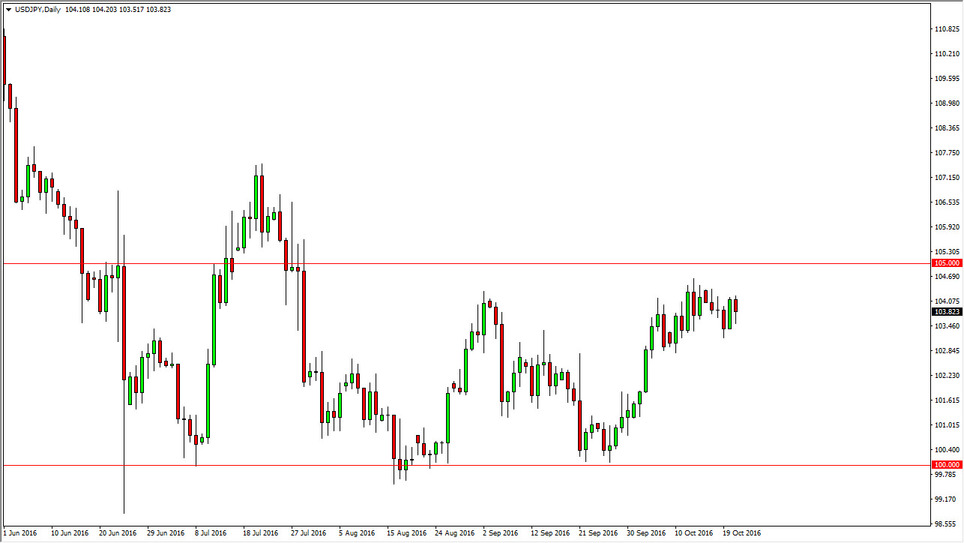

USD/JPY

US dollar initially fell during the course of the day on Friday but did find enough support below to turn things around and form a bit of a hammer. That hammer of course is a very bullish sign overall, but we have significant resistance just above. With this candle tells me is that the market is continuing to try to build a bullish pressure. By doing so, I feel that we will eventually reach above the 105 level, which would signal a longer-term bullish pressure. Pullbacks at this point in time should continue to find support, and I believe that the 103 level below is essentially the “floor” at this point in time. With that in mind, I continue to buy dips but I am realistic in the sense that I think it’s only a matter of time before we pull back again and again while trying to build up momentum.

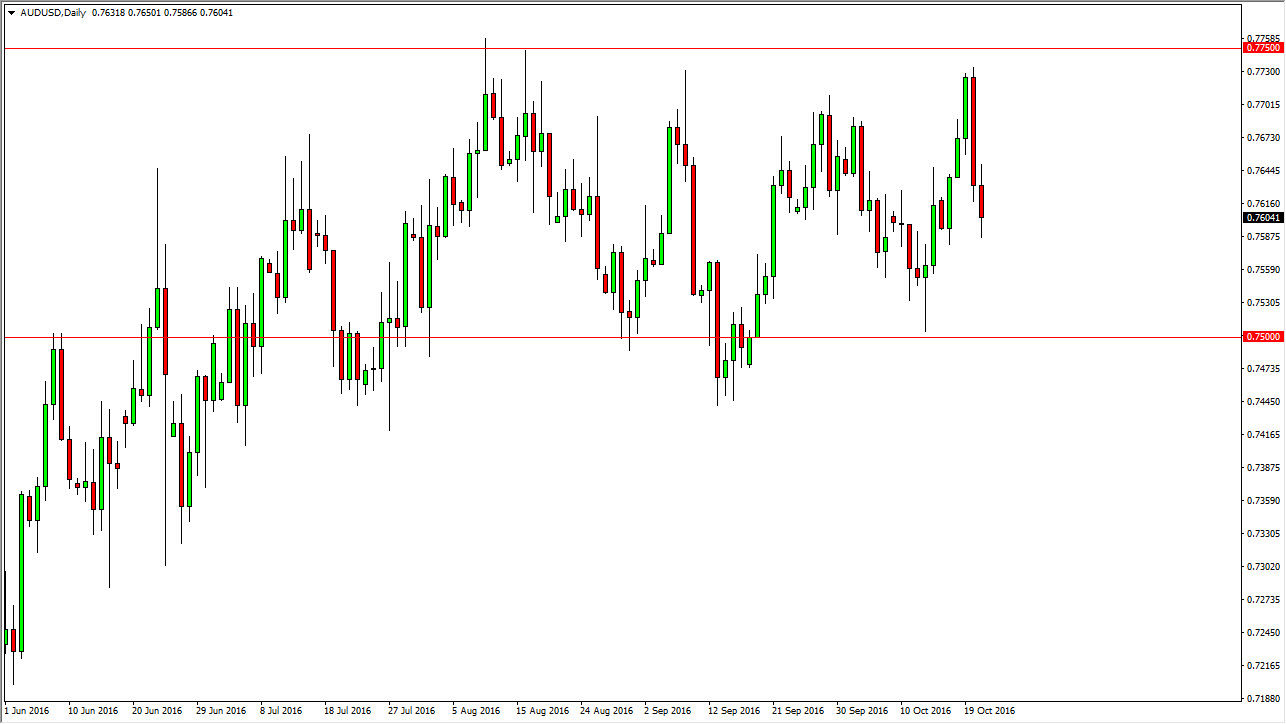

AUD/USD

The Australian dollar fell again during the day on Friday as we continue to see quite a bit of volatility in this market. The negative pressure of course is simply an extension of the overall consolidation between the 0.75 level and the 0.7750 level. With that in mind, I feel that sooner or later the buyers will return, and a supportive candle would be exactly what I would look for in order to go long yet again.

Keep in mind that the gold markets tend to be very influential when it comes to the Australian dollar see what the pay attention to them as well as there is a strong positive correlation between both markets. The gold does breakout and continue to show real strength, likely that the Australian dollar will go higher given enough time. Of course, the opposite is true as well, so we break down in the gold markets, it’s likely that the Australian dollar will do the same.