Gold prices settled at $1324.76 an ounce on Friday, scoring a gain of 0.34% on the week, as soft U.S. jobs data lured investors back into the market. The XAU/USD pair traded as high as $1331.01 after the Labor Department reported that the economy added 151K jobs in August and unemployment rate held at 4.9%. Data also showed that gains for the prior month were revised up by 20K. This report is far from a being disaster but it falls short of expectations by enough to throw a rate hike at the Fed's next meeting in to doubt.

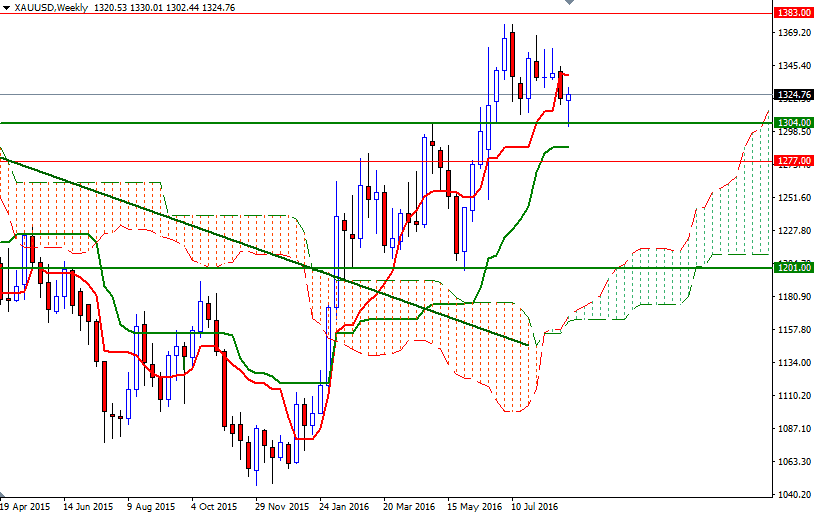

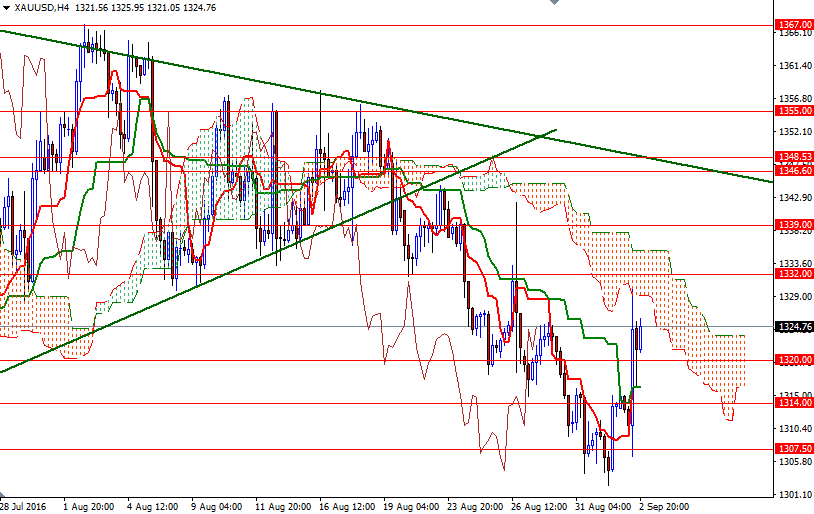

Federal Reserve Chair Janet Yellen and Vice Chair Stanley Fischer signaled recently that an interest rate increase could be on the horizon but it appears that a December rate hike is more likely at this point and this could be supportive for gold in the near-term. From a technical perspective, there are two things catch my attention at first glance. First of all, XAU/USD returned to the key 1307.50-1304 area after breaking the lower line of the triangle and prices bounced up nicely from there, pushing the market back above the daily Ichimoku cloud. Secondly, the short-term charts are bullish at the moment, with the market trading above the Ichimoku clouds on M30 and H1 time frames, This reaction is of course a positive sign though a bit of caution is advised as the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are negatively aligned.

That said, I think the market has to anchor somewhere above the 1332/0 area, in order to continue to move to the upside. In that case, 1340/39 and 1348.53-1346.60 could be the next potential targets. Once beyond that, the bulls will be aiming 1358/5. On the other hand, if XAU/USD fails to break through the 4-hourly cloud and reverses, the market may test 1320/19 and 1315/4. Breaking below 1314 implies that we are heading back to the 1307.50-1304 zone. The bears have to capture this camp so that they can force the market to test the 1297 level. If 1297 is breached on a daily close basis, we could go all the way down to the 1277 level.