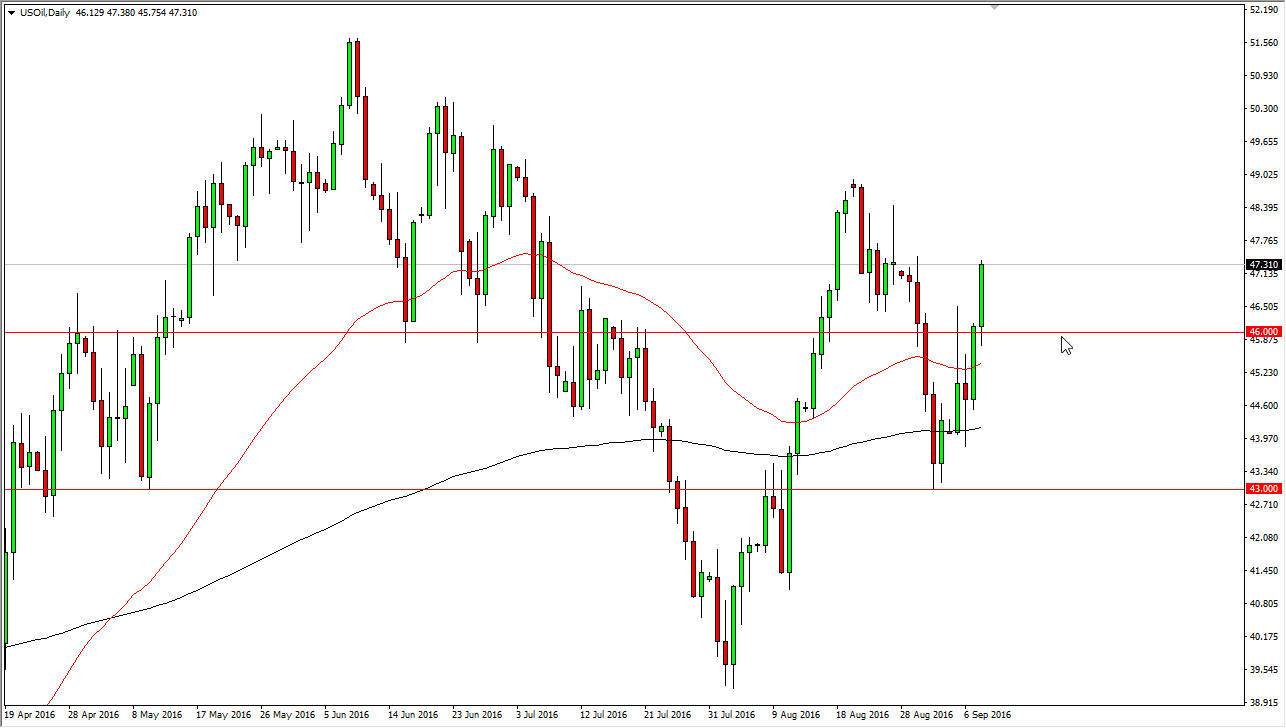

WTI Crude Oil

The WTI True Oil market initially fell during the course of the session on Thursday, but found quite a bit of support just below the $46 level and the market shot higher. We are still below quite a bit of resistance though, so at this point in time I feel that any rally is going to have to deal with quite a bit of noise. Short-term pullbacks could be short-term buying opportunities unless of course we get back below the $46 level. Once we get below there, I would feel more than likely that the market would continue to consolidate in general between that level and the $43 level below. At this point in time, I believe that the one thing you can count on is quite a bit of confusion as we come back from the summer holiday.

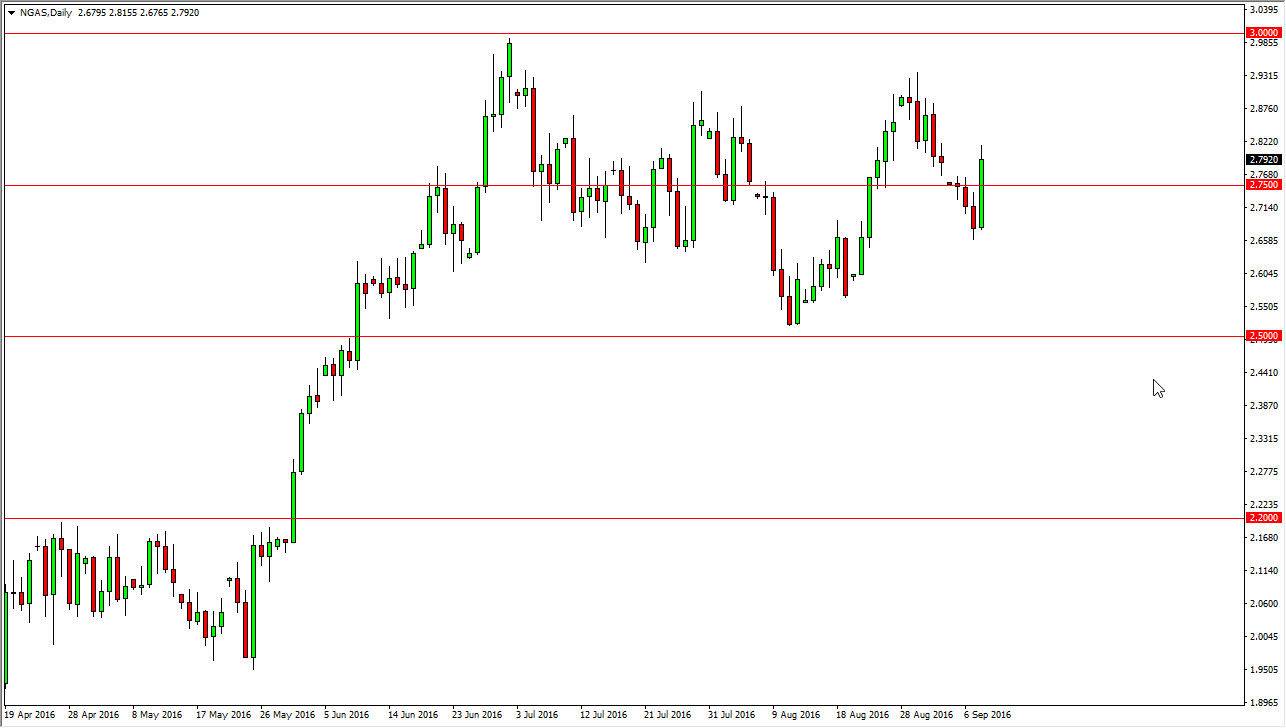

Natural Gas

The natural gas markets also rose during the course of the day, slicing through the $2.75 level and more importantly the gap from the beginning of the week. However, we did pullback a little bit from there so it does suggest that perhaps we are going to find resistance in this general vicinity. Nonetheless, I believe that the $2.90 level is going to be massively resistive, and that of course is going to cause quite a bit of trouble. I believe the choppiness will continue, and quite frankly we are still waiting to see when we get the longer-term move. At this point we are still stuck in consolidation, and not much has changed truthfully. Most of the summer we have spent near the $2.75 level, which is just a little bit below where we are now. With this being the case, I continue to look at this is a short-term trader’s type of market, and as a result scalping back and forth is probably the best way to approach this market if you feel the need to trade.