USD/JPY Signal Update

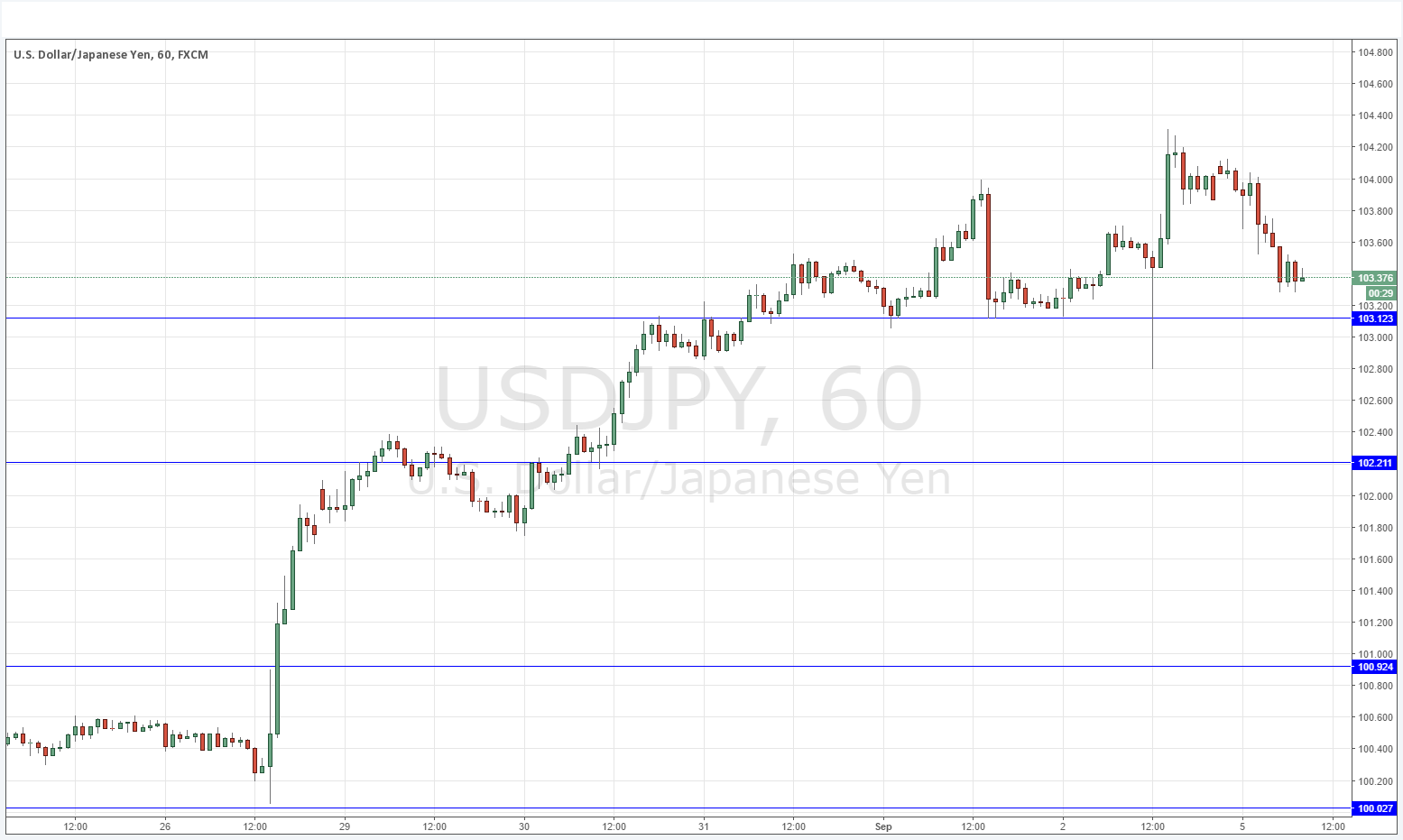

Last Thursday’s signals produced a profitable short trade after the doji/pin candle hourly chart rejection of the resistance level identified at 103.96.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am and 5pm Tokyo time only, over the next 24-hour period.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 103.12 provided the price did not already fall significantly below that level during the London or New York sessions earlier.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair was notably bullish all week last week, but has been falling off quite steadily since this week’s open, enhanced by the Governor of the Bank of Japan’s more hawkish public spin today upon the subject of near-term monetary policy. The price now looks quite likely to reach the supportive area not far below at 103.12. The U.S. has a major public holiday today, so it will be up to Tokyo to decide whether lower prices are bargain buys or not.

There is no obvious resistance before 106.00 so there is a lot of space for the price to rise. Of course, the 105.00 level has psychological significance so can always become a barrier to movement.

There is nothing due today concerning either the JPY or the USD. It is a public holiday in the U.S.A.