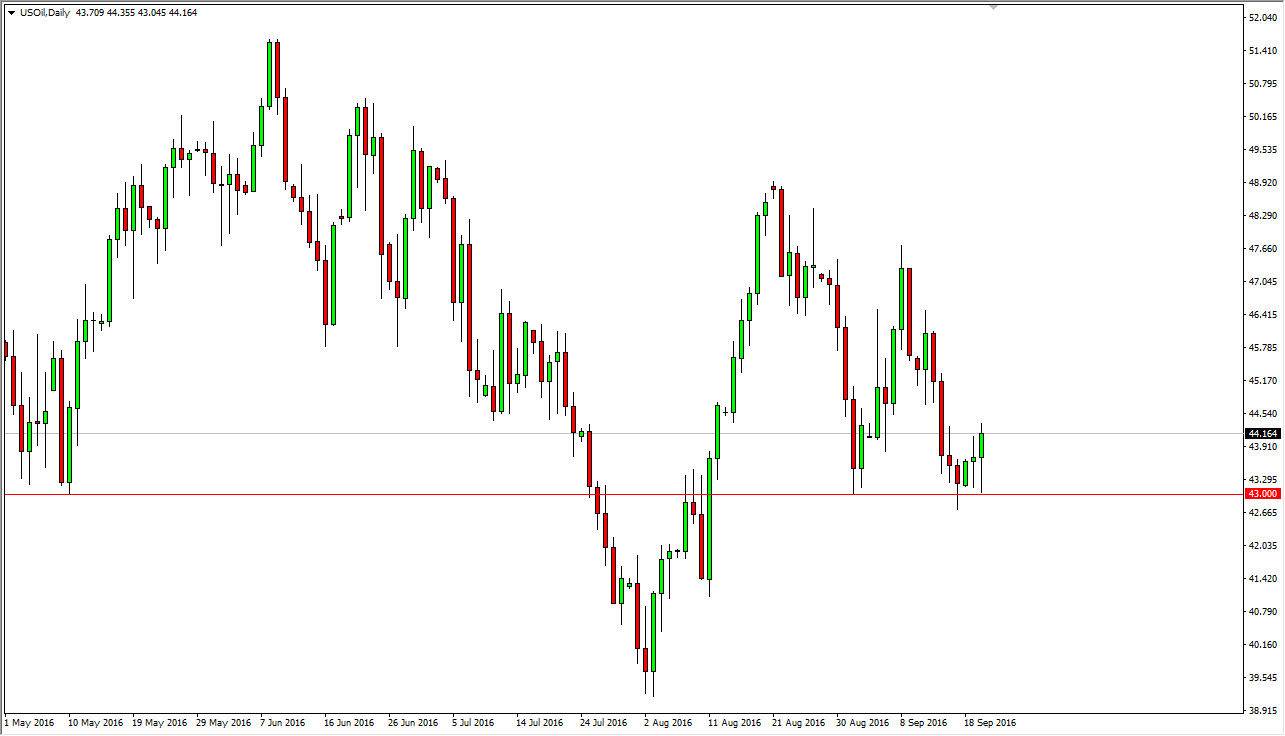

WTI Crude Oil

The WTI Crude Oil market initially fell on Tuesday, but found the $43 level to be supportive enough to turn things around. Because of this, we ended up forming a hammer of sorts, and with this being the case, I think that the market very well could be looking to go higher. However, the Crude Oil Inventories announcement comes out today, and with this it is likely to have a strong influence on this market. The markets are still bearish longer-term in my estimation, mainly because there is a serious oversupply as predicted by the IEA, and expected to last into late 2017. With this, I look at any serious rally as potential selling opportunity. This market is likely to reach $40 over the longer term.

Natural Gas

The natural gas markets rallied during the session on Tuesday, breaking well above the $3 level. This barrier being broken is a strong sign, and I think that this market will continue to grind its way to higher levels, perhaps the $3.40 level. This market will be choppy, but given enough time I expect it to reach those levels.

The strength of the candle is of course pretty impressive, so I think that the follow through should be strong, and as a result this market is one that I am only willing to buy at this point. The market has plenty of support all the way down to the $2.80 level, which is very unlikely. The market breaking below there would be a very bearish sign, and with this it is likely that the market would be unravelling at that point. I doubt this is going to happen anytime soon though, so at this point I expect the buyers to continue to run the market. Longer-term, I am still bearish of natural gas, as there is far too much out there to think supply will ever truly get tight.