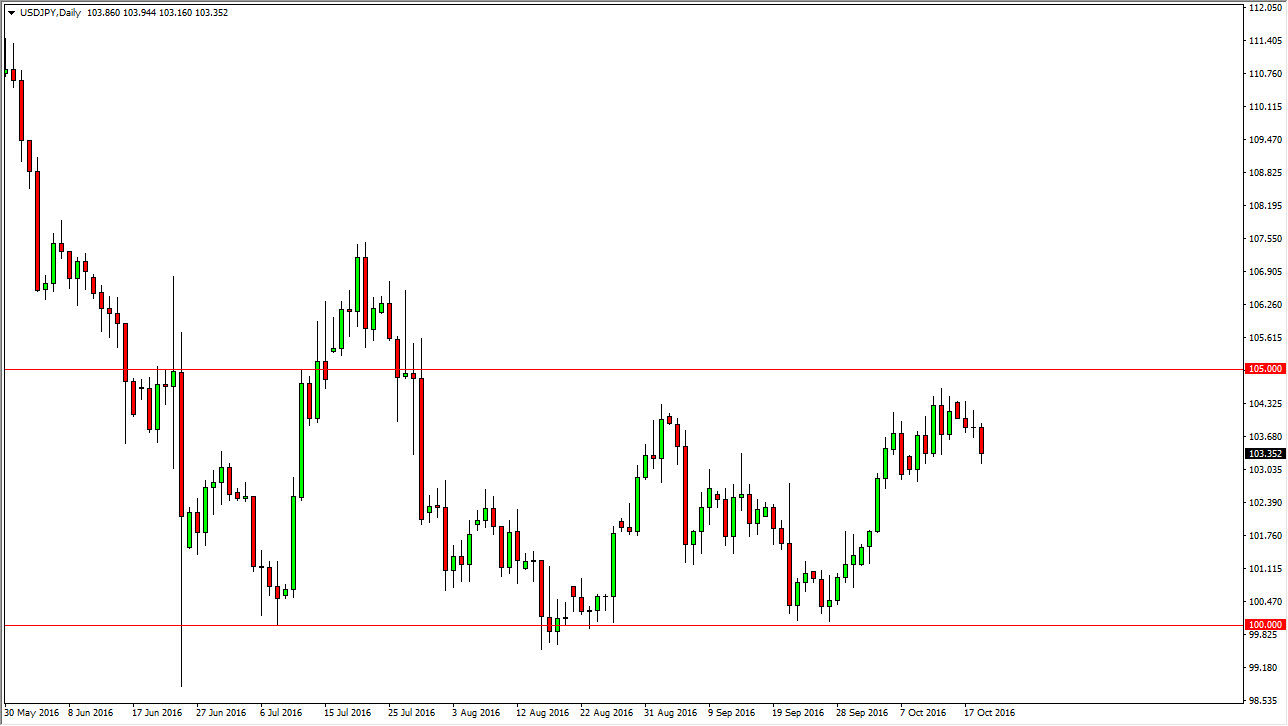

USD/JPY

The USD/JPY pair fell during the day on Wednesday, as we continue to roll over from the recent surge higher. Ultimately though, I do think that we are going higher over the longer term and at this point in time I think there’s a bit of a “floor” at the 103 level. Even if we broke down below there, I think there are plenty of places where the buyers could step back into this market, and I still believe that the “line in the sand” as far as the Japanese central bank is concerned is to be found near the 100 handle. In other words, I think we are going to pull back from time to time, but that’s only going to offer short-term buying opportunities. If we can break above the 105 level, it’s likely that we would then reach towards the 107 level above that.

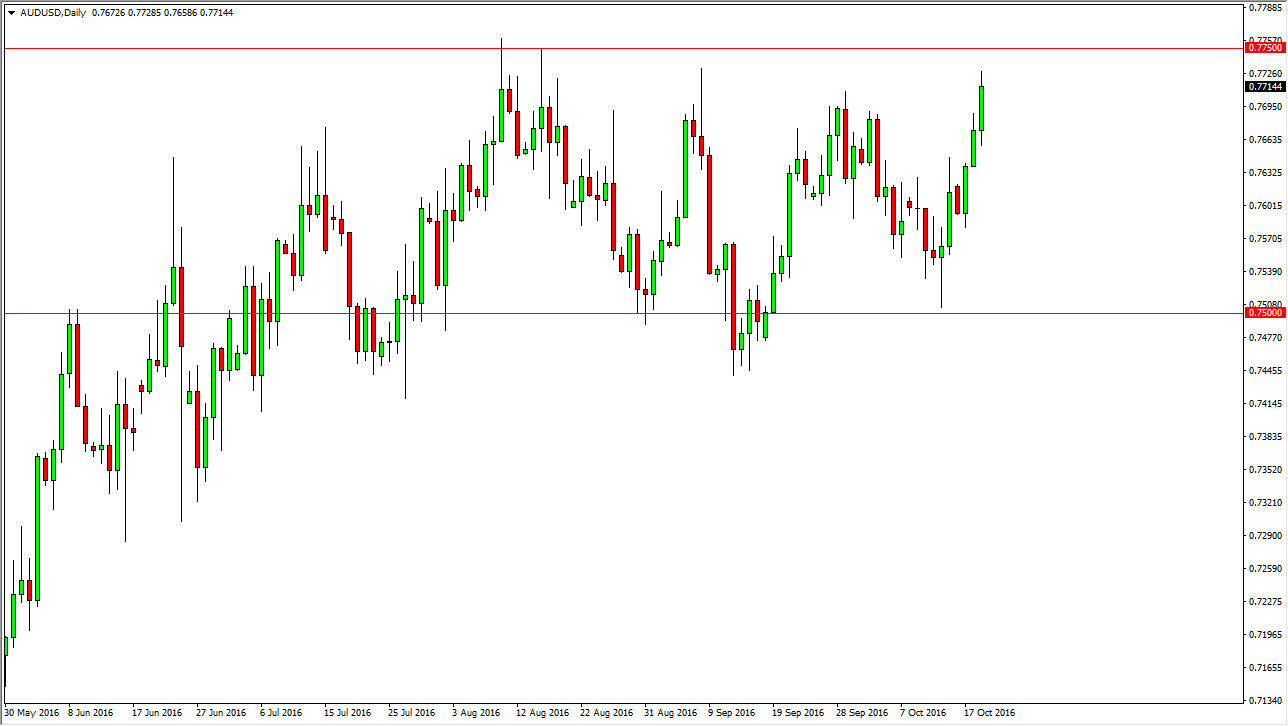

AUD/USD

The Australian dollar initially fell during the day but then shot higher after the softness dissipated. It looks as if we are trying to break towards the 0.7750 level, and a move above that would of course be very bullish. After all, this area has been rather resistive lately and has defined the top of the consolidation zone that the market has been working in. However, it’s likely that we may not build a break above there as we are getting a bit extended at this moment, so pullback could just simply be a momentum building exercise, something that quite common for trends they continue to extend and of course an attempt to break out a pretty significant consolidation overall.

Pay attention to the gold markets, they are starting to perk up a little bit, and that of course is bullish for the Australian dollar in general. If they continue to break higher, especially if we can break above the $1280 an ounce level, I believe that the Australian dollar will follow suit. In the meantime, I look at pullbacks as potential value in this market.