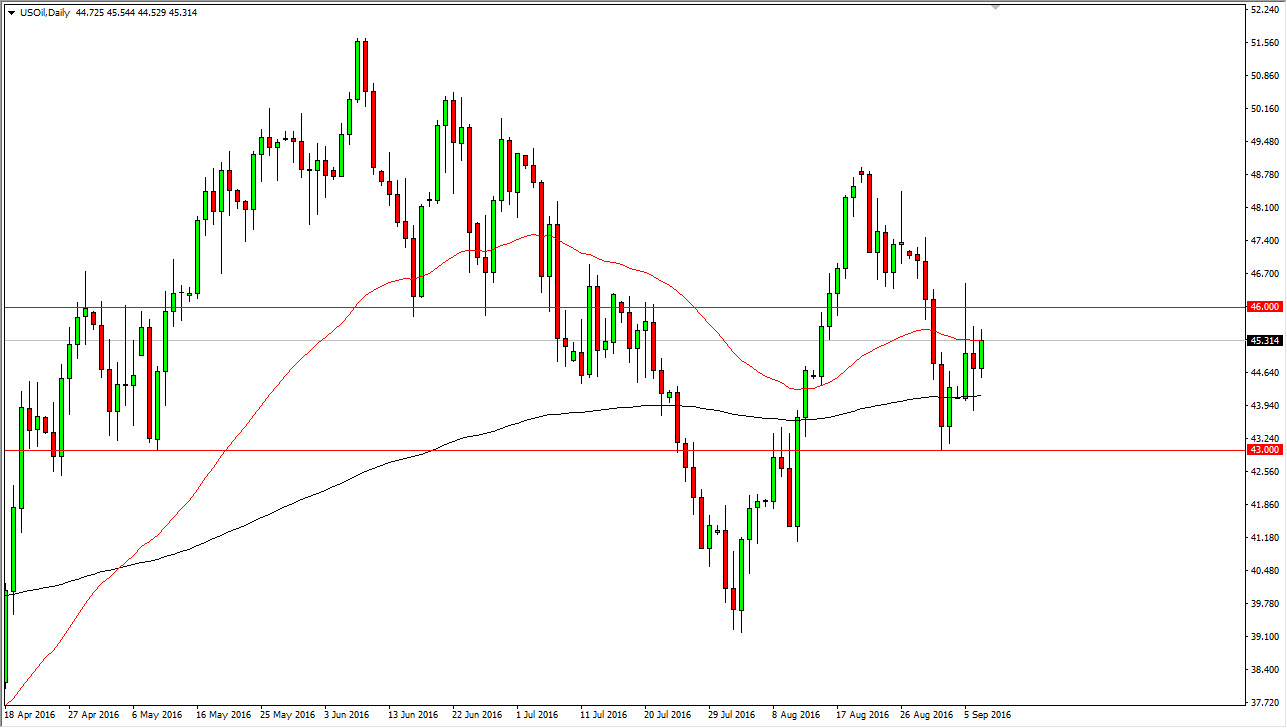

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the session during the day on Wednesday, as we continue to bounce around in this general vicinity. The $46 level above is massively resistive, just as the $43 level is supportive. At this point in time, the market looks as if it is going to go sideways overall, but I think that as we have the Crude Oil Inventories number coming out today, it’s very likely that we will get some type of decisive move. I’m simply waiting until we break out of this trading range before us are putting any real money in this market. That being the case, I believe that the end of the day should be very interesting.

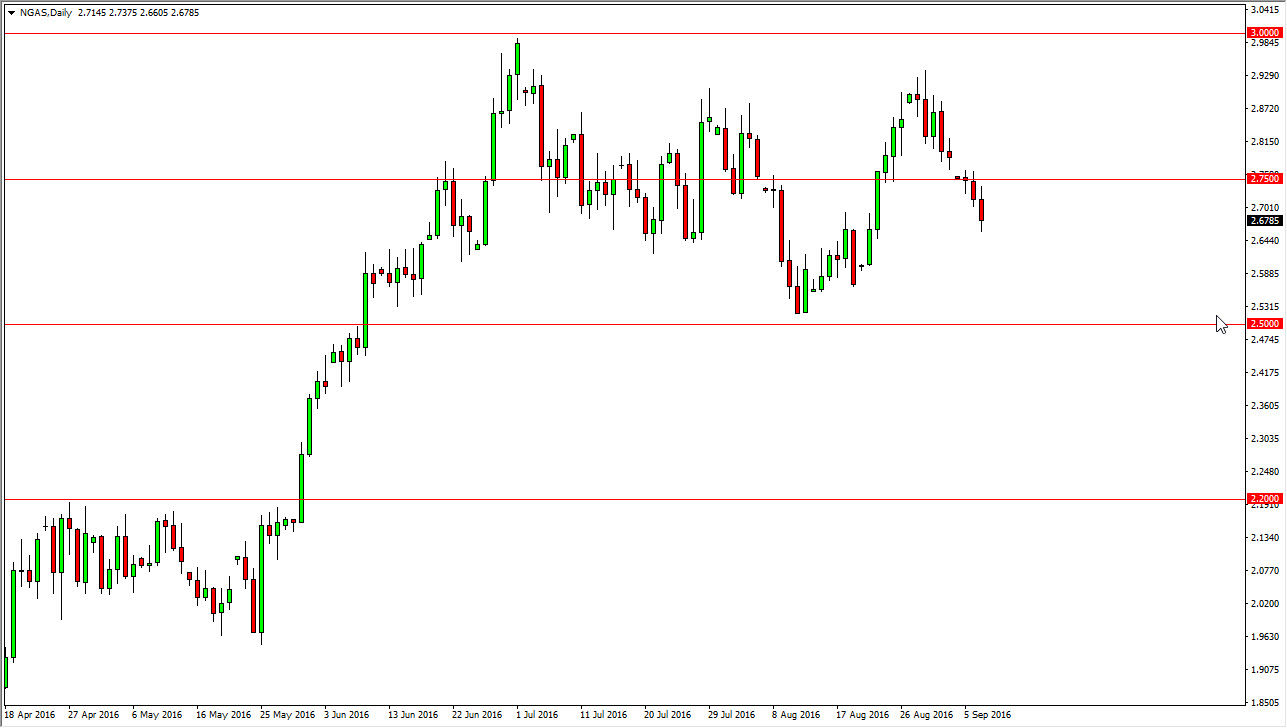

Natural Gas

The natural gas markets initially tried to rally during the course of the session on Wednesday, but the $2.75 level above is resistive, so having said that it’s likely that the market will continue to fall from here. The negative candle of course is just another reason to start thinking about selling this market as we should reach down to the $2.50 level on the bottom. I think that every time we rally, it is a selling opportunity as the downward trend continues. I believe that signs of exhaustion are going to be a nice selling opportunity. Ultimately, this is a market that I think is struggling due to the fact that the cooling season is over, and as a result it’s likely that the demand will drop. Also, we have the storms that were threatening natural gas production now gone, so likely we will start to see a little bit more bearish pressure in this market and perhaps even a little bit more reality when it comes to the pricing of natural gas. At this point, I have no interest whatsoever in buying this market.