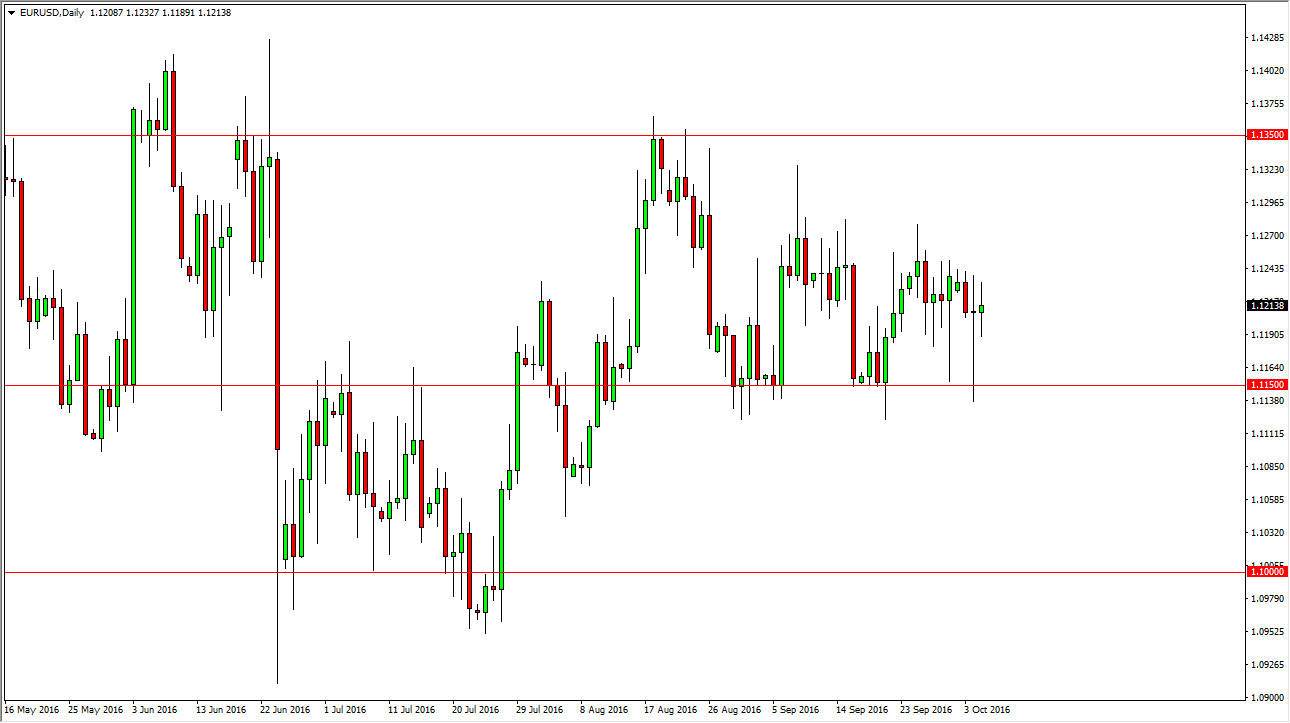

EUR/USD

The EUR/USD pair went back and forth during the course of the day on Wednesday, as we continue to see quite a bit of volatility. Ultimately, this does look like a market that continues to find sellers every time we rally, perhaps reaching down to the 1.1150 level below, and then even down to the 1.11 handle after that. If we can break down below there, the market then should reach towards the 1.10 level below. I think rallies will continue to show signs of exhaustion going forward as we continue to grind lower more than anything else. You can make a real argument for a descending triangle in this pair, so it is looking very much like a market that’s trying to drop significantly. I have no interest in buying this pair at the moment.

GBP/USD

The GBP/USD pair initially fell during the course of the session on Wednesday, but then turn right back around to form a bit of a hammer, and because of this it’s likely that the market will trying to bounce towards the 1.2850 level. This is an area that has previously been supportive, so it should now be rather resistive. I have no interest in buying this market though, I think that as we grind our way higher, this will be an attempt to find more sellers in order to continue to the downside. I believe that the 1.25 level below is the longer-term targets, but it doesn’t mean that we are going to get there tomorrow. I think selling short-term rallies that show signs of exhaustion again and again will probably be the best way to trade this market, as we are still punishing the British pound for the vote to leave the European Union. On top of that, we have the US dollar on the other side of the trade, and that of course has been gaining strength in general over the last several weeks, especially after recent comments that perhaps the interest-rate is too low by a particular Federal Reserve voting member.