Gold prices fell for an eighth consecutive day as upbeat U.S. economic data fed expectations that the Federal Reserve could raise interest rates in coming months. The XAU/USD pair touched its lowest since June 8 at $1249.86 after data from the Labor Department showed the number of people filing first-time claims for unemployment insurance payments dropped by 5K to 249K. Investors are waiting for the official non-farm payrolls report due today for more clues about the economy.

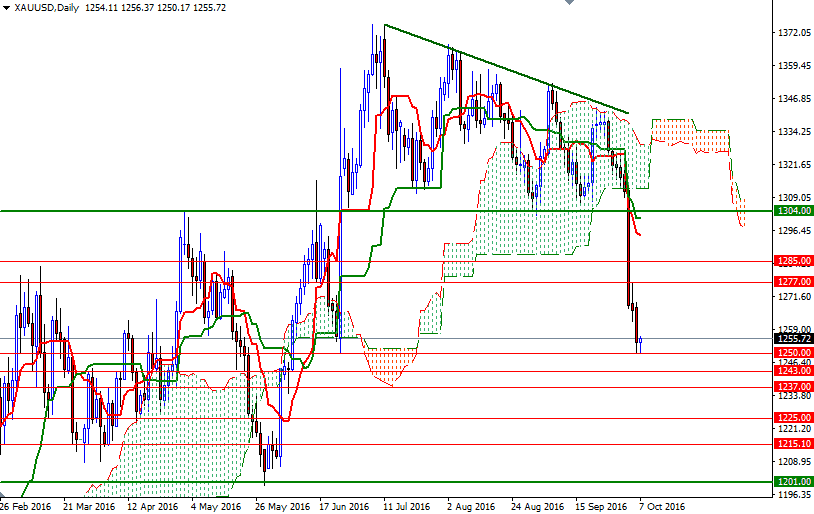

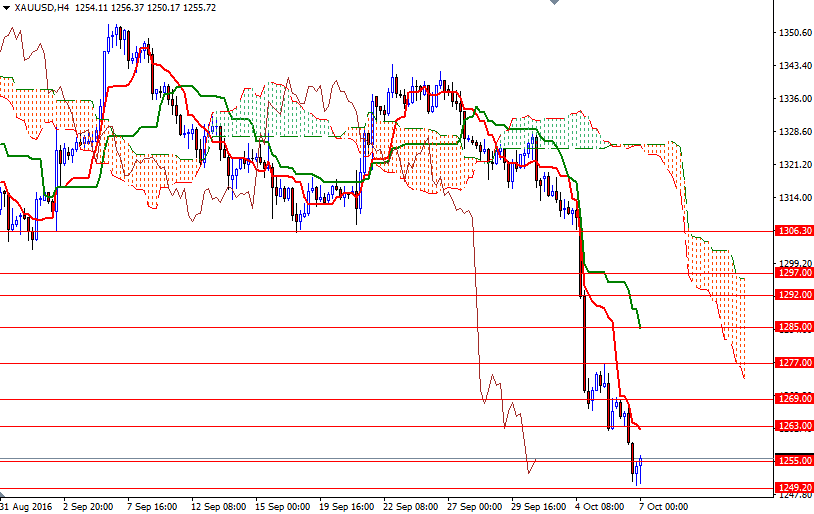

The technical outlook remains bearish while the XAU/USD pair trades below the Ichimoku clouds on the daily and 4-hourly charts. In addition to that, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both time frames. In my previous analysis I had said the market appeared to be as if we were heading back to the 1250 and we reached there eventually. This area (1250/49) may act as effective support, at least before the release of the closely watched September jobs report. Similarly, the area between 1260 and 1263 levels may hold as resistance.

While a break down below 1249 could increase the downward pressure and pave the way for a test of the 1229/5 area, climbing above 1263 could allow the market to tackle 1270/69. Beyond that the first solid resistance is located at 1277. If prices can break through 1277, then the 1285 level could be the next port of call. On the other hand, if the downward pressure continues and 1250/49 is convincingly broken, XAU/USD may test 1243 and 1237/4 afterwards. Falling through 1237/4 could encourage sellers and increase the possibility of an attempt to visit the 1229/5 zone.