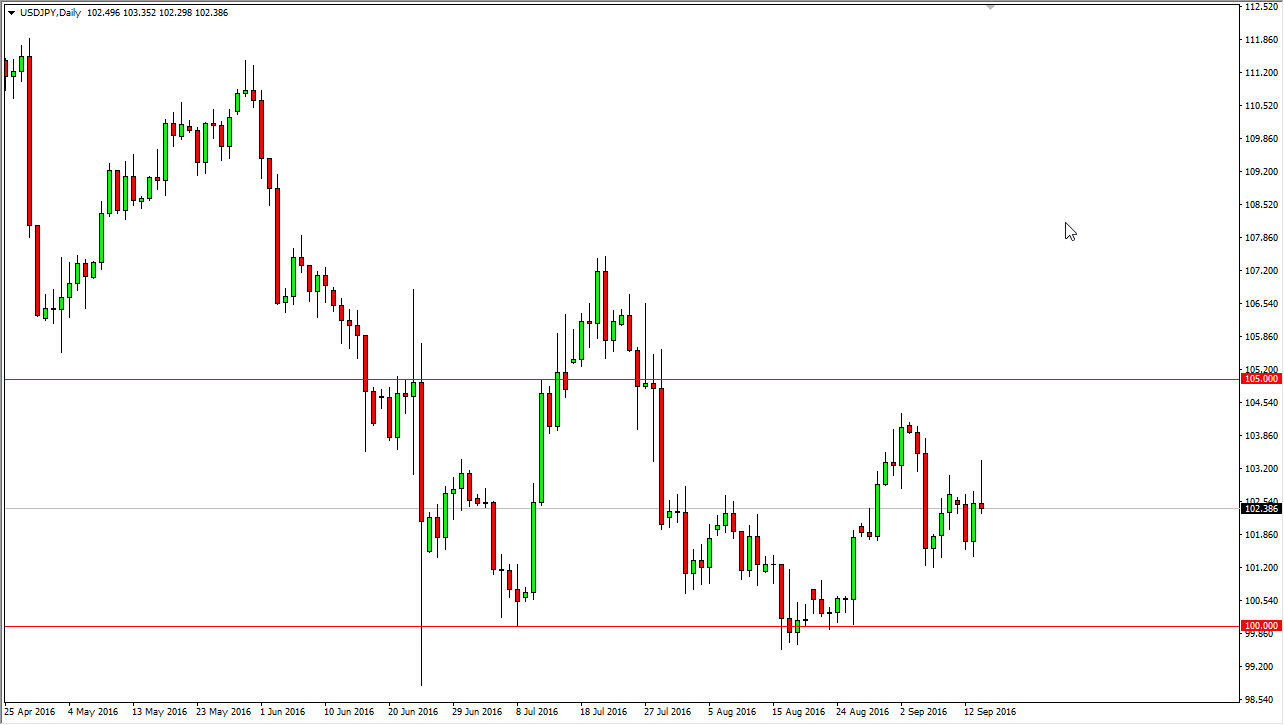

USD/JPY

Initially, the USD/JPY pair rose during the course of the day on Wednesday, but turn right back around to form a shooting star. The shooting star of course is a very negative candle, so I feel that the market will probably grind its way a little bit lower from here. However, I do recognize is somewhere near the 101 level there is a very strong support level, and most certainly down at the 100 level below there. I think if you are going to sell this pair, and I would be the first to say that I’m not going to, you have to take your profits fairly quickly. On the other hand, if we break above the top of the shooting star that would be very positive sign as we would reach towards the 105 level at that point.

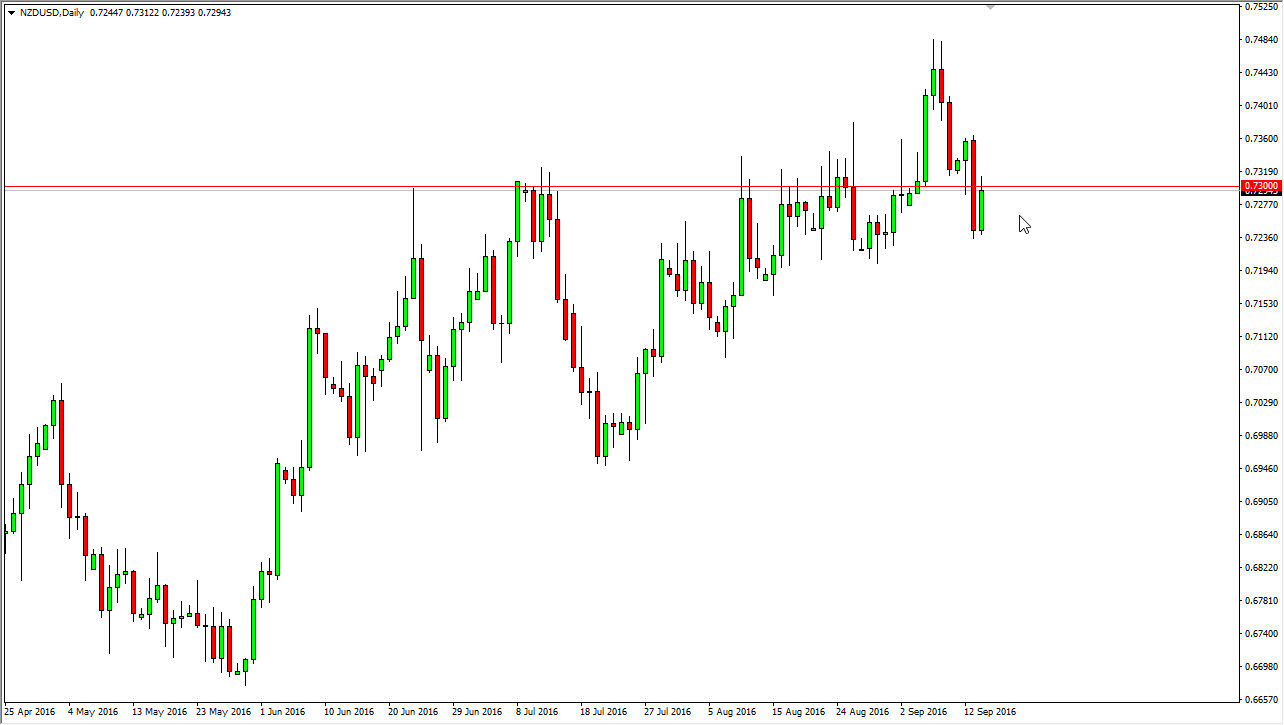

NZD/USD

The New Zealand dollar rallied during the day on Wednesday, slamming into the 0.73 handle. This is an area that has previously been massively resistive, and as a result it’s not a surprise to see that the sellers got involved again. At this point in time, I anticipate that short-term exhaustion will be the way to start selling this market, and as far as buying is concerned I’m not necessarily interested in doing so until we get above the top of the impulsive candle from the Tuesday session. At that point in time, I would anticipate that the New Zealand dollar within reach towards the 0.75 handle.

Ultimately, I think that we will probably try to reach down to the 0.70 level given enough time, but it’s going to be a fight to get down there. I would anticipate quite a bit of choppiness between here and there, and as a result I think that any treaty take is going to be a little bit gut wrenching. However, I certainly see this is a market that has more sellers than buyers as far as pressure is concerned at the moment.