USD/JPY

The USD/JPY pair rose slightly during the course of the session, but as you can see we did not hang onto much in the way of gains. I believe that the market will continue to bounce around just above the 100 level, which I believe is a “line in the sand” when it comes to this market. I think that this market will more than likely be very sideways for the short-term, simply because the market recognize that the Bank of Japan will continue to defend the 100 level, but quite frankly there is serious concerns about whether or not the Federal Reserve can raise interest rates anytime soon. With this, I do believe that eventually this pair goes higher, but it is going to be very choppy to say the least, and as a result I think short-term buying opportunities again and again will present themselves, but not much more than that.

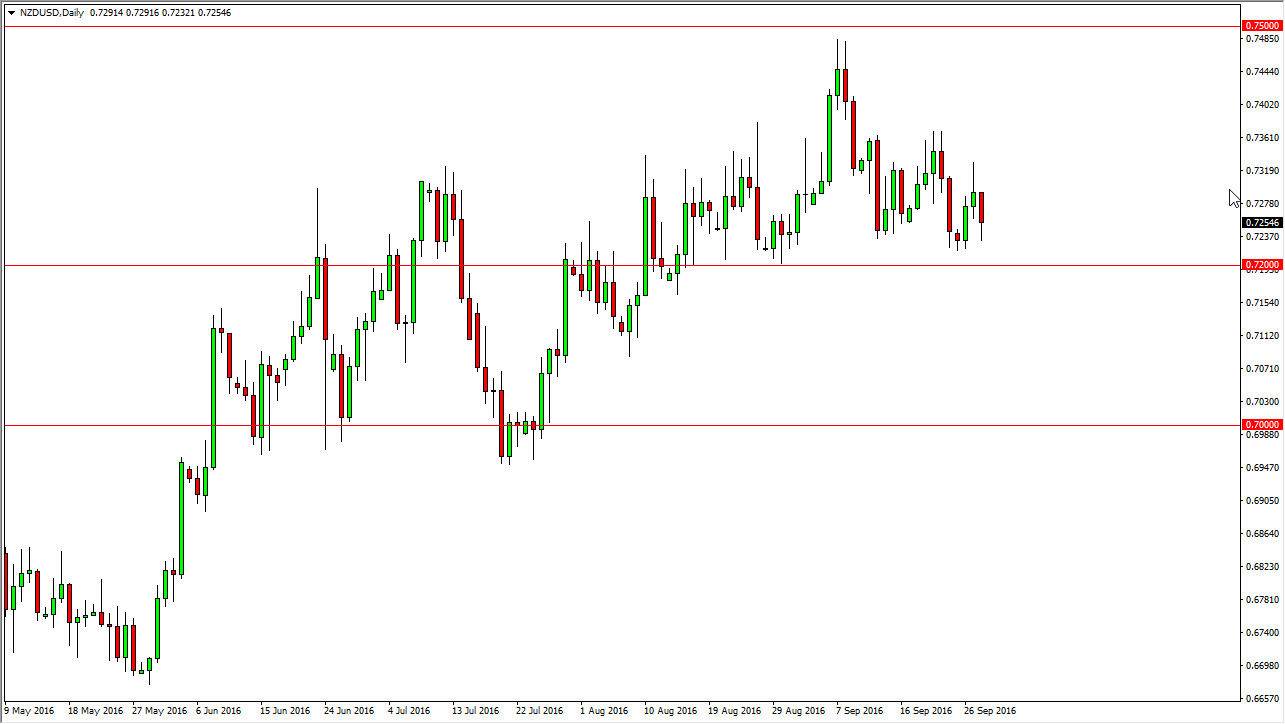

NZD/USD

The New Zealand dollar fell during the day on Wednesday, but turned around to form a bit of a hammer. The 0.72 level below is massively supportive as far as I can tell, so as long as we stay above there the market should continue to reach towards the 0.7350 level. There is resistance there, but I think we will eventually break above there as well. The 0.72 level below is very likely to be very supportive going into the future, so I think short-term buying opportunities will present themselves again and again.

If we did break down below the 0.72 level with any type of momentum, I would anticipate that the market would probably reach towards the 0.70 level underneath that. However, I don’t really think that’s going to happen anytime soon so having said this I prefer buying this market more than anything else, but I do recognize that we will probably continue to have a massive resistance at the 0.75 level above there.