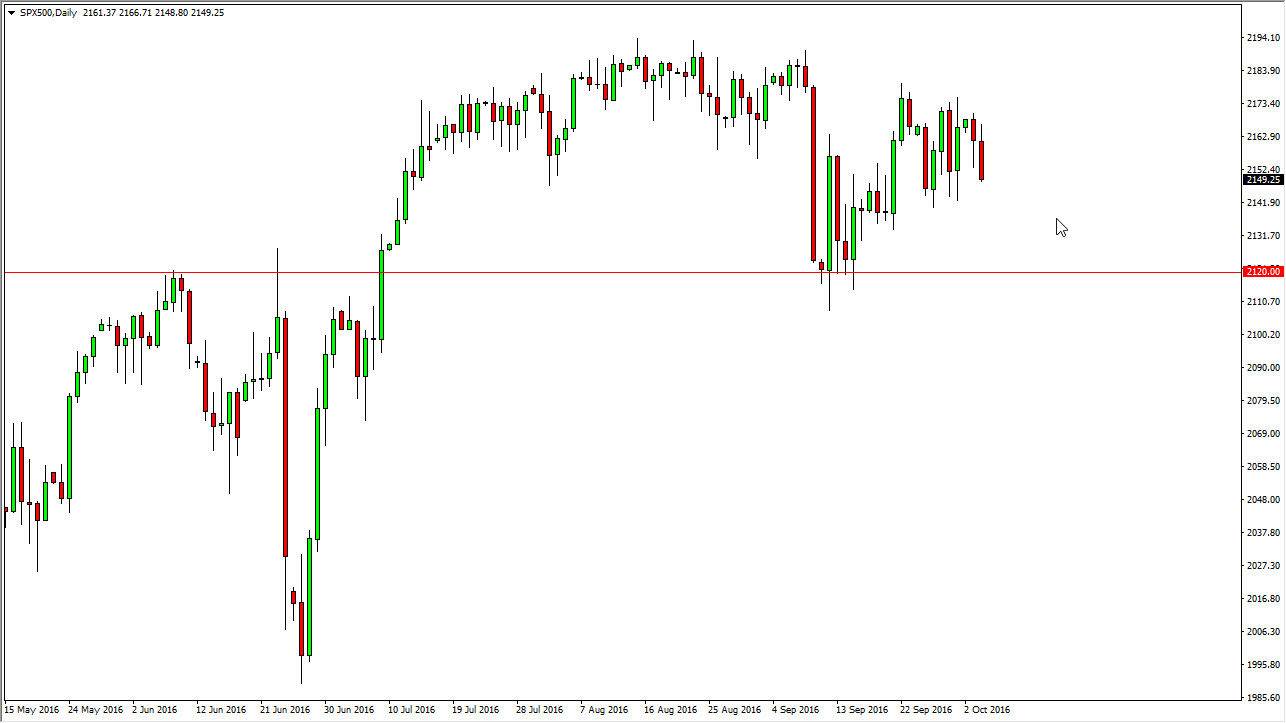

S&P 500

The S&P 500 initially tried to rally during the day on Tuesday but fell rather significantly as we now look like the sellers are starting to make a bit of a statement. With this being the case, it’s likely that the market will continue to grind a bit lower, perhaps reaching down towards the support level at the 2120 handle. This is the “floor” in this market, and as a result it’s only a matter of time before we find buyers in this market. The interest-rate situation of course is still fairly negative, and as a result I do believe that we will continue to see buyers given enough time. Ultimately, the knee-jerk reaction to the Federal Reserve President of the Richmond branch during the day suggesting that the interest-rate level in the United States is far too low, and it could be as high as 1.5% at the moment. Ultimately, this reaction is a short-term anomaly, and I believe that we will continue to go higher.

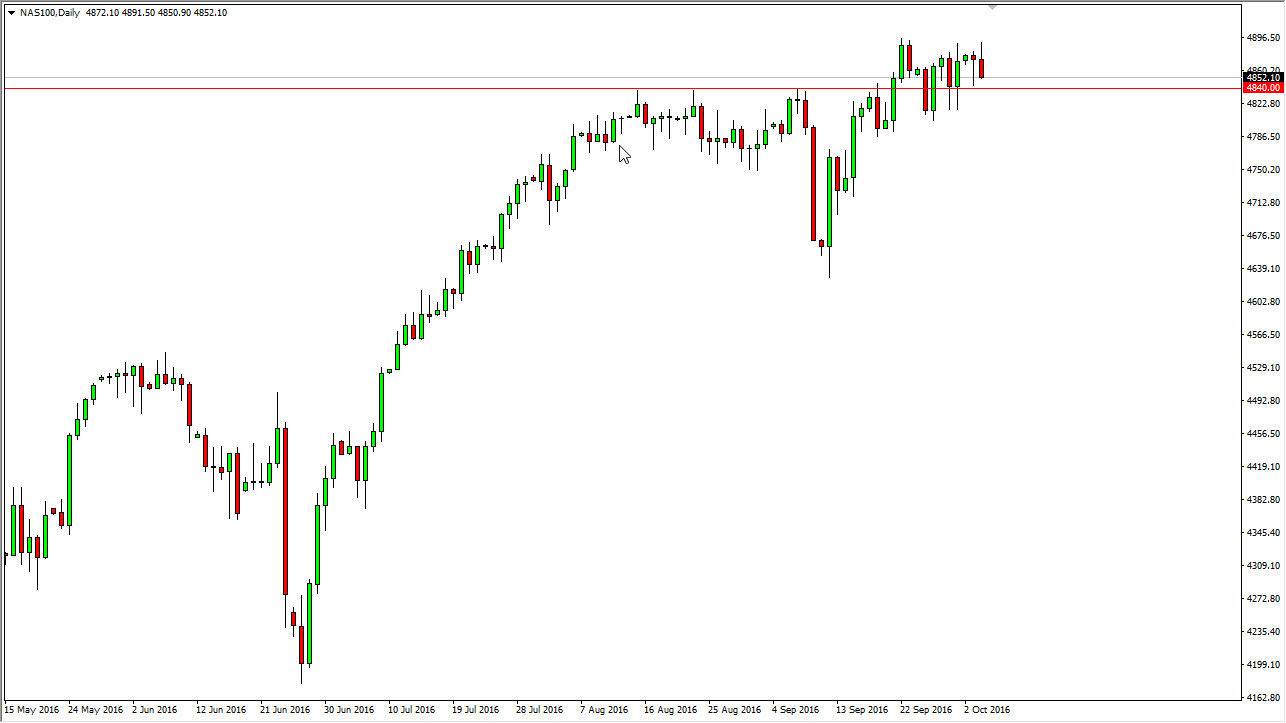

NASDAQ 100

The NASDAQ 100 initially rallied during the course of the session on Tuesday, but turned right back around to fall towards the bottom of the support level at 4840 or so. Ultimately, I believe that the buyers will return, and as a result we should continue to go much higher and perhaps reach towards the 5000 level. There is a significant amount of support below the 4840 level as well, so at this point in time it’s difficult to imagine that the market will be able to fall for any real length of time.

If we break above the top of the candle, we will see quite a bit of bullish pressure enter the market at this point in time, and with that being the case the market should continue to go even higher and a much quicker manner.