The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 9th October 2016

Last week I predicted that the best trade for this week was likely to be long NZD/USD. This trade made a loss of -1.61%.

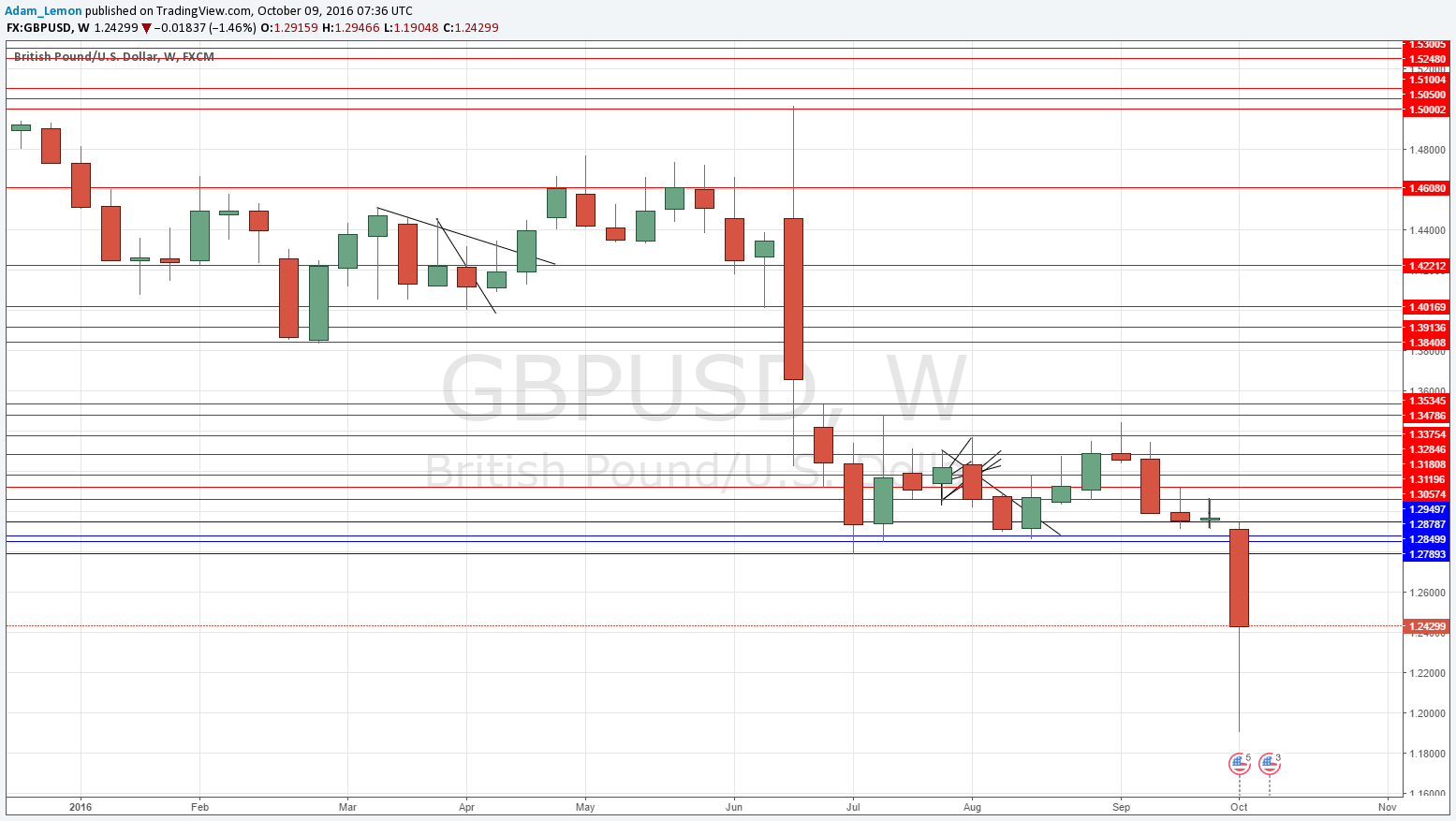

The market seems easier to forecast this week, as the strongest long-term trend (short British Pound) again has strong momentum in the direction of the trend.

For this reason, I suggest that the best trade this week is likely to be short GBP/USD, in line with its long-term multi-month trend.

Fundamental Analysis & Market Sentiment

Fundamental analysis is of little use right now, although better-than-expected U.S. economic data has been boosting the greenback over recent weeks. In spite of a slightly worse than expected Non-Farm Payrolls and Unemployment Rate numbers release last Friday, the dollar seems to have held up, and feels as if it is being bought.

The British Pound has dived sharply since the British Government announced it is going to being proceedings to leave the European Union next year, with a “hard Brexit” seemingly the exit route, i.e. without the U.K. remaining part of the single market.

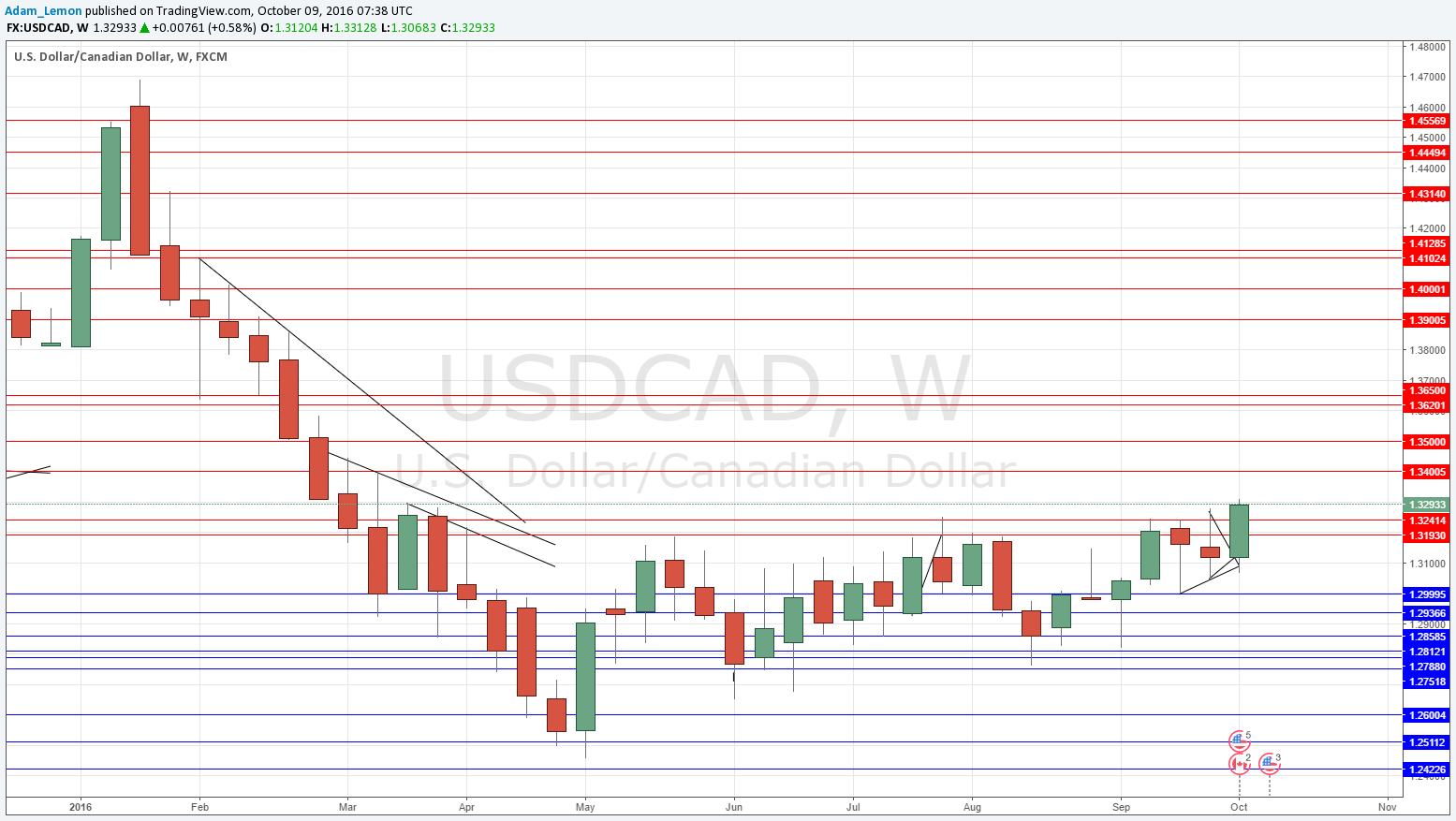

The Canadian Dollar is looking weak in spite of better than expected Employment data. The USD is making new 6-month high prices against this currency.

Technical Analysis

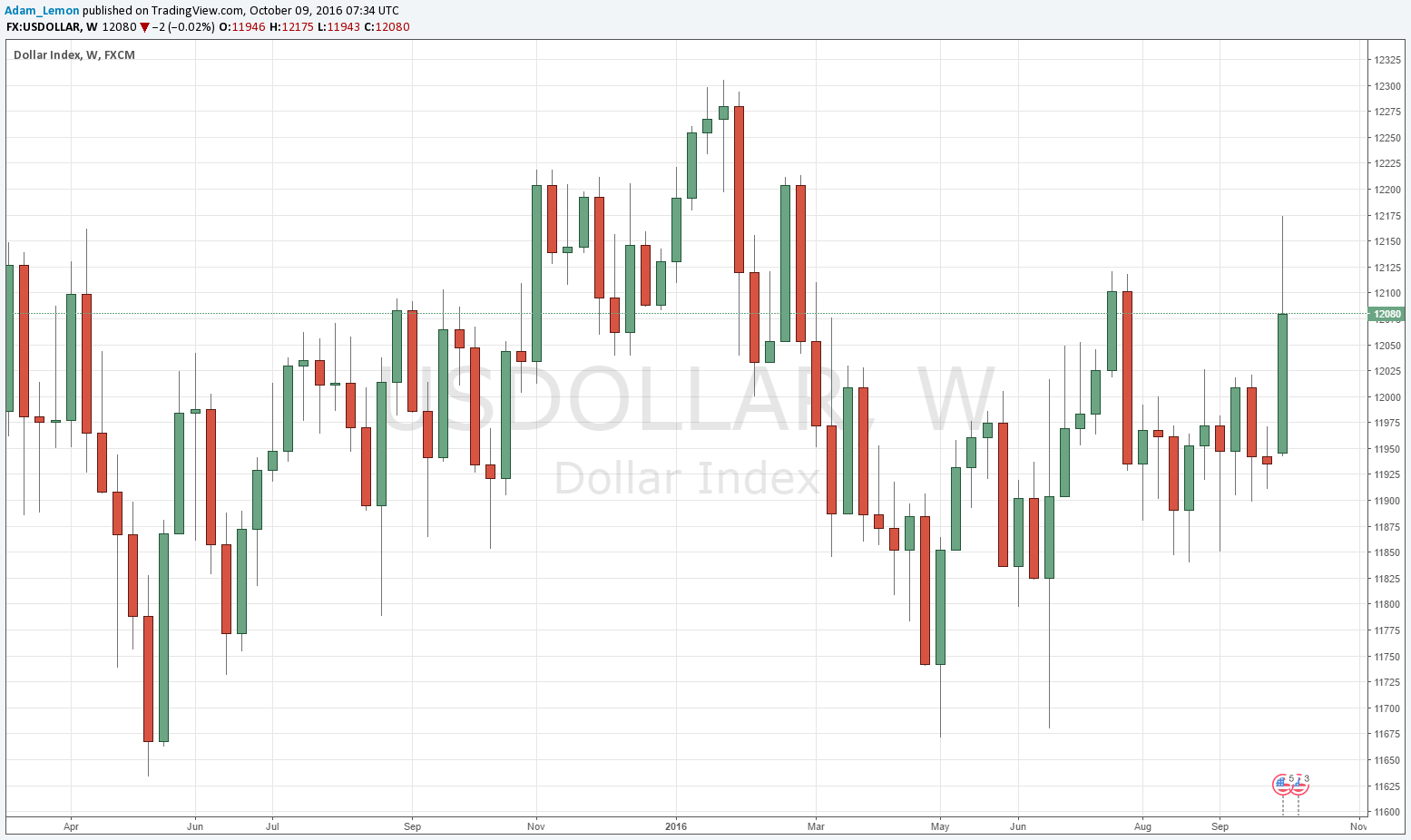

USDX

The U.S. Dollar has a new bullish trend, being above its historical prices from both 13 and 26 weeks ago. Last week’s candle was long and bullish although there is an upper wick, suggesting bullish exhaustion, but I would not read too much into that. A glance at the chart below will show the action has been generally choppy and consolidative. However, the situation is definitely looking increasingly bullish.

GBP/USD

Last week saw this pair dramatically break down past its range of recent weeks and made a new 31-year low, which is a dramatic event for any currency pair. There was a “flash crash” during Friday’s Asian session so the true length of the candle is less than it looks. Although there was a recovery in price last Friday, the Pound is being rocked by the prospect of a “hard Brexit”, and although there may be volatile pullbacks, it looks set to fall further.

USD/CAD

The chart below shows something interesting: the week closed at a 7 month high, and it looks as if the price is finally breaking out up past its range into “blue sky”. This could mean a strong, swift upwards move is in store for this pair, although both the U.S.A. and Canada have public holidays tomorrow (Monday).

Conclusion

Bearish on GBP/USD.