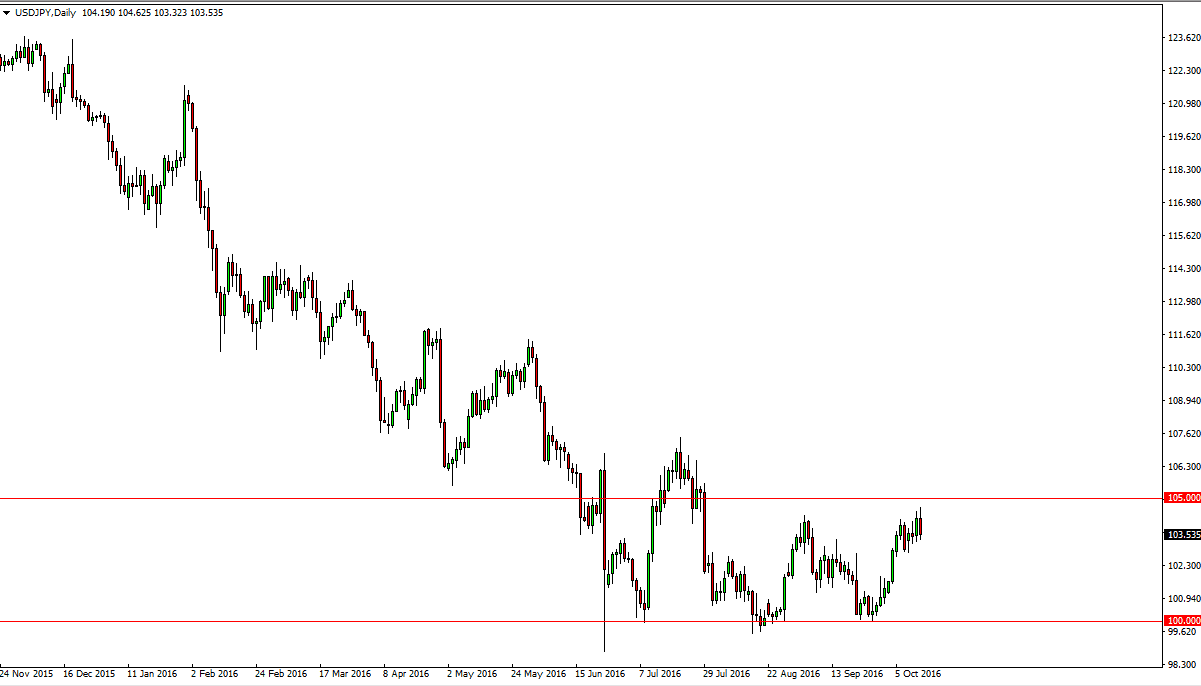

USD/JPY

The USD/JPY initially tried to rally during the course of the session on Thursday, but found the area close to the 105 level would be a bit too rich for the buyers. This makes sense, as we have been grinding our way higher and we are a bit overbought, but most importantly we are at the top of consolidation. In other words, a pullback from here makes perfect sense but I do see a lot of noise just below and as a result I think that sooner or later the buyers will come back into the marketplace at a higher level than previously. I still believe that the 100 level continues to be the “line in the sand” when it comes to the Bank of Japan. On the other hand, if we just shoot straight up from here and finally cleared the 105 level, that is also a buying opportunity.

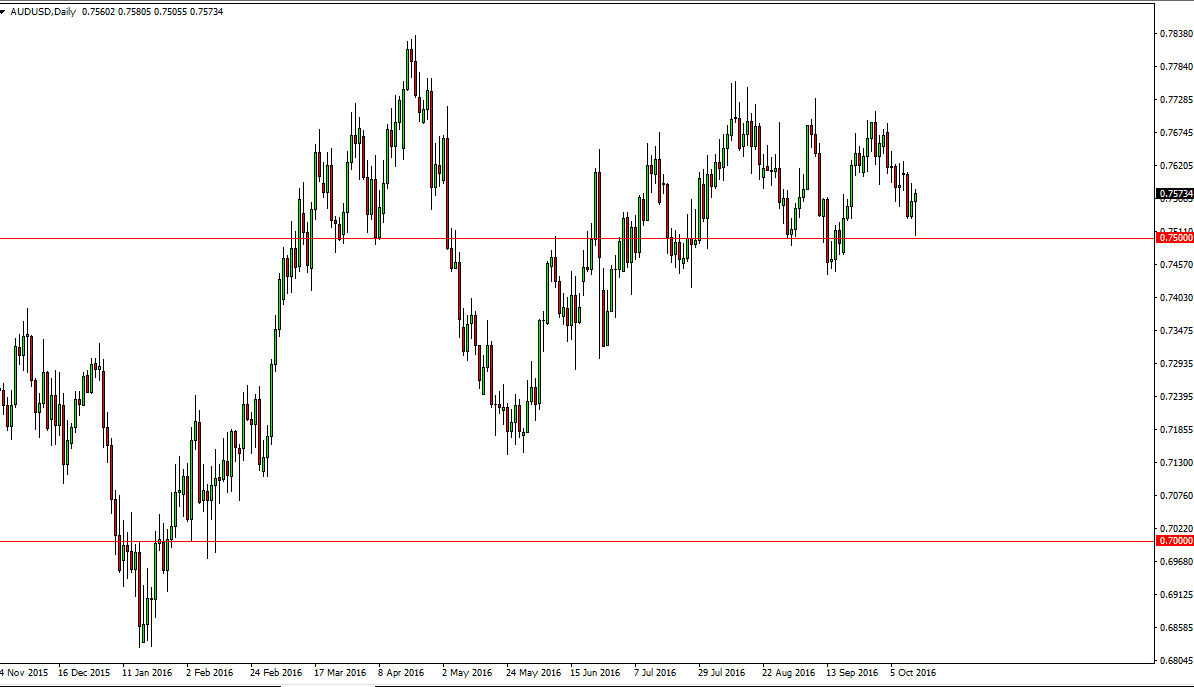

AUD/USD

The Australian dollar fell during the day on Thursday, and rather significantly. However, we found in the support of the 0.750 turn things around for a bit of a hammer. The hammer, one of the most bullish candlesticks that you will see normally has buyers coming in. If we can break above the top everything we could grind our way back towards the 0.77 level above. That’s an area that is rather resistant, and I do not expect to get above there. The one thing that could change things is if the gold market start rallying rather strangely. Until that happens, I am a bit hesitant to get too involved in the Australian dollar but this is a relatively strong signal, so I believe that a short term buying opportunity may be presenting itself.

If we break down below the bottom of that hammer, that would be an extraordinarily bearish sign and could send this market much lower, at least to the 0.74 level in the short run, if not down to the 0.72 handle.