USD/JPY

The USD/JPY pair initially tried to rally during the course of the session but turned right back around to form a positive candle. In fact, we even broke above the top of the shooting star from the previous session, so having said that it’s likely that we will continue to go higher. The 105 level will more than likely offer quite a bit of resistance, and as a result I think that it is going to be difficult to get above that level, at least in the short-term. However, I think pullbacks will have buying opportunities present themselves on short-term charts that show signs of support. Once we do get above the 105 level, we should then reach towards the 107 handle above.

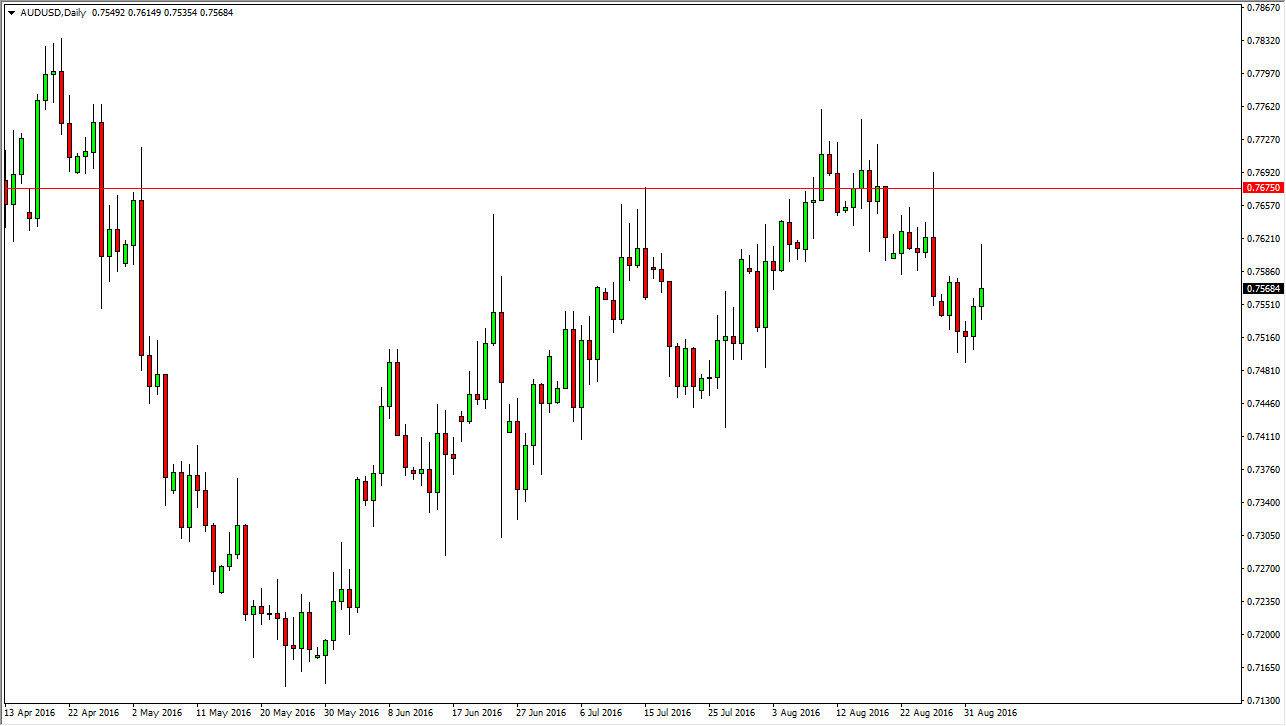

AUD/USD

The AUD/USD pair rallied during the course of the session on Friday, but gave back quite a bit of the gains in order to form a shooting star. The shooting star of course is very negative, but I do recognize that the 0.75 level below will continue to offer support. If we can break down below the most recent low, I think the market could continue to go much lower. Ultimately, rallies at this point in time should be selling opportunities on short-term charts as well, and as a result I think it’s only a matter of time before we have negativity enter the market.

Once we break down, I believe that we will more than likely reach towards the 0.73 level. That’s an area that causes quite a bit of support as far as I can tell, and as a result it’s likely that we will get a slight move lower, but it will only be short-term at best. Any break above the top of the shooting star for the session on Friday will send this market looking for the 0.7675 level.