USD/JPY

The USD/JPY pair initially tried to rally during the day on Tuesday but ended up falling all the way down to the 100 region. However, by the end of the day we got some type of stability and as a result we formed a neutral, although shooting star looking candle. With this being the case, I think there is a significant amount of bearish pressure but in the end the 100 level is an area that the Bank of Japan will continue to pay attention to. With that being the case, I think that any break down below that level will more than likely trigger buying opportunities on signs of support and of course intervention. I don’t necessarily think that the Bank of Japan is going to intervene directly, but they most certainly will defend this area one way or another. A break above the top of the shooting star is alternately a buying opportunity as well.

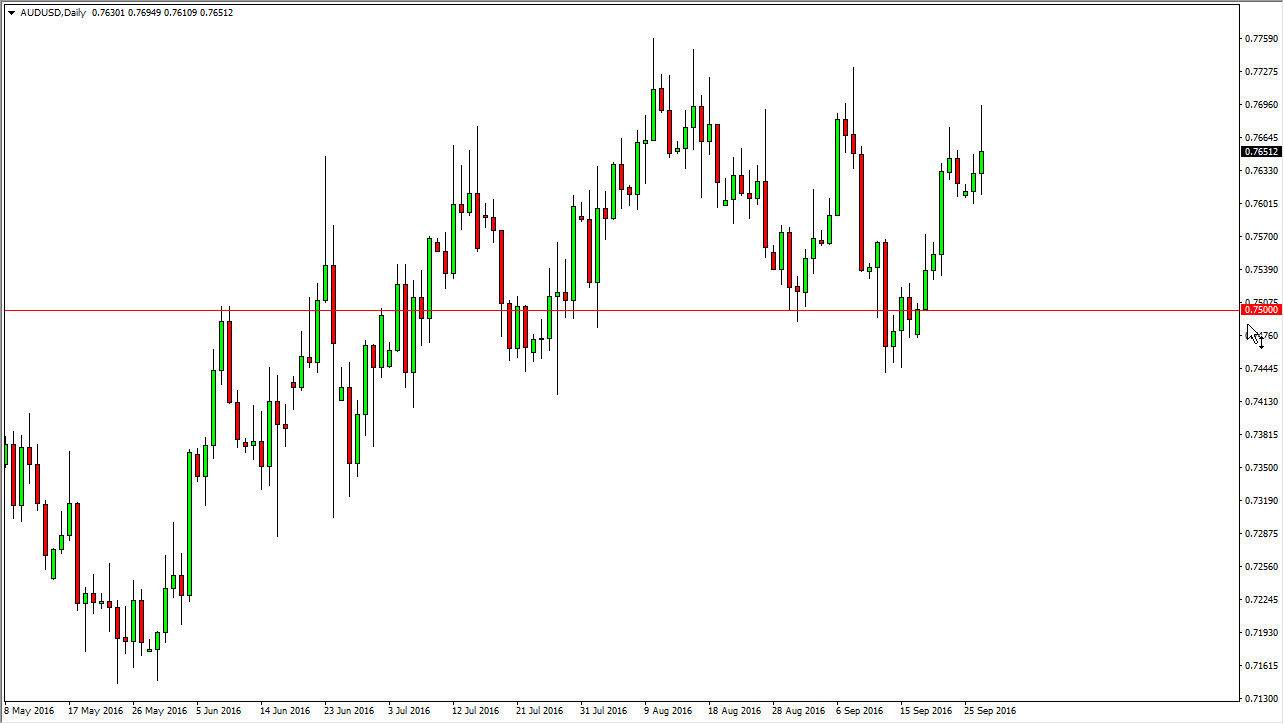

AUD/USD

The Australian dollar rally during the day after initially falling on Tuesday, but as you can see gave up quite a bit of momentum once we got to the 0.77 handle. The biggest problem I have with this market is that there is simply far too much noise above to continue going higher with any type of momentum. Because of this, I believe that we will eventually break down below the bottom of the candle for the session on Tuesday, and that could be a selling opportunity. I wouldn’t risk shorting this market quite yet though, I would need to see that break down in order to put actual money to work. At that point in time, I would anticipate a move down to the 0.75 handle as it seems to be relatively important.

One thing that I would point out is that the highs keep getting lower, and that is a sign that we are starting to run out of upward momentum in general. With this being the case, I am mildly negative as far as bias is concerned.