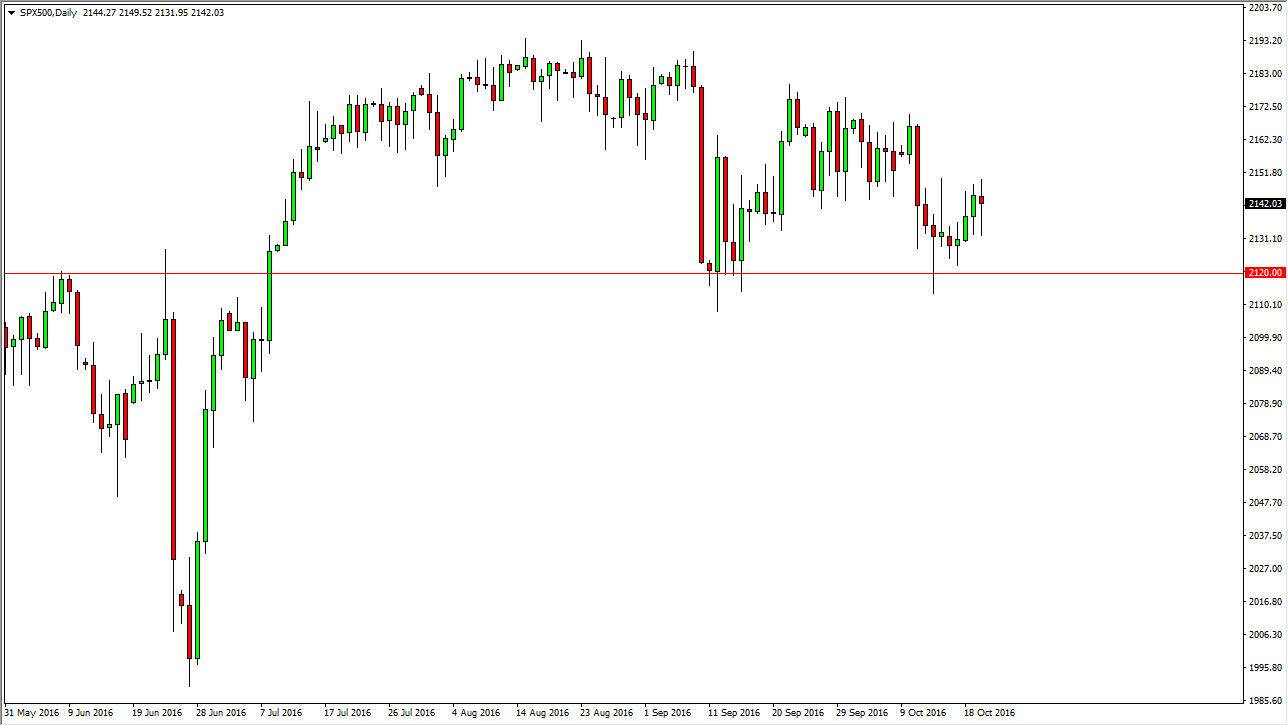

S&P 500

The S&P 500 initially fell during the day on Thursday but found enough support to turn things back around and form a hammer. This of course is a bullish sign and therefore I think we are going to bounce again and go much higher. The 2175 level above is resistance, so I think that’s where were heading. I believe that it will be choppy and volatile, so short-term pullbacks could be short-term buying opportunities. A break above the 2200 level could send this market looking for much higher levels, perhaps even 2500 over the longer term, but at this point in time I believe that short-term back and forth type of trading is probably going to be the way going forward. The 2120 level below is the beginning of significant support extending all the way down to the 2100 level, so it’s not until we break down below there that I would consider selling.

NASDAQ 100

The NASDAQ 100 goes back and forth during the course of the session on Thursday but then in sub turning back around to form a hammer so therefore it looks very bullish. I believe that a break above the top of the hammer sends this market looking for the 4900 level, and possibly testing the previous highs. If we can get above there, the market should then reach towards the 5000 level above. I still believe that the 4750 level below is massively supportive. Every time we pullback, I would expect the buyers would come in looking for value, and you have to keep in mind that the market should continue to grind its way to the upside and therefore have no interest in selling.

If we did break down below the 4750 handle, the market could very well break down to the 4700 level followed by the 4650 handle. Ultimately though, we have been grinding higher over the longer term and I believe that will continue to be the case in this low interest-rate environment.