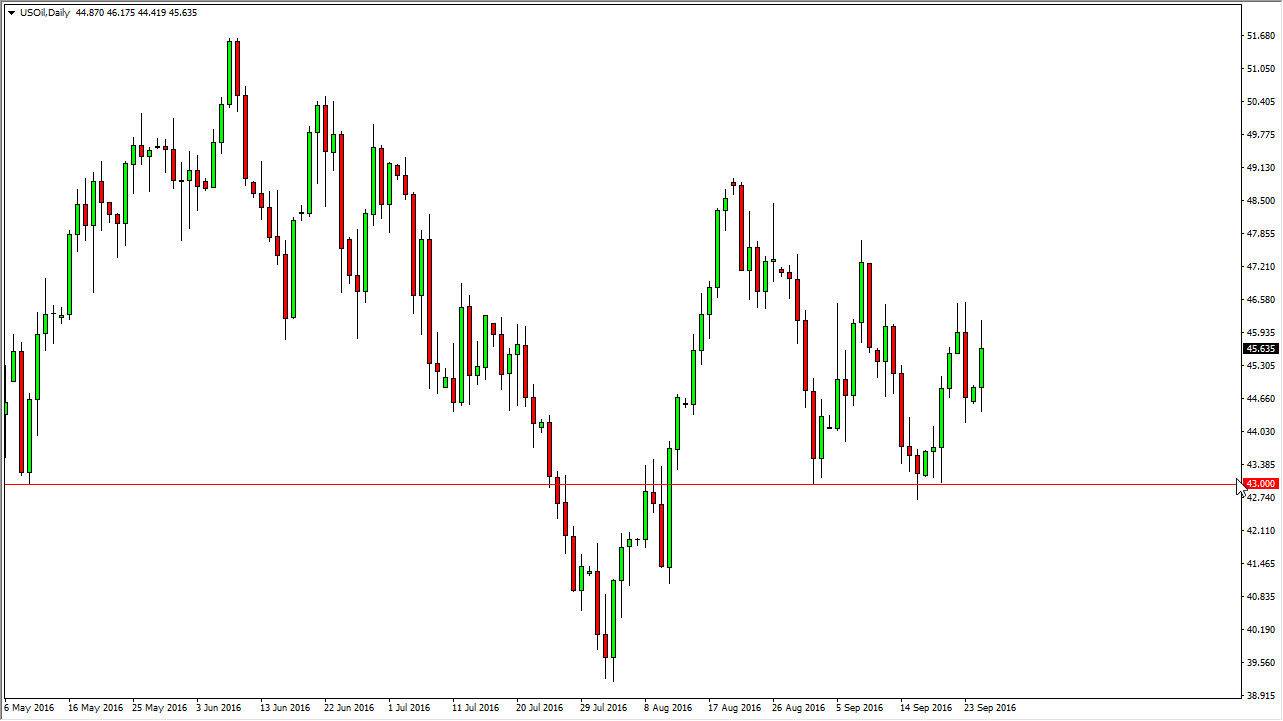

WTI Crude Oil

The WTI Crude Oil market had a very volatile session during the course of the day on Monday, but ended up showing a fairly positive candle. With this being the case, looks as if we are waiting to see whether or not the OPEC members will come up with some type of an agreement in the informal meetings that we will have over the course of the week. If they can agree on some type of output cut, it’s likely that the market will go much higher, but ultimately it’s likely that the sellers will enter this market as we have seen every time this market tries to rally. The highs are getting lower, and as a result it’s very likely that the sellers will continue to push this market lower, perhaps trying to test the $43 level. That’s an area that’s massively supportive, and a break down below there could be a longer-term signal to start selling.

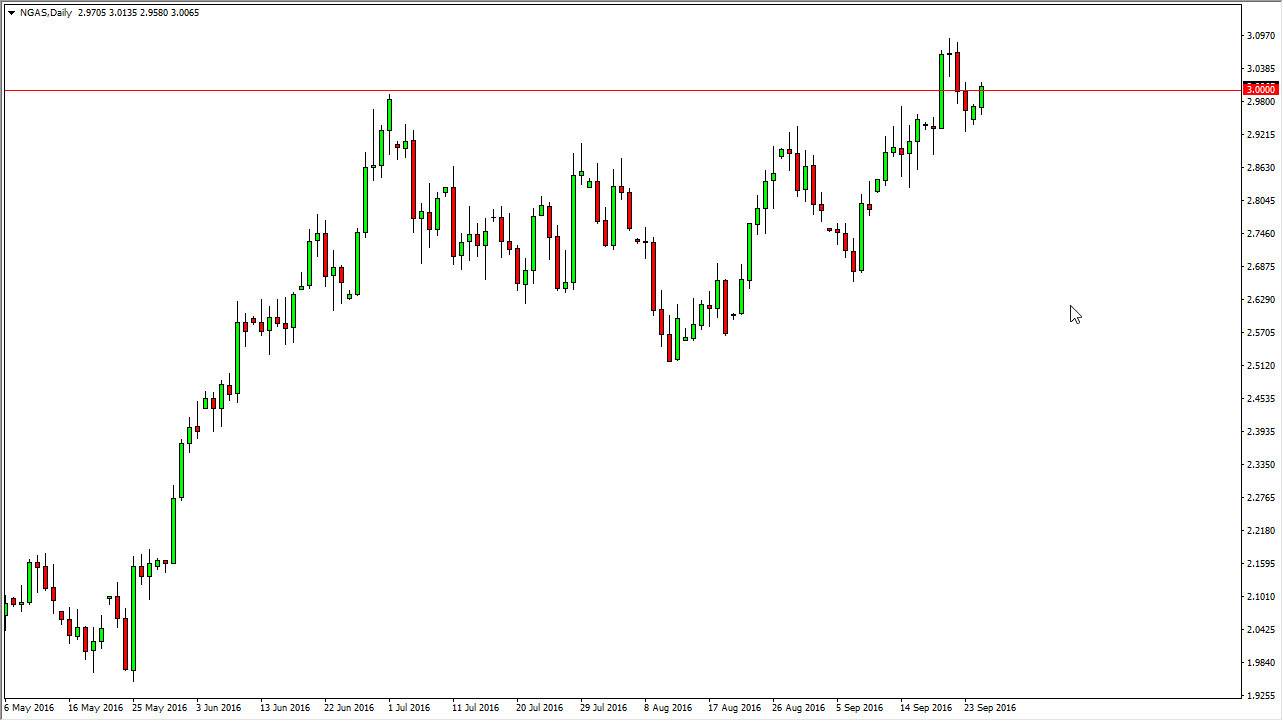

Natural Gas

The natural gas markets rose during the course of the session on Monday, testing the $3 level. A break above the top of the range during the course of the session that of course sends this market higher in my estimation, and with that being the case I think that the market would then reach to the $3.40 level above. Pulling back will continue to offer value, and I believe that there is a lot of support below at the $2.90 level, which of course was an area that was massively resistive previously.

With this being the case, I feel that the market has broken out and it is now trying to confirm the breakout as we have found plenty of buyers and bounced enough to show that the momentum is starting to pick back up to the upside yet again. I have no interest in selling until we get well below the aforementioned $2.90 level at the very least.