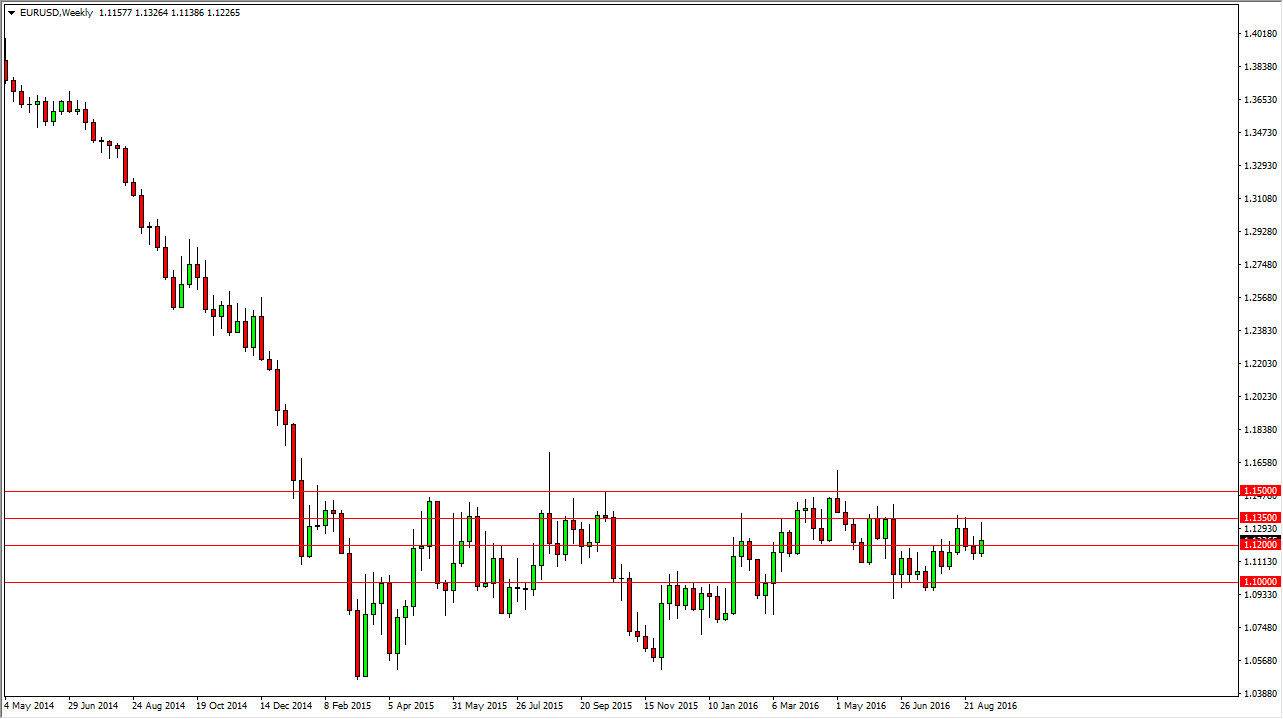

EUR/USD

The EUR/USD pair rose during the course of the week, slamming into the 1.1350 level. However, we turn right back around and form a bit of a shooting star so having said that it’s likely that the market will continue to be very volatile and choppy. We ended up doing just that, and as a result it looks like the market is going to continue to be very negative but in a very choppy manner. Truthfully, I don’t like this market at all currently.

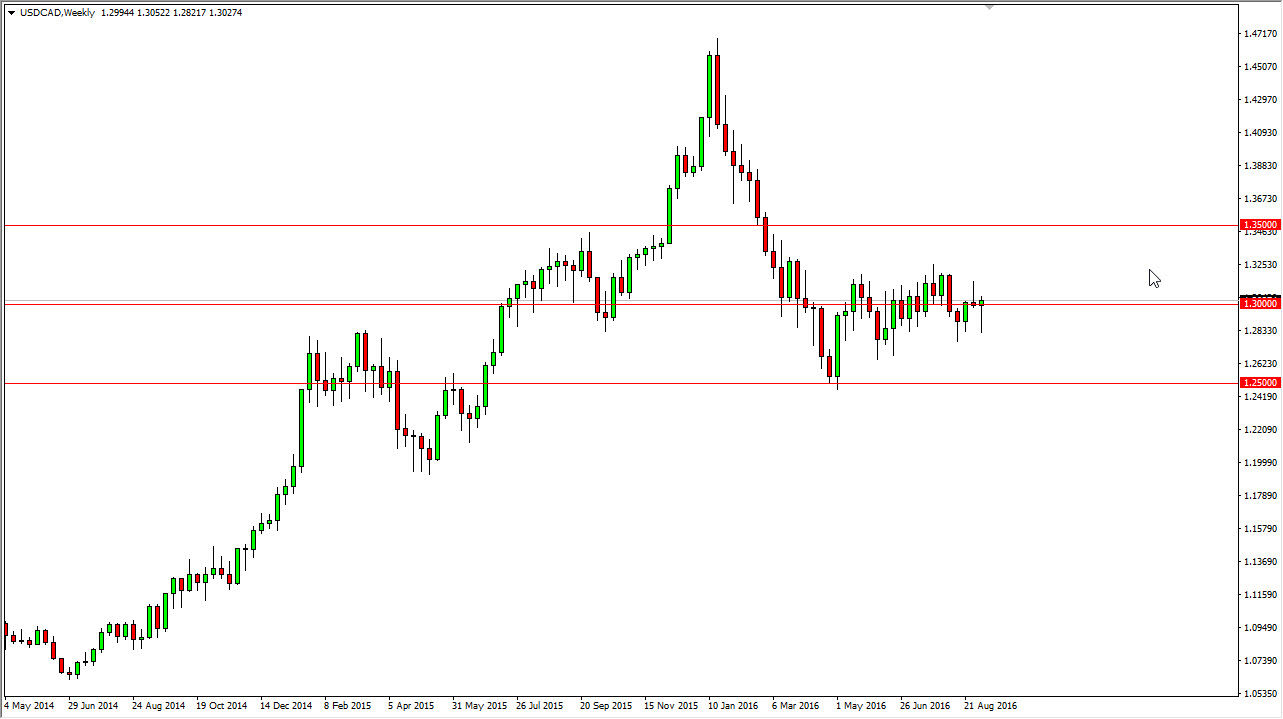

USD/CAD

The USD/CAD pair fell during the course the week but turned right back around to form a rather supportive looking hammer. The hammer sits just above the 1.30 level, so I think that the buyers will continue to pushes market higher given enough time. I think the target will be 1.3250, and perhaps even higher than that. I also recognize that oil has a massive influence on the Canadian dollar, so you have to keep an eye on that as well.

NZD/USD

The New Zealand dollar initially rallied during the course of the week, crashing into the 0.75 level. That being the case, we found quite a bit of resistance and turned right back around to form a shooting star. The shooting star of course is a negative sign, so having said that I believe that a break down below the bottom the shooting star sends this market lower, but there is plenty of support below so with that being the case I feel it’s only a matter time before the buyers get involved. In other words, I feel that we sell off shortly, and then turn right back around.

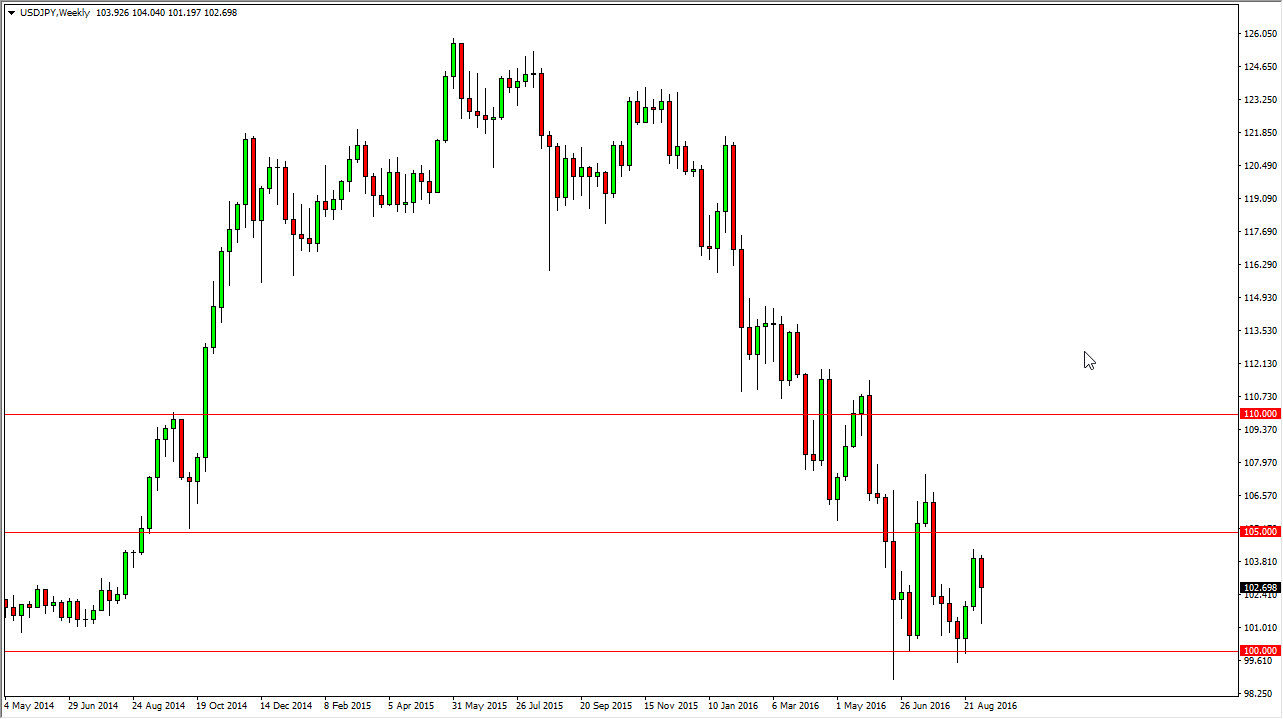

USD/JPY

The USD/JPY pair fell initially during the course of the week but turned right back around and form a massive hammer. Ultimately, this market looks as if it is trying to bounce higher, and then reach towards the 105 level. A break above there could send this market much higher. This is a market that is supported by the Bank of Japan so at this point in time I am buying this market every time we pullback and show signs of support.