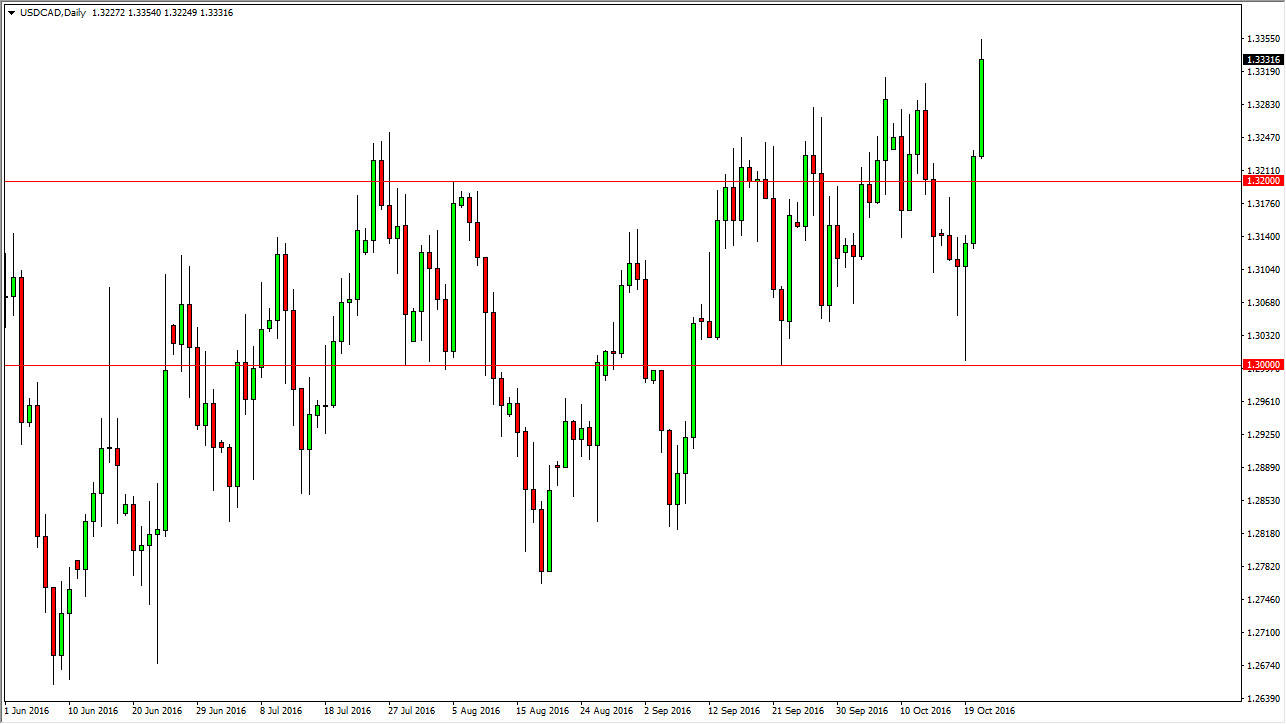

USD/CAD Signal

Risk 0.5%

Can be taken anytime of the day

Long Trade 1

• go long USD/CAD at 1.3355

• stop loss at 1.3225

• move stop loss to break even once 50 pips in profit

• target 1.35

Long Trade 2

• on a pullback that shows the 1.32 level to be supportive, start buying

• stop loss would be at 1.3185

• target would still be 1.35

USD/CAD Analysis

With the breakout that we have seen during the Friday session, this is now a “one-way trade” for the time being. There is more than enough support below to make selling far too risky. I believe that a break above the highs from the session on Friday will only be a continuation of bullish pressure, but I also recognize that a pullback could come. If it does, as long as we can find support or a bounce off of the 1.32 handle, I have no interest whatsoever in selling. This will be especially true if the oil markets start falling as they are so heavily influential on the Canadian dollar.

There are no announcements that should move this market significantly today