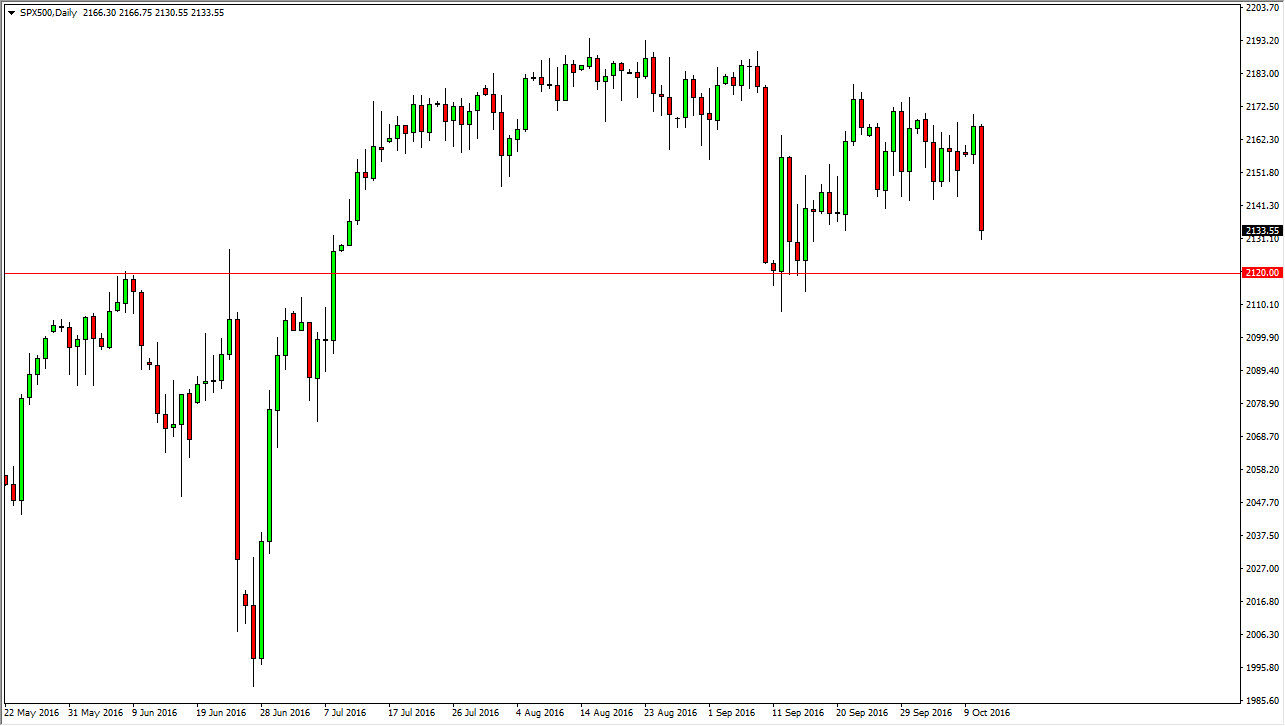

S&P 500

The S&P 500 fell rather significantly during the course of the session on Tuesday, as we saw quite a bit of volatility in the markets. However, I think that the 2120 level below should be rather supportive, and possibly even extend all the way down to about 2000. With that being the case, I have no interest in selling them I look at this potential pullback as value that we might be able to take advantage of going forward. The first signs of support near the 2120 handle would have me very interested in going long. Having said that, I have to admit that the candle was very negative, and that of course is something to pay attention to but as things stand right now, we are still very much in the uptrend and overall consolidation of the last several months.

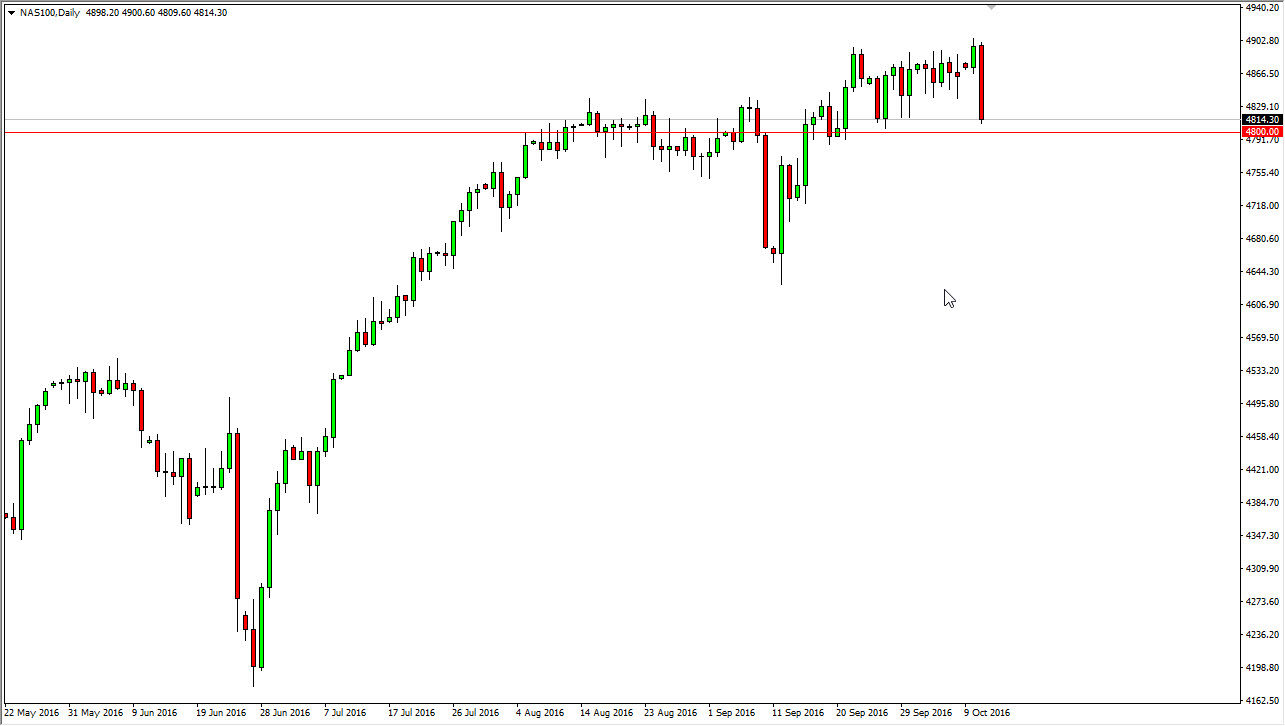

NASDAQ 100

The NASDAQ 100 of course did very much the same thing during the day, reaching towards the 4800 level. Because of this, it’s likely that we will see support come back into play fairly soon, but I have to admit that this is a pretty impulsive candle. Because of this, if we managed to break down below the 4775 handle, I think at that point time you have to start considering selling the NASDAQ 100. However, it’s likely that sooner or later we will find buyers in this market as it has been so positive over the longer term.

Another thing we have to pay attention to is the fact that we have the FOMC Meeting Minutes coming out, and that of course can give us an idea as to whether or not there will be an interest-rate hike anytime soon. If not, it’s likely that the market will react positively as it would continue the low interest-rate environment that stock traders seem to like.