S&P 500

The S&P 500 initially tried to rally during the course of the day on Tuesday but turned back around to form a negative candle. Ultimately though, I see a massive amount of support below, extending all the way down to the 2120 handle, but we don’t have the right supportive candle to start going long yet. We could also break above the top of the range during the course of the day on Tuesday, and we do think the market would then reach towards the 2175 handle. This is a market that has plenty of support below, so the only thing I can do go long at this point in time, but at this point I recognize that it’s going to be a lot of noise between here and the upside, so with this it’s very difficult to trade, but if you are patient you should be able to make money to the upside.

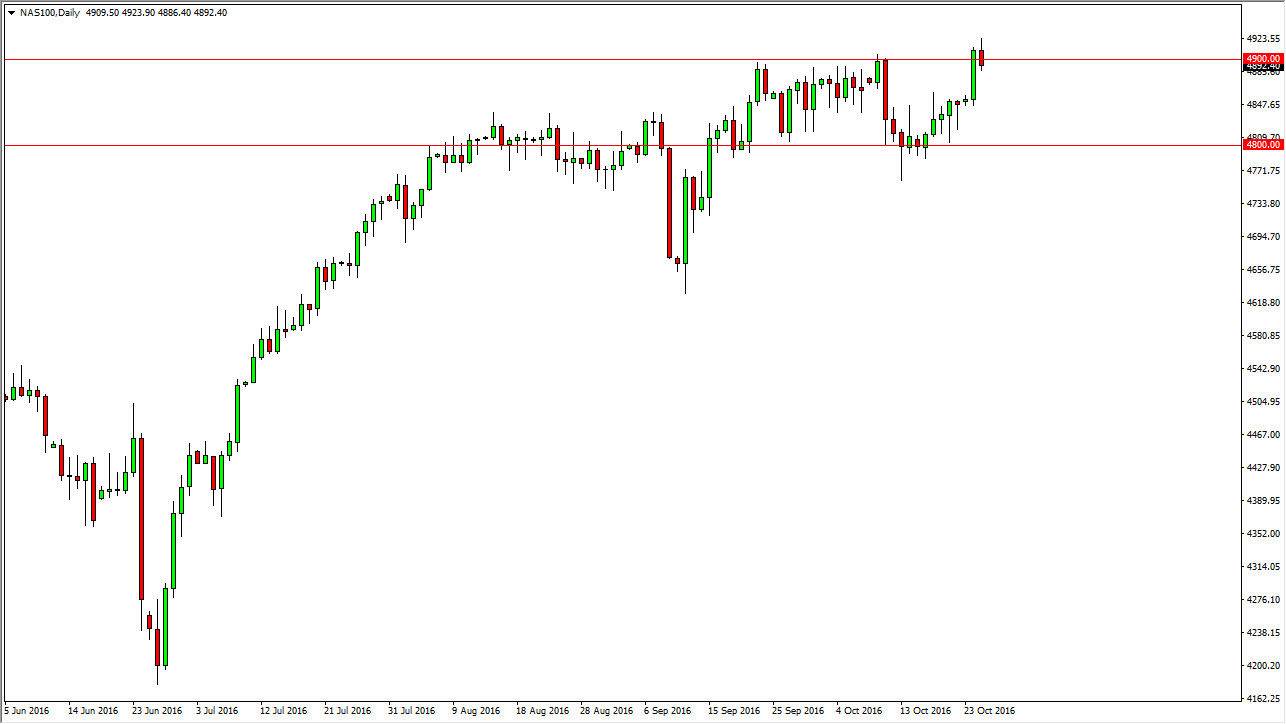

NASDAQ 100

The NASDAQ 100 initially tried to rally during the course of the session on Tuesday, but pulled back below the 4900 level one point. Ultimately though, I believe that there is a lot of support just below, as we should continue to go higher, and reach towards the 5000 level which is been my longer-term target for some time. I believe that the “floor” in the market is somewhere towards the 4800 level, as the market continues to look bullish from the longer-term perspective and of course we have a low interest rate environment that we are working with. With this being the case, I have no interest in selling and I believe that sooner or later the buyers will overwhelm the sellers, and we will reach my longer-term target. In fact, I would not be surprise at all to see this market break above the 5000 level beyond that, but first things first, we need to find supportive action