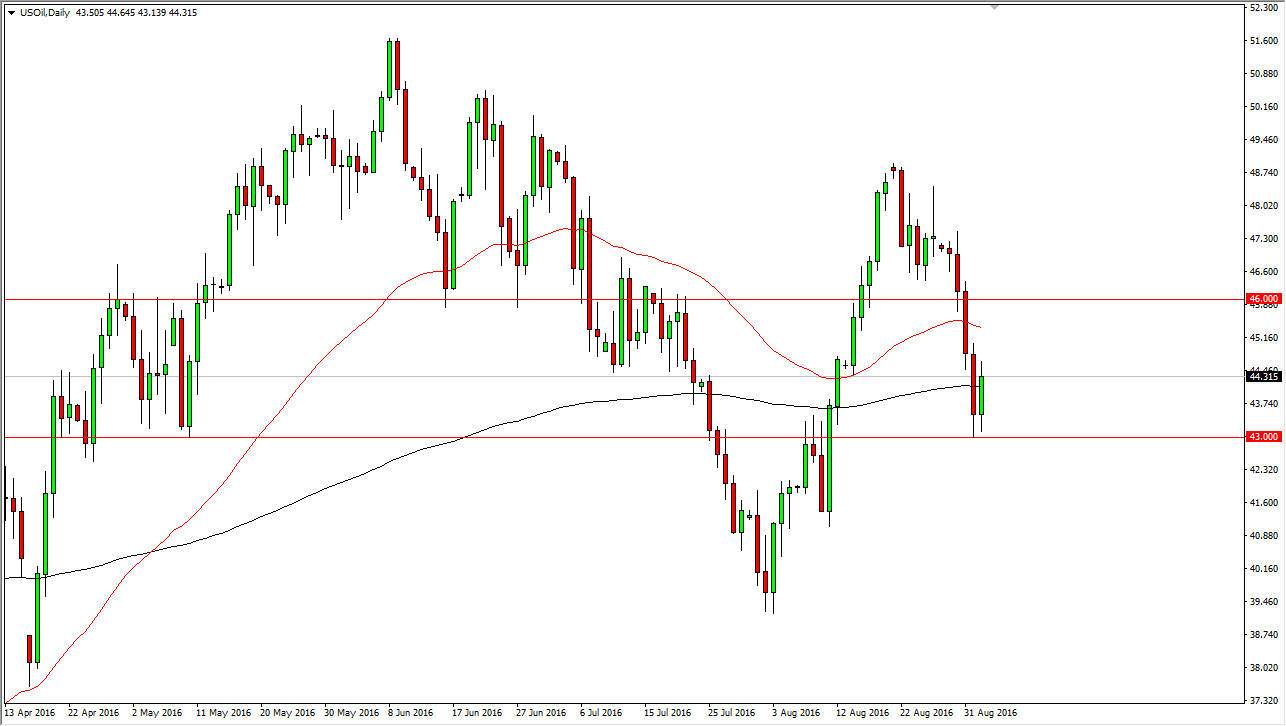

WTI Crude Oil

The WTI Crude Oil market bounced significantly off of the $43 level during the day on Friday, as of course that supportive area has offered quite a bit into the market. I think there is a lot of resistance above near the $46 level as well though, so I think that any type of exhaustive candle above could be a nice selling opportunity. I also believe that a break down below the $43 level would be extraordinarily negative, and therefore I would have to start selling there as well. I have no interest whatsoever in trying to buy this market at the moment, as I think there are far too many moving pieces going forward.

Natural Gas

Natural gas markets went back and forth during the course of the session on Friday, as the $2.75 level below continues offer quite a bit of support. If we can break down below there, the market could very well drop this market down to the $2.65 level, and then possibly even as low as the $2.50 level. On the other hand, we could break above the top of the candle for the day on Friday, and send the market looking for the $2.90 level again. I believe that there is a massive amount of resistance between there and the $3.00 level above, so quite frankly it’s only a matter of time before the sellers get involved.

Quite frankly, recently we have seen quite a bit of strength in the natural gas markets due to the potential storms hitting Florida, and of course the rigs in the Gulf of Mexico have been slowed down, and some have even been shut down, cutting down on production recently. Now that the storm appears to be going past the area, it’s likely that we will continue to see sellers sooner rather than later.