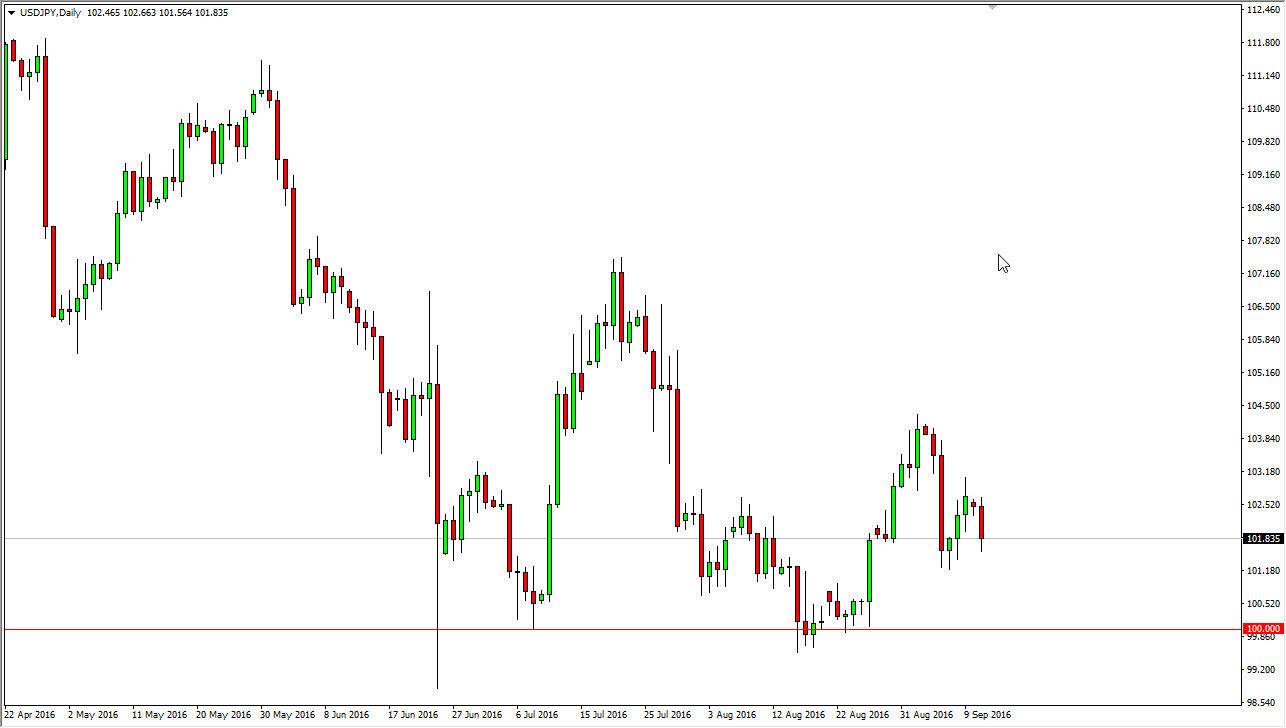

USD/JPY

The US dollar fell against the Japanese yen during the session on Monday, as it appears that a certain amount of safety buying has returned to the yen. However, I think that there is more than enough support just below to keep this market going higher, and I believe that the 100 level below is going to continue to be the “floor” in this market. I believe it’s only a matter of time before the buyers return into the market and start buying again. I have no interest in selling, and I believe that at this point in time we are more than likely going to see this market go higher rather than lower given enough time. With this, I believe that the Bank of Japan will continue to be fairly active one way or another, and with that this pair should go higher.

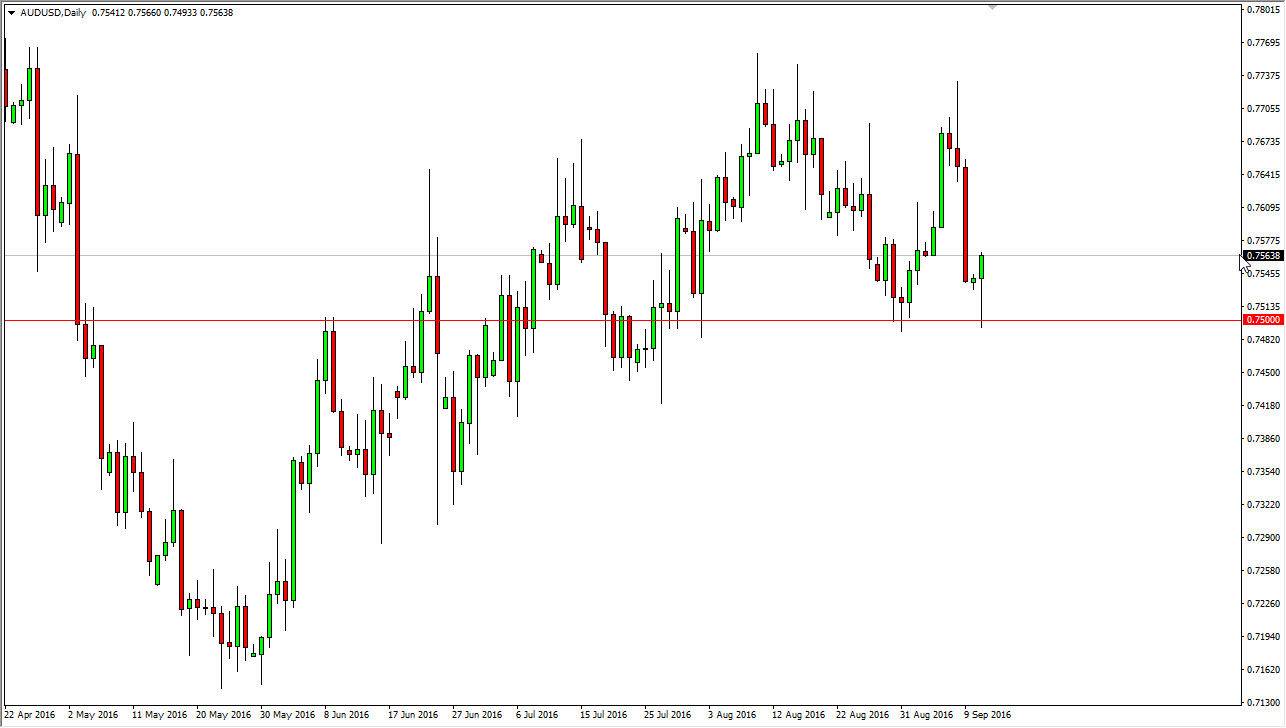

AUD/USD

The Australian dollar initially fell during the course the day on Monday, but found enough support at the psychologically important 0.75 level to turn things around and form a bit of a hammer. The hammer is of course a very bullish sign, and a break above the top of it would be a very bullish sign. I think at that point in time we would then begin to go back to the top of the consolidation area that we had previously been trading in, which means we should then start reaching for the 0.77 level above. I think that every time we pullback, buyers will look at this as an opportunity to take advantage of a bit of value in the Aussie dollar.

If we did break down below the 0.75 handle, I think there is support all the way down to the 0.74 level, so this point in time I don’t really have any interest in selling. If we did break down below the 0.74 level though, I feel we could drop down to the 0.72 handle.