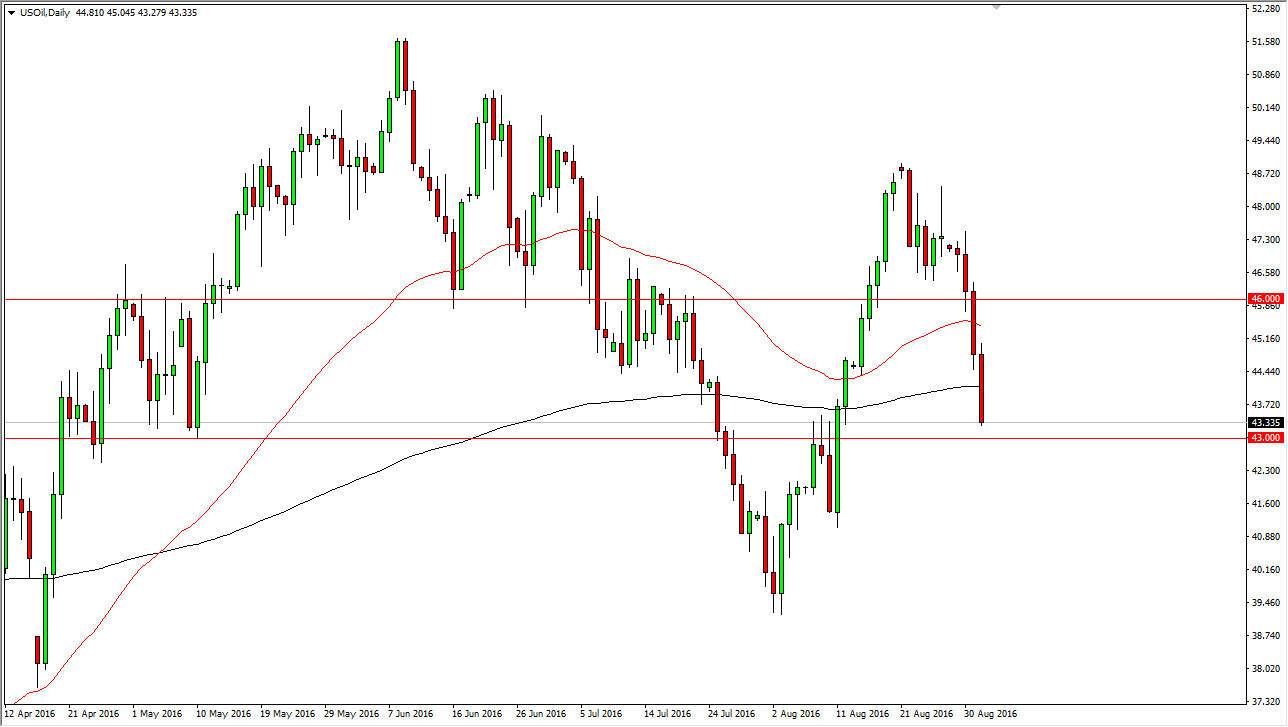

WTI Crude Oil

During the day on Thursday, the WTI grade of crude oil got absolutely pummeled yet again. We are approaching the $43 level, an area that could be supportive. However, I believe the given enough time we are selling off even if we do rally from here. This is a market that is dealing with the fact that demand simply isn’t there as I had anticipated previously. On top of that, it appears that the oversupply problem in crude oil will last through most of 2017, so a lot of the reason for the rally has just been undermined. With this, I believe short-term rallies offer selling opportunities just as a significant break below the aforementioned $43 handle will be.

Natural Gas

Natural gas markets got hit pretty hard during the session on Thursday as well. However, we are still very much within the consolidation area, and I believe that the $2.75 level below will offer support. A lot of the bullish action that we have seen in this commodity is due to the fact that there is a tropical depression just outside of the Gulf of Mexico that now looks likely to trade become a hurricane. This has shut down a significant portion of the natural gas production in the United States, but quite frankly there is so much gas at the moment that it’s difficult to imagine this rally lasting any real length of time. Beyond that, we have a significant amount of resistance above the $2.90 level, extending all the way to the $3 handle. In other words, I don’t think we’re going anywhere any time soon, and it could be a market that might be best avoided at the moment due to all of the volatility. With that being said though, I am watching and will be interested to see how the jobs number affects the demand picture when it comes to natural gas.