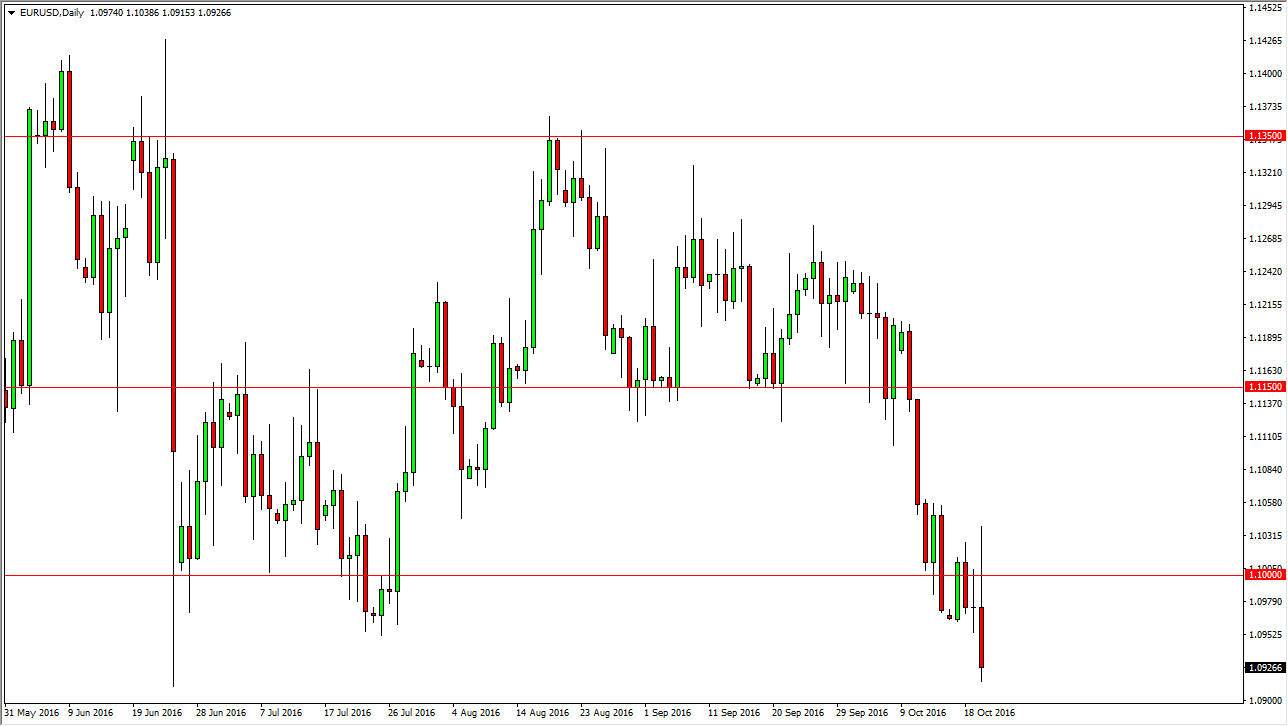

EUR/USD

The EUR/USD pair initially rallied during the day on Thursday, breaking well above the 1.10 level, but then turned right back around to fall significantly. With this being the case, the market broke down and tested the 1.09 level below. If we can break down below there, it’s likely that the markets will reach towards the 1.05 handle. Any rally at this point in time should be sold on signs of exhaustion, because the market has fallen so significantly over the last several weeks. Also, during the day on Thursday we had the European Central Bank suggests that the quantitative easing will continue and there won’t be any serious discussion about tapering off of it until December. With that being the case, the Euro will continue to fall in my estimation.

GBP/USD

The British pound initially fell during the day but did bounce a bit in order to form something akin to a hammer. If we can break above the top of the hammer, we could drift towards the 1.25 handle above, but at this point in time I feel that it’s likely that there will be sellers given enough time, and as a result I believe that signs of exhaustion will continue to be opportunities to sell this market as the US dollar continues to be one of the stronger currencies around the world. Ultimately, the British pound is still being punished for the exit vote, and we should then reach towards the 1.20 level below. I believe that the 1.2850 level above is the top of the current trading area, but it has to be said that we most certainly are in the downtrend and therefore it’s much easier to sell than trying to buy against longer-term pressure.

If we break down below the 1.20 level, the market will then reach to the 1.15 level given enough time in my estimation. That is a major bottom on the monthly charts that goes back years, so that will be a major fight.