USD/JPY

The USD/JPY pair initially tried to rally on Monday but then turn right back around to form a fairly negative candle. This shooting star of course suggests that we are going to go lower from here but I think there is more than enough support underneath the keep this market higher. The 103 level below should continue to be massively supportive, and with that being the case I feel it’s only a matter time before we form a supportive candle that we can go long on. On the other hand, if we continue to go higher and break above the 105 level, this is a market that could go much higher. The Bank of Japan continues to work against the value of the Japanese yen in general, so I do believe that buying is essentially the only thing you can do at this point in time.

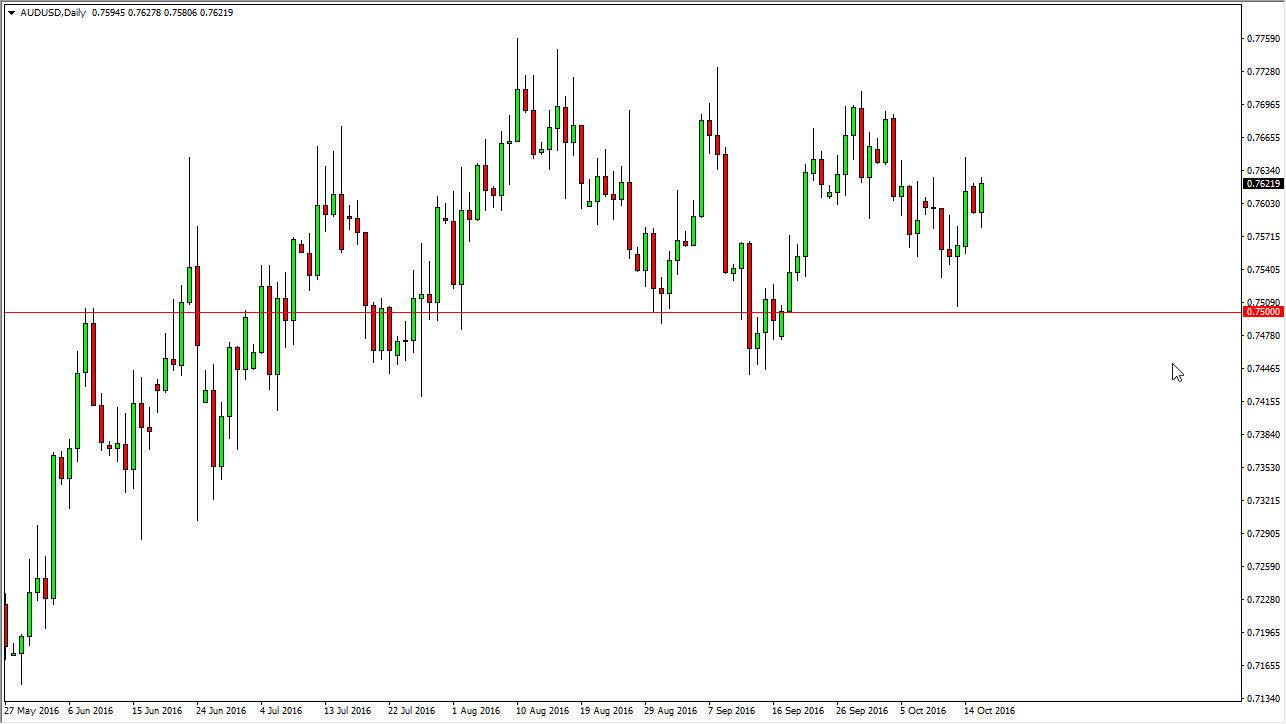

AUD/USD

The Australian dollar fell initially during the course of the session on Monday but turned right back around form a positive candle. With this being the case it looks as if we are going to try to grind our way higher but I recognize that the 0.77 level above is massively resistive. A pullback at this point in time should continue to find support all the way down to the 0.75 level, and as a result I’m waiting to see whether or not a supportive candle presents itself, and I believe that the 0.75 level below is essentially the “floor” in this market.

Keep in mind that the gold markets have a massive influence on the Australian dollar in general, so as it rises, so does the Aussie. Of course the opposite is definitely true, so having said that I feel that the market is essentially can offer buying opportunities but you also have to keep in mind that it is going to be very volatile as there are minor support and resistance levels all over the chart.