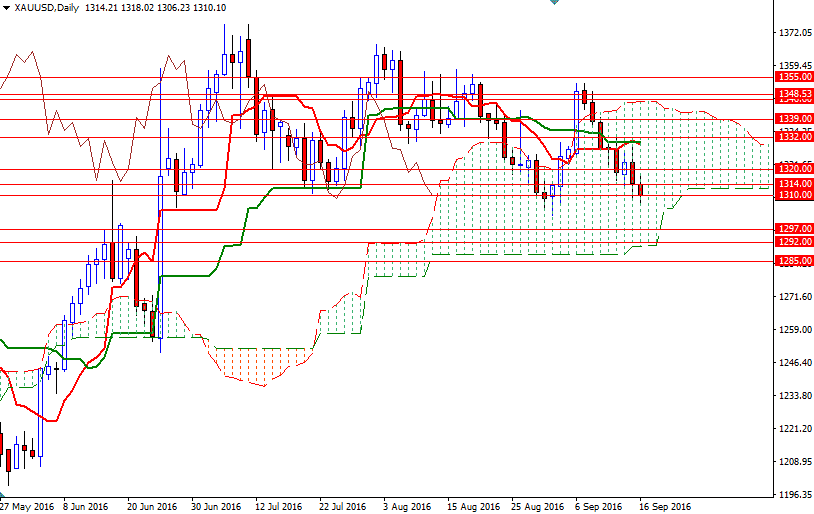

Gold ended the week down by 1.35% at $1310.10 an ounce, weighed down by a stronger dollar, weak physical demand in Asia and uncertainty surrounding Federal Reserve policy. The XAU/USD pair tried to climb above the $1332 level but the market found strong resistance in the vicinity. As a result, prices reversed and broke down below the $1320/19 support zone and tested the $1314 and $1310 levels as expected.

The market will focus on the Federal Open Market Committee meeting, which will include updated economic forecasts for growth, inflation, unemployment and interest rates. Federal Reserve Chair Janet Yellen will hold a press conference following the meeting. Although weaker-than-expected U.S. economic data over the past few weeks reinforced the notion that the Fed will most likely wait until December, some investors think that a September hike cannot be ruled out completely. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 285413 contracts, from 307860 a week earlier.

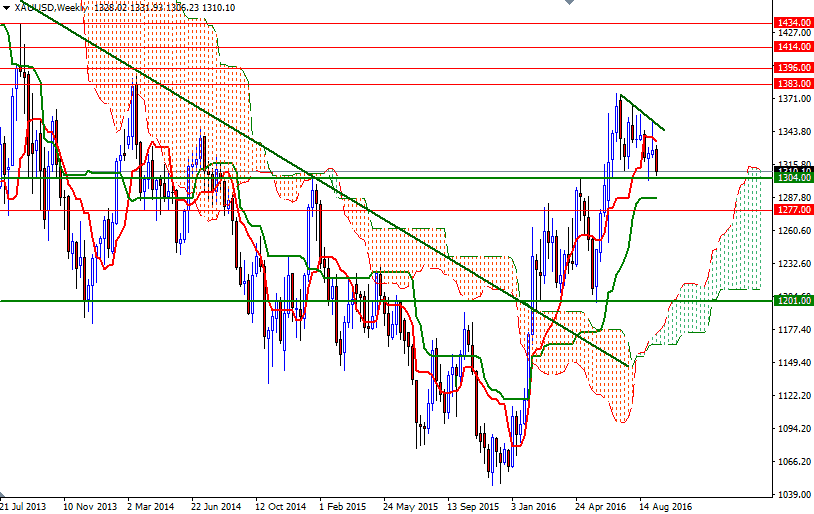

Technically, trading below the Ichimoku cloud on the H4 chart and posting the lowest weekly close in 12 weeks indicate that the short-term outlook for XAU/USD remains negative. Adding to the bearish picture, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on the daily and 4-hourly time frames, along with Chikou Span/Price cross in the same direction. It looks like we may be heading down to the key 1304/0 area which is likely to act as effective support, at least before the Fed's decision. If this support remains intact and prices start to rise, the market may test the 1314 and 1320 levels. The bulls have to push prices above 1320 so that they can approach the 1327.46-1326.40 zone. Beyond that, the 1332/0 zone stands out as an obvious key resistance. Penetrating this barrier on a daily basis cloud could prolong the bullish momentum and open a path to 1339. However, it is quite possible that XAU/USD will continue its bearish tendencies if the 1304/0 support gives way. In that case, 1297/5 and 1292/0 will be the next possible targets. Closing below 1290 would make me think that the market will be aiming for 1285 and 1277 afterwards.