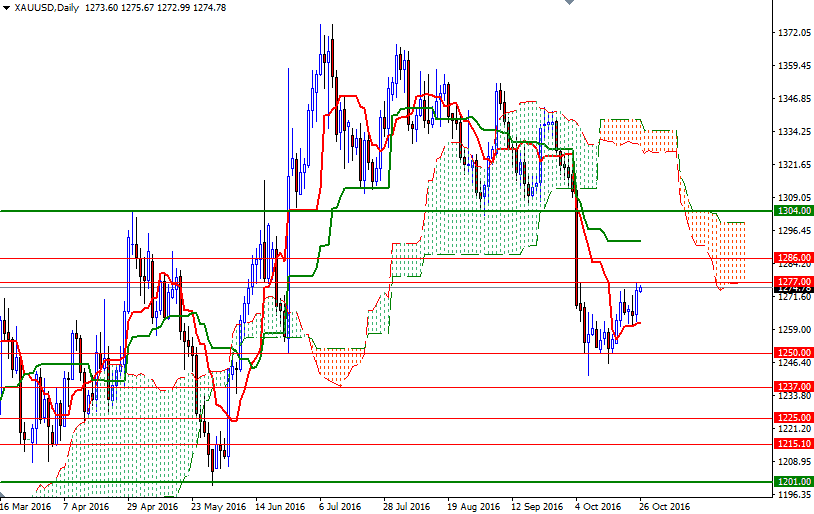

Gold prices ended Tuesday's session up $8.94, to settle at $1273.67 an ounce, as losses in US equities and a drop in the U.S. dollar lent some support to the precious metal. The dollar weakened after the Conference Board reported that its consumer confidence index dropped to 98.6 from a downwardly revised 103.5 the prior month. The XAU/USD pair reached the $1280/77 region as expected after the bulls pushed prices above the $1272/0 area.

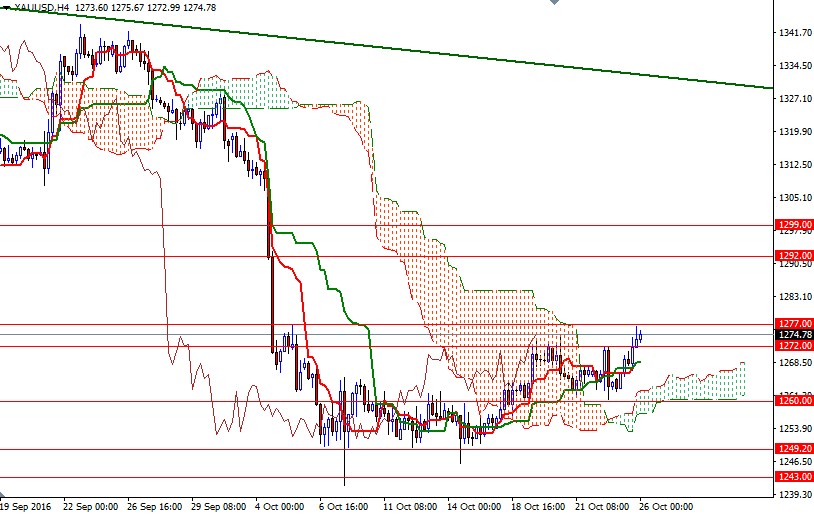

Gold prices are slightly higher in Asia trade, trading up 0.1% at 1274.78, and from a technical point of view, I think the XAU/USD pair is at a crossroads that will determine the next price movement in the short-term. The short-term charts are slightly bullish at the moment, with the market trading above the 4-hourly and hourly the Ichimoku clouds, but as you can see right on top of us there is an anticipated resistance zone that stretches from 1277 to 1280.

If the market can cleanly break above the 1280/77 zone, we could see a bullish run targeting the 1286 and perhaps 1292 levels. The market has to break through 1294/2 in order to test the next significant resistance at around 1299. On the other hand, if the bears successfully defend the 1280/77 barrier and increase the downward pressure, the market will probably head down to 1272/0. Falling through this support could pull the market back to the 1266/4 region. The bottom of the 4-hourly cloud currently sits at 1260 and I think the bears have to capture this strategic camp if they intend to take the reins and make an assault on the 1255 level.