USD/JPY

The USD/JPY pair rallied a bit during the day on Friday, but we continue to meander right around the 101 level. I believe that there is a massive amount of support below though, so it’s only a matter of time before the buyers get involved. I also recognize the 100 level as the “line in the sand” that the Bank of Japan has placed in this market. Because of this, it will be very difficult to start shorting at these low levels.

That’s not to say that is going to be easy to serve buying, I believe that there will be a lot of noise and volatility in the next several sessions. Because of this, I recognize that unless you can go into it with the attitude of hanging onto the trade for some time, it might be difficult to buy. However, with the central bank sitting below, selling is all but it in possibility in my mind.

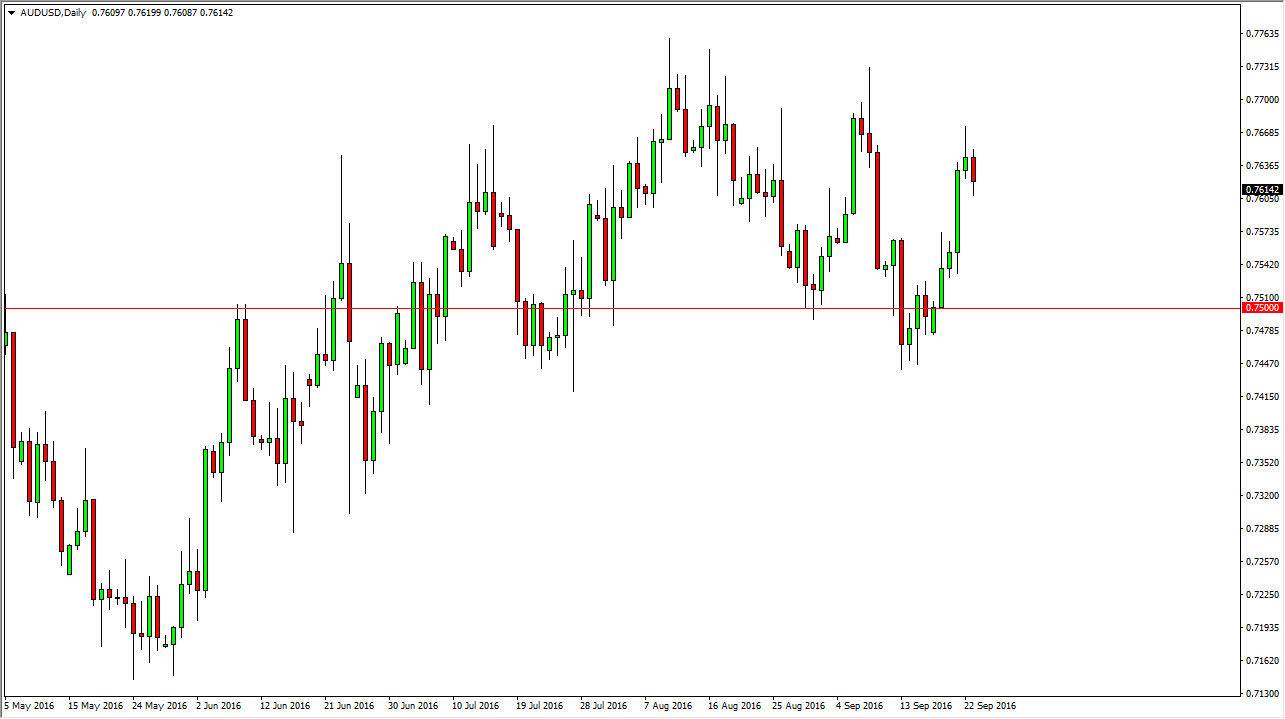

AUD/USD

The Australian dollar fell a bit during the day on Friday, breaking the bottom of a shooting star that had formed on Thursday. We are gradually starting to see “lower highs”, psychologically lay matter time before we drift back towards the 0.75 handle. I think at this point in time it is a market that’s going to be somewhat soft, but I’m not necessarily looking for some type of massive breakdown. I think this is just a market that doesn’t know what to do with self, which is quite frankly what I am seeing around the Forex world at the moment. I think in general consolidative move, meaning down to the support at the 0.75 level seems about right in a market that doesn’t really have any real drive to go in one direction or the other. However, if we can break above the top of the shooting star from the Thursday session, that could encourage buyers but I still think is can it be a tall order to get above the 0.7750 level anytime soon.