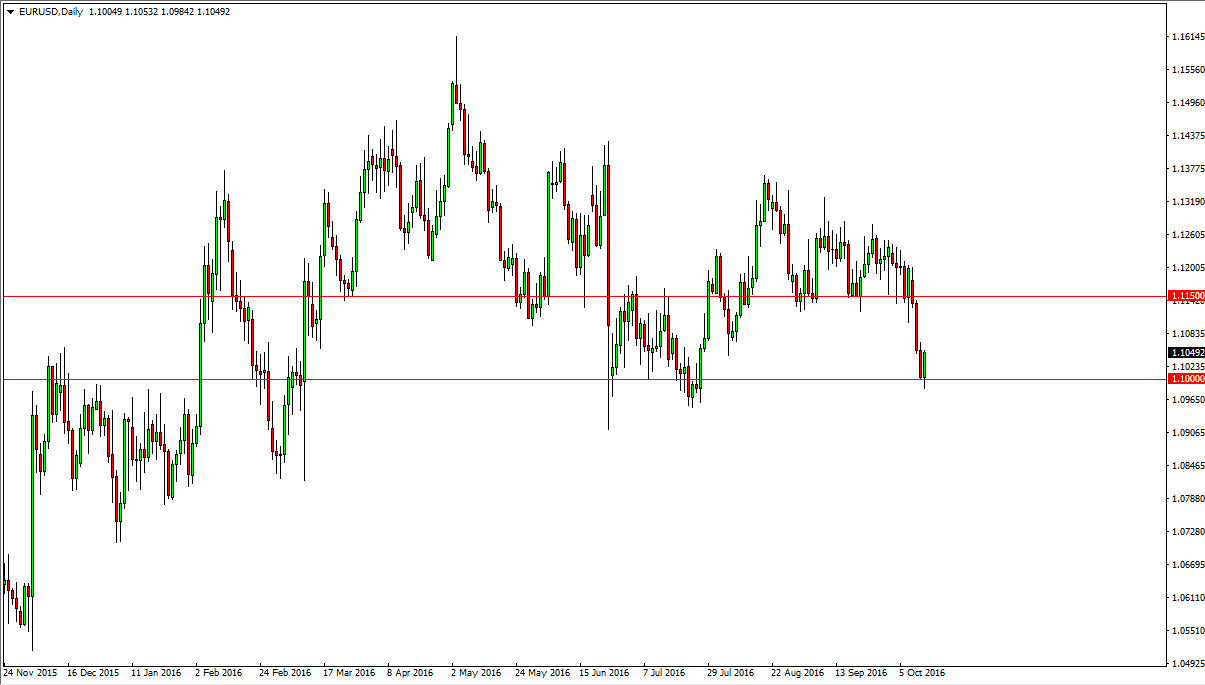

EUR/USD

The Euro initially fell during the day on Thursday, but turned right back around to show signs of support as we bounced enough to break towards the 1.105080. With this being the case, I feel that the market will probably try to bounce towards the 1.1150 over the next couple of sessions, so we can have a short-term rally. On the other hand, if we break out below the 1.10 level, and more importantly the bottom of the candle for the day on Thursday, we can see the market try to break down significantly, perhaps down to the 1.08 handle. Longer-term, I feel that it’s much easier to sell this pair than buying it, but I do recognize that the pair does tend to chop around so it makes sense that this minor bounce is about to happen.

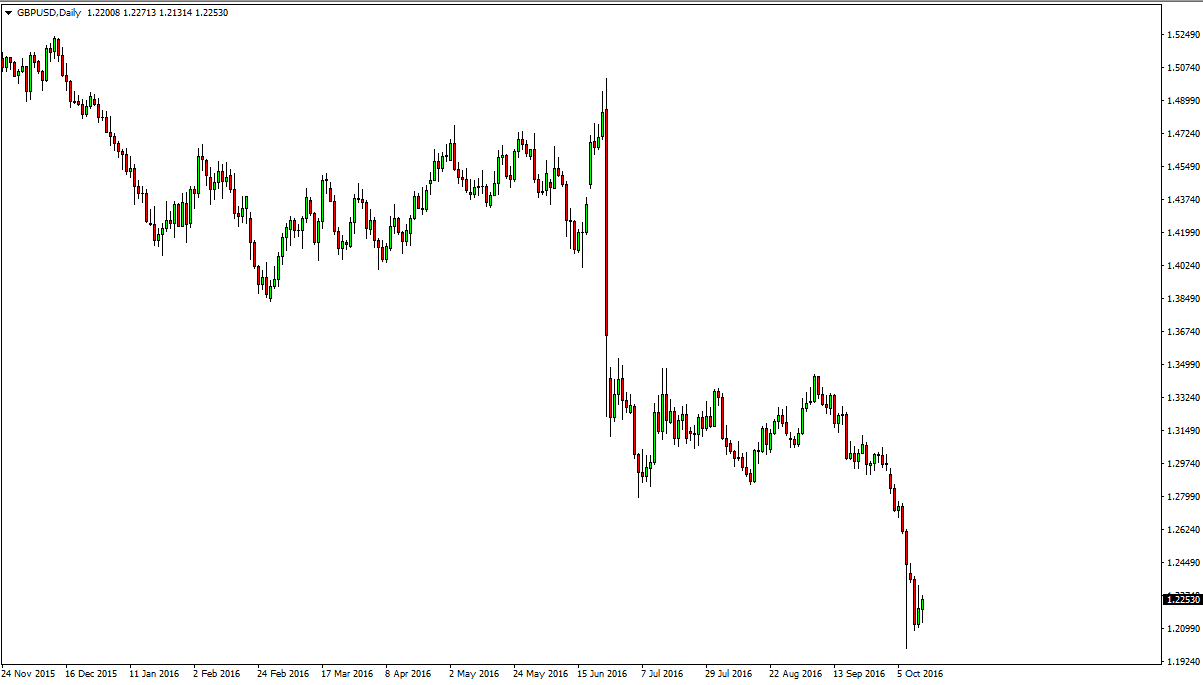

GBP/USD

The British pound initially fell on Thursday but bounced enough to form a bit of a hammer as we continue to see buying pressure appear. The 1.20 level below should be supportive, as it is a large, round, psychologically significant number, and of course essentially where the flash crash from several sessions ago stopped. I believe that at this point in time it’s likely that the markets will try to conduct a little bit of a “relief rally”, but it is only a matter of time before the sellers return as this market is most certainly bearish. After all, we are still punishing the British pound for leaving the European Union, and course have broken through some pretty major support levels over the last several weeks.

I look for the balance coming as a nice selling opportunity on signs of exhaustion. After all, represent a bit of “value” in the US dollar, as the freezer is much closer raising interest rates than any other central bank in the world, and that’s especially true when it comes to the Bank of England.