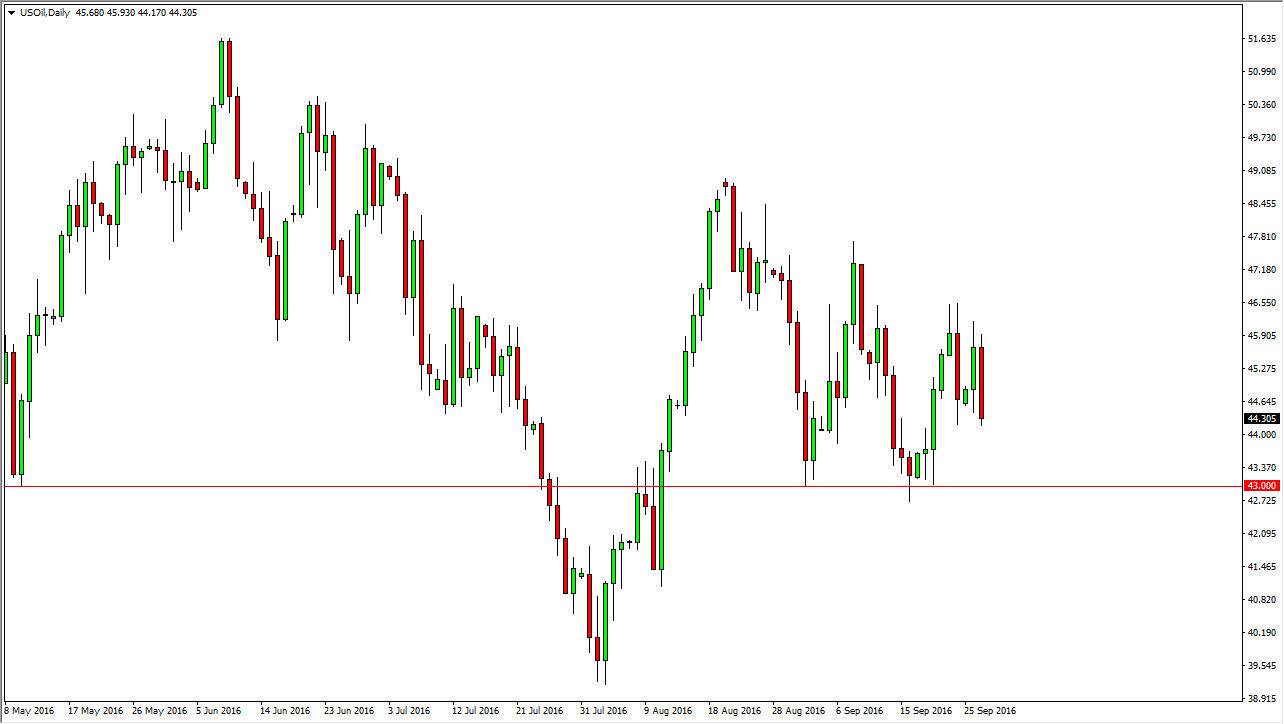

WTI Crude Oil

The WTI Crude Oil market fell significantly during the course of the session on Tuesday, forming a very bearish looking candle. I find this particularly interesting as we approached the Crude Oil Inventories announcement today. I think one of the biggest drivers of the negativity is the fact that the Iranian Oil Minister suggested that there would be no talk of oil production cut in Algiers this week, as some traders around the world may have been hoping for. With this being the case, and the fact that the US dollar is strengthening in general, I believe that we will continue to go lower and perhaps reach towards the $43 level. The one caveat being that the inventory number may be a little bit more bullish than anticipated, but any knee-jerk reaction should end up being a selling opportunity on signs of exhaustion as well.

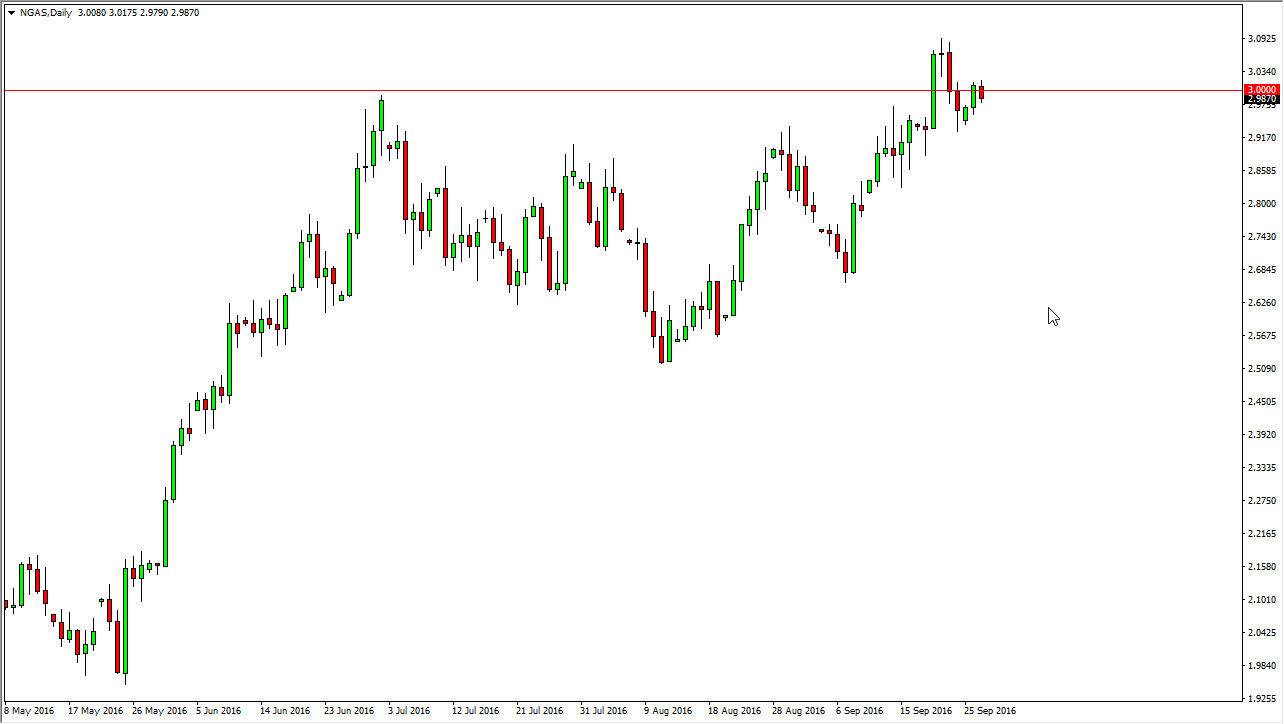

Natural Gas

Natural gas markets fell during the course of the day on Tuesday, breaking down below the $3 level again. This is an area that has a lot of psychological importance to it so it’s not a big surprise to see that we are struggling a bit. Nonetheless, I think there is a massive amount of support somewhere near the $2.90 level, so any type of supportive candle in that general region could probably bring in buyers yet again based upon “value.” I also believe that a break above the top of the candle during the session on Tuesday is a reason to start buying as well, as we should continue towards the $3.10 level above, and then perhaps above to the $3.40 level longer term as I see that as an important level on longer-term charts.

However, if we do break down below the $2.85 level, I feel the market will probably change trends again as there is more than enough natural gas out there in the ground in North America alone to fuel most of the world for the next 300 years. In other words, it can be very difficult to have a tight supply for any real length of time.