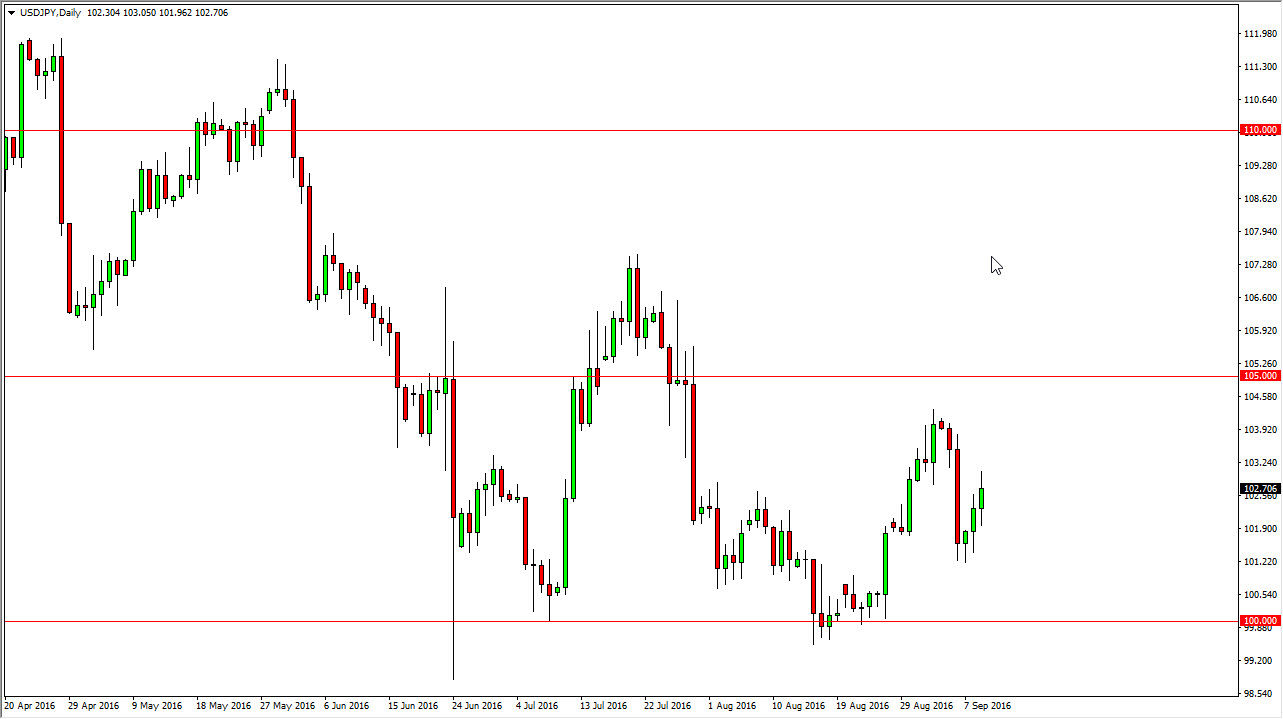

USD/JPY

The USD/JPY pair went back and forth during the course of the session on Friday, as we continue to see buying opportunities in this market. I believe that the Bank of Japan will continue to push this pair higher given enough time, either due to the Bank of Japan getting involved, or just a simple fact that traders continue to prefer the US dollar over most currencies. However, this is obviously a bit different when it comes to the Japanese yen as it is considered to be an even “safer” currency than the US dollar. The market should reach towards the 105 level given enough time, but I think it could be rather choppy. I’m not looking for a straight shot higher, just simply a grind towards that direction.

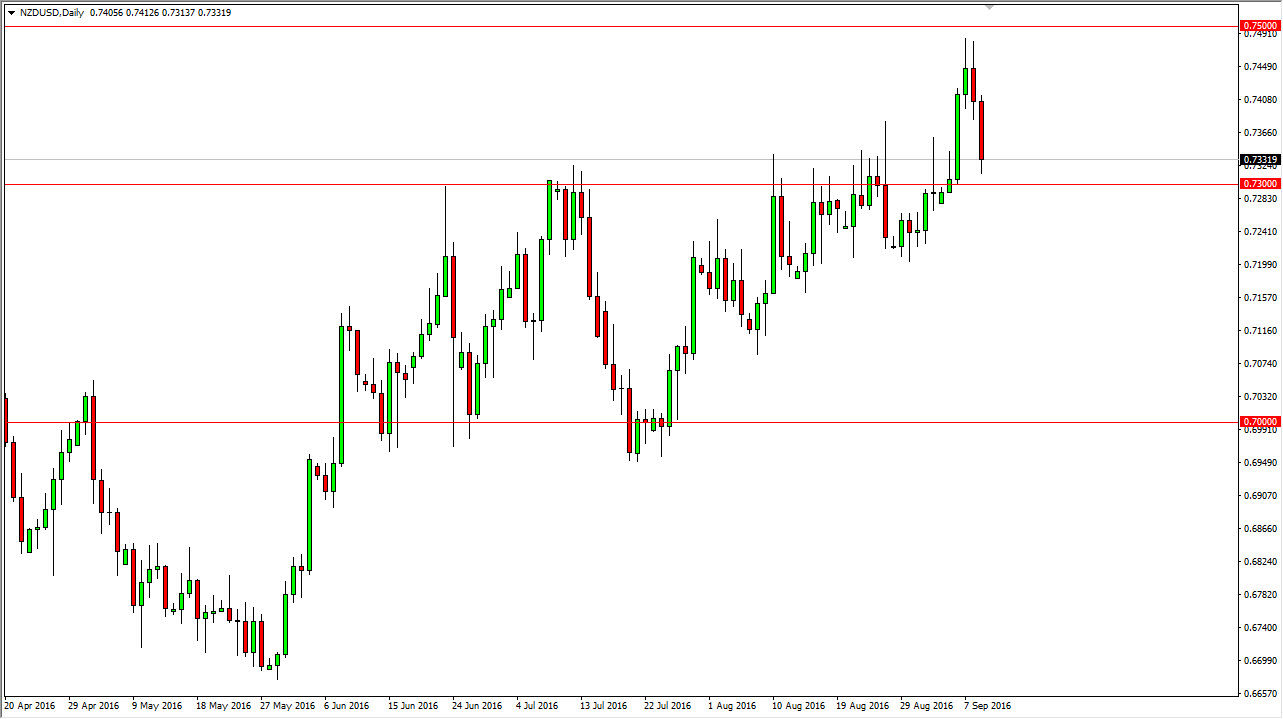

NZD/USD

The New Zealand dollar fell significantly during the course of the session on Friday, testing the 0.73 level. This is an area that was previously resistance, so it makes sense that it is now support. Ultimately, I believe that the market will continue to show quite a bit of volatility but given enough time I think the buyers will return just due to the fact that there is a serious lack of interest rate help out there. I believe that people will continue to take advantage of the swap, and I’m not interested in selling this market until we break down below the bottom of the 0.72 handle below, which I think is the bottom of the “support range” in this market.

Ultimately, I think we may be entering a new consolidation area, with the 0.73 level being the bottom, and the 0.75 level being the top. Expect a lot of choppiness, but ultimately I think that the markets will make a serious argument for a longer-term move. Once we get that, I will be much more comfortable.