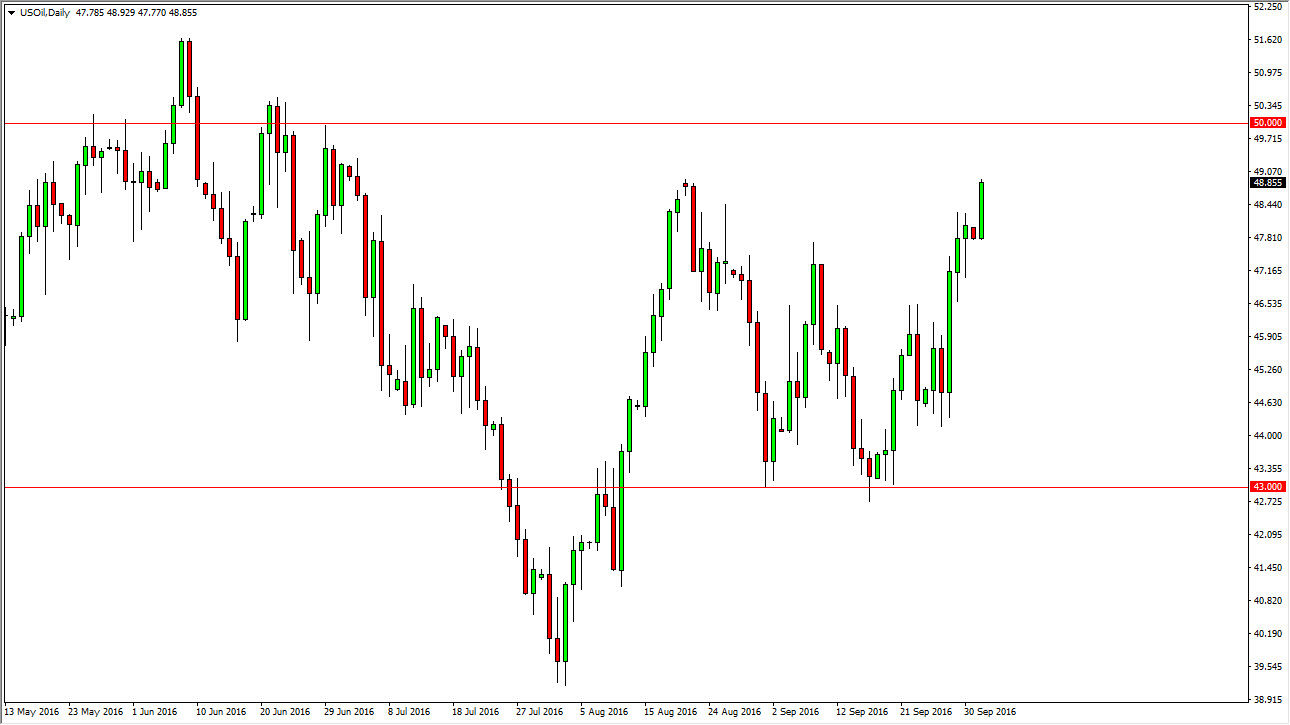

WTI Crude Oil

The WTI Crude Oil market broke higher during the course of the session on Monday, breaking above the top of the hammer from the Friday session, and it looks like we are trying to grind our way towards the $50 level. With this being the case, I believe that the market may try to reach towards the $50 level, but it is not going to be easy. This is in reaction to a recent production cut by OPEC being announced, but at this point in time if you keep in mind that it doesn’t even start until November, and it doesn’t even address the total oversupply. With this, I believe it is only a matter time before the sellers returned but obviously they are not going to right now.

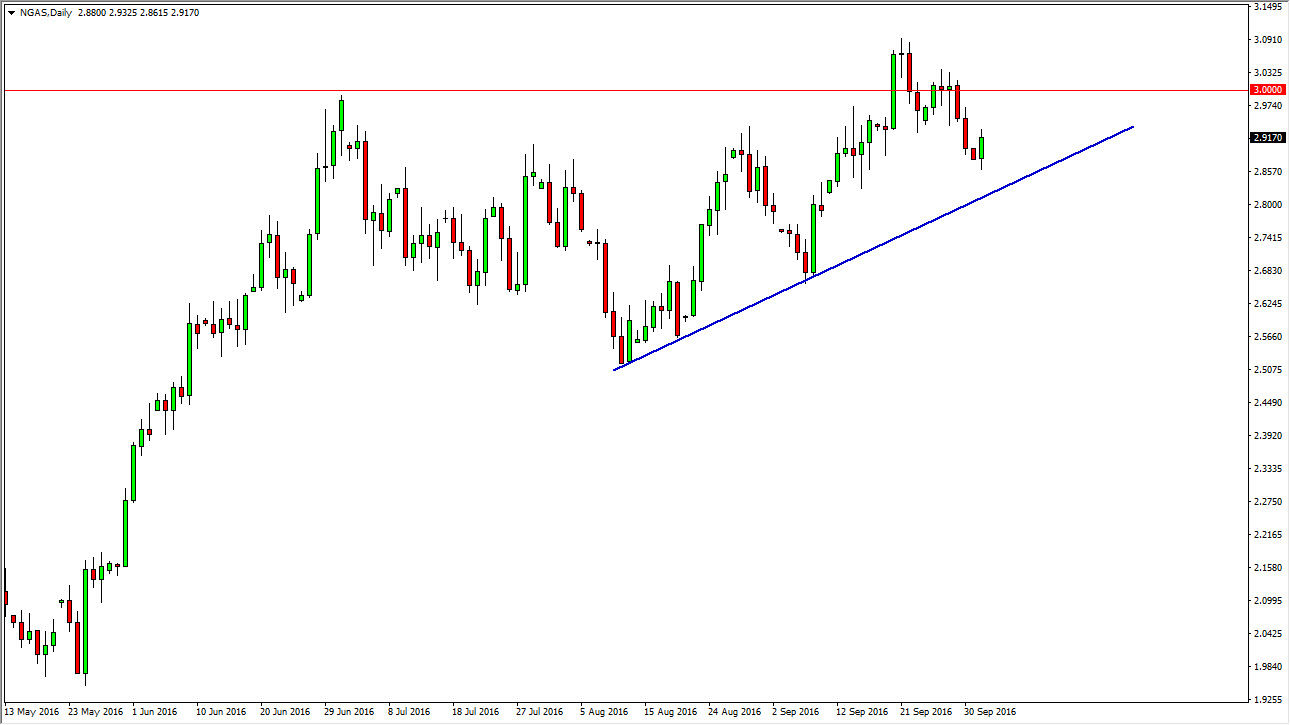

Natural Gas

The natural gas markets initially fell during the course of the day on Monday, then turn right back around to form a bullish candle. I think at this point in time we will try to get towards the $3.00 level above, and as you can see I have an uptrend line on this chart that shows exactly how supported this market has been lately. With this, I think that every time we pull back you have to start thinking about picking up value in a market that is so obviously bullish. With this being the case, I have no interest whatsoever in selling this market, at least not until we break down below the uptrend line below, which is roughly near the $2.85 level below.

Ultimately, this is a market that should continue to grind higher, but that’s probably going to be the key word here: grind. With this being the case, this is a market that is probably best traded off of short-term charts more than anything else. On entering, if we break down below the uptrend line, that would be a very negative sign.