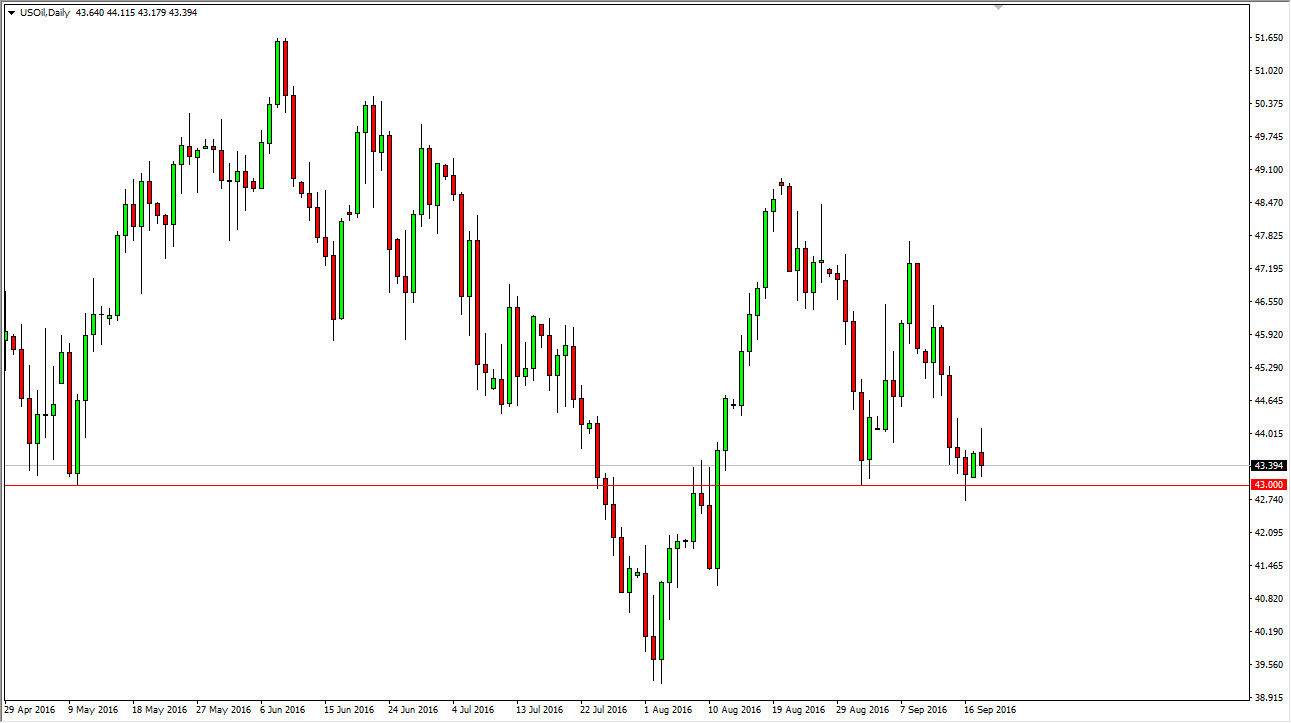

WTI Crude Oil

The WTI Crude Oil market had a very choppy day during the Monday session, forming a fairly neutral candle. However, the market looks like it is getting a bit of exhaustion is starting to set in. The $43 level below is massive support, so I think if we can break down below there we then can see a move lower, perhaps down to the $40 handle. If we can break above the top of the candle during the course of the session on Monday, perhaps buyers will get involved then try to push this market towards the $46 level. However, I think that any type of exhaustion after a short-term rally will end up being a selling opportunity. After all, there are a lot of things out there that are working against the value of oil at the moment.

Natural Gas

The natural gas markets initially fell during the day on Monday, but did turn right back around to form a bit of a hammer. The hammer is of course the supportive candle that the market has been forming again and again as we are trying to break out above the $3.00 level. If we can break above there, the market should then continue to go higher, perhaps reaching towards the $3.40 level. The market breaking down below the bottom of the hammer would be negative, but is not until we clear the $2.80 level to the downside that I would consider selling as the market should then roll over towards the $2.65 level. Ultimately though, it does look as if the buyers are in control, and that it should continue to go much higher. I have no interest whatsoever in selling this market as I said previously, at least not until we get the breakdown. Longer-term, I am bearish, but at this moment time it certainly looks like the buyers are in control.