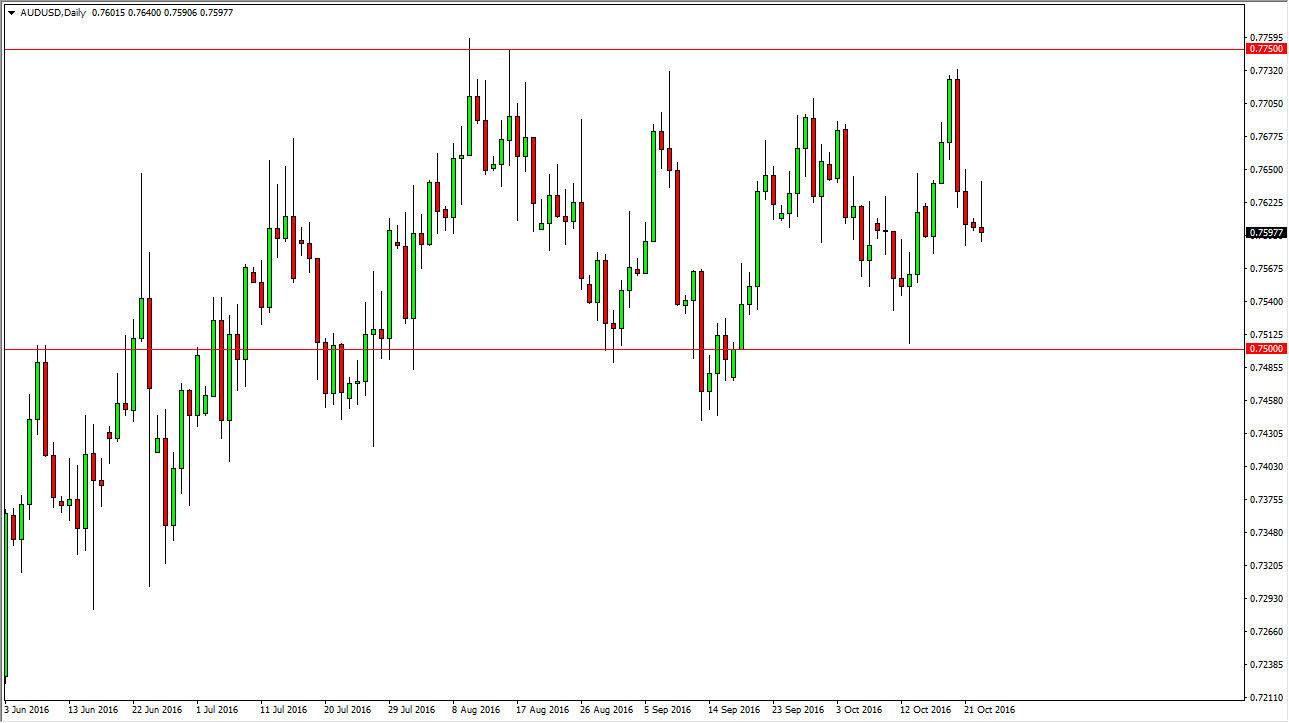

AUD/USD

The Australian dollar initially tried to rally during the course of the session on Monday, but turned right back around to form a shooting star. Ultimately, the shooting star suggests that the market could drop down to the 0.75 level below. Ultimately, a break down below the bottom of this candle has me selling but only for the short-term. I think that sooner or later the 0.75 level continues to offer a bit of a “floor” in this market, so therefore I don’t think we go lower than that. On the other hand, if we break above the top of the shooting star, the market should then reach towards the 0.7725 handle above. With this being said, pay attention to the gold market, because quite frankly the gold markets offer quite a bit of momentum for this market, as the longer-term correlation tends to be very positive. If we can break above the 0.7750 level over the next several sessions, the market could break out for the longer-term move.