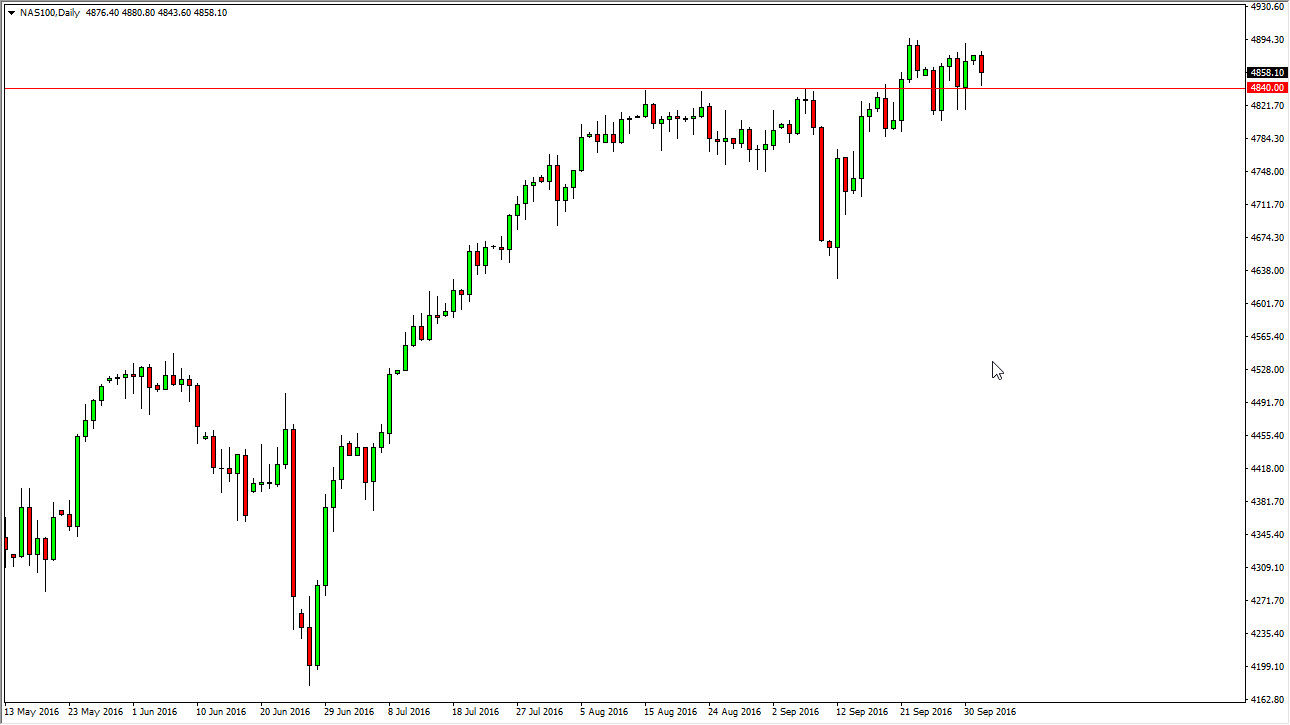

S&P 500

The S&P 500 fell during the day on Monday as we returned from the weekend. However, you can still make an argument for an uptrend line just below, so this point in time I feel that the buyers will return sooner rather than later. There is a lot of noise just below, and I think that there are so many noisy and supportive areas between here and the 2120 level that it’s almost impossible to sell this market. With that being the case, I am waiting for supportive candles in order to start buying, and would even consider short-term charts in order to do so. This is a market that will continue to chop back and forth but with an obvious upward bias as far as I can see.

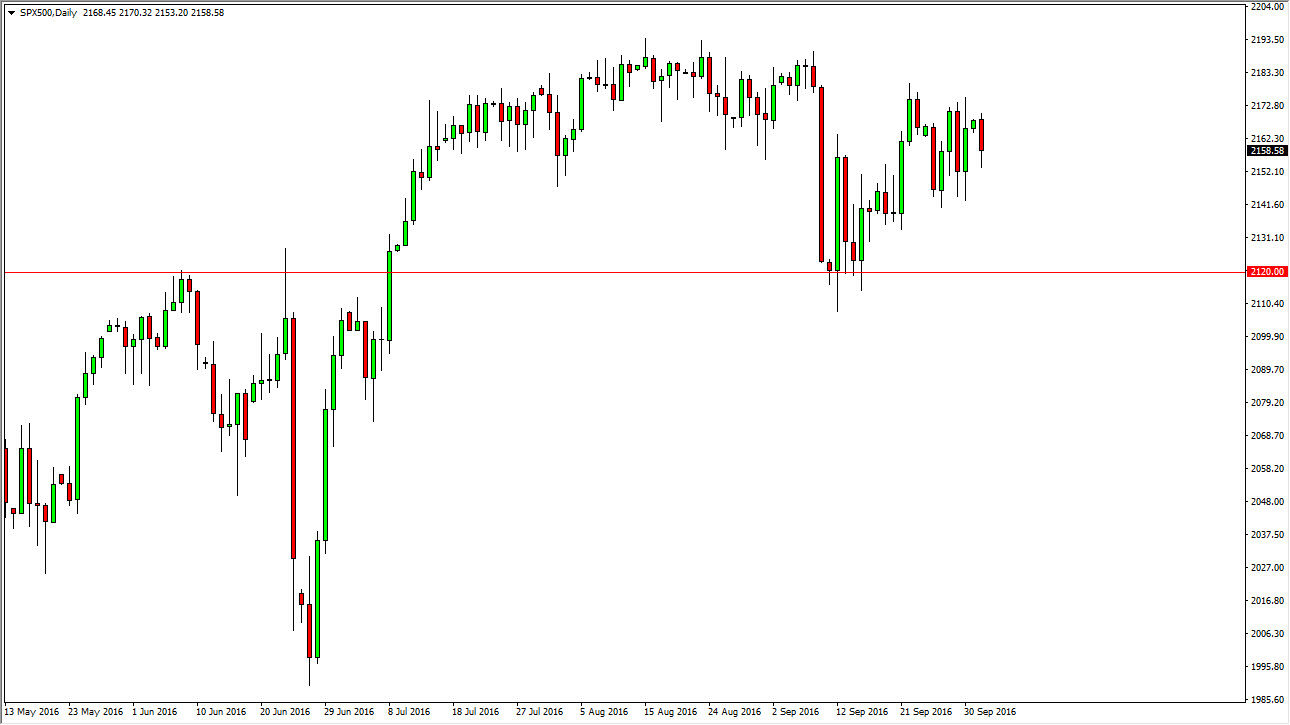

NASDAQ 100

The NASDAQ 100 fell during the course of the day on Monday as well, but it has a much more clear and concise area where the support is. It’s at the 4840 handle, and I believe that the market has support all the way down to at least the 4800 level. A pullback from here will more than likely see a bit of a bounce that could turn the market around again, and have the buyers returning again and again. I believe that ultimately we are going to reach towards the 5000 level which is the longer-term target that I’ve been looking for over the last several months.

I don’t have any interest in selling this market, at least not until we break down well below the 4750 level, which doesn’t even look like a thread at this point in time. I like the idea of buying again and again on short-term pullbacks in order to scalp the market to the upside. I have no interest in selling this market until her break down below the aforementioned support level, so ultimately this is a market that I think makes us a “long only” type of environment.