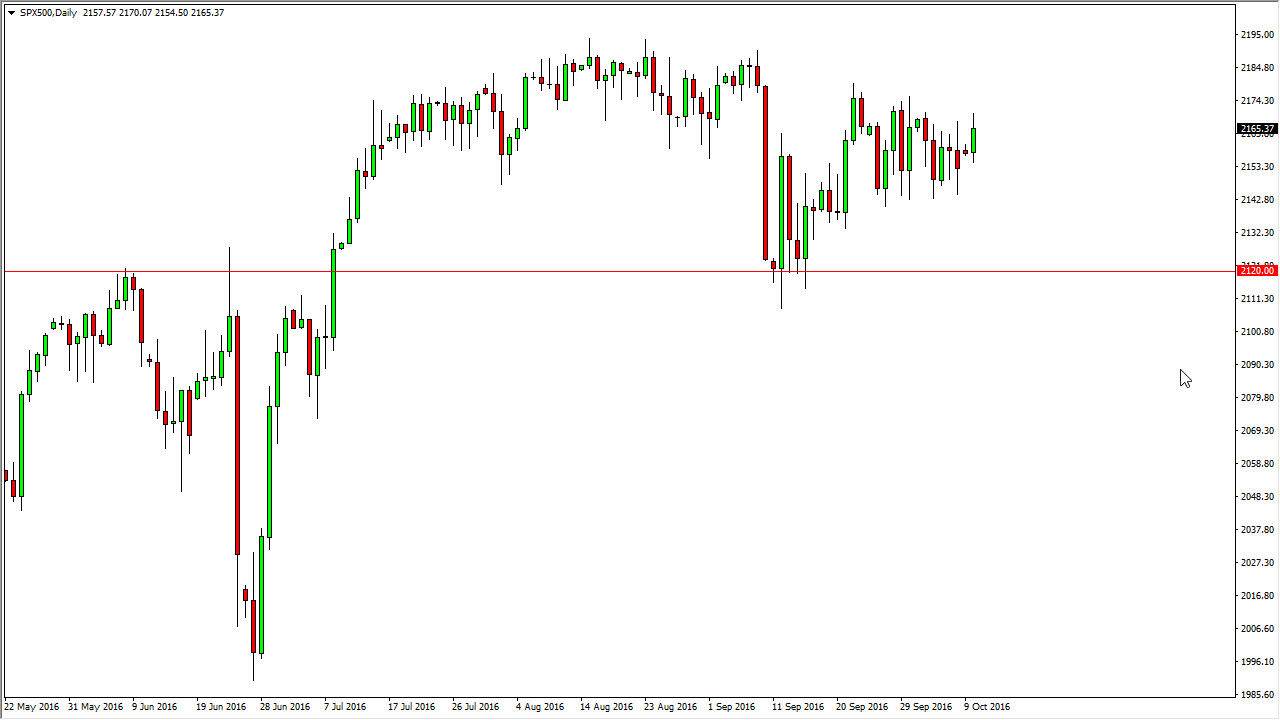

S&P 500

The S&P 500 broke higher during the course of the session on Monday, breaking above the top of the symmetrical triangle that we had been trading in. However, we did pullback a little bit so I think that we will continue to go higher, but it will be more or less a grind to the upside. With this being the case, I think we eventually try to reach towards the 2200 level above, and then even higher than that. I recognize that there is going to be a lot of noise between here and the aforementioned 2200 level, so you probably will have to buying short-term pullbacks for short-term trades at this point in time. I recognize that the 2120 level below is essentially the “floor” in this market, so therefore I have no real interest in selling.

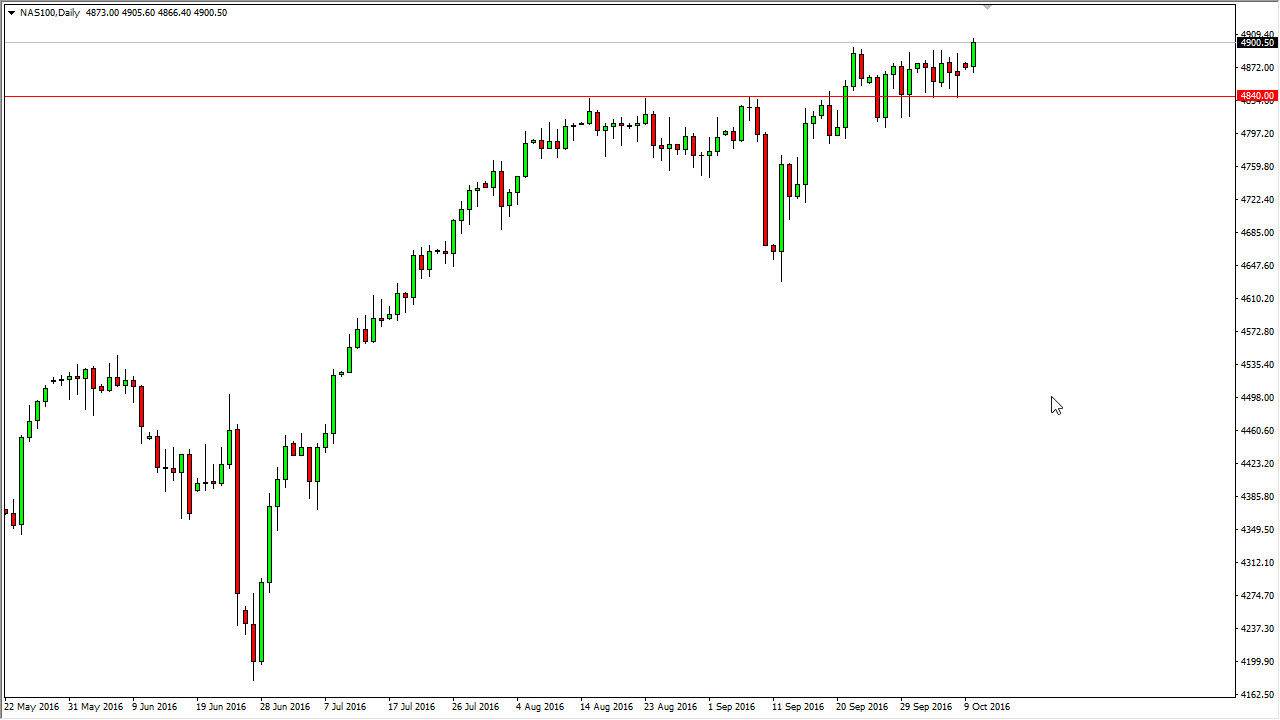

NASDAQ 100

The NASDAQ 100 broke out to the upside during the course of the day on Monday, clearing the 4900 level one point. It appears that we are going to continue to go higher as we have broken out, and with that being the case I would expect this market to then reach towards the most significant round number ahead, the 5000 handle. That’s been my longer-term target for quite some time, and I believe now we are starting to see the beginning of that move.

Pullbacks continue to be buying opportunities and as you can see on the chart I have a red line at the 4840 handle which I think will offer quite a bit of support. If we pullback anytime soon, I think the buyers will show up down in that area, if not even higher than that. I do recognize that eventually the 5000 level will be targeted and of course it will offer quite a bit of resistance, but I think we very well could find yourselves going beyond that.