S&P 500

The S&P 500 initially fell during the course of the day on Wednesday, but bounced off of the 20-day exponential moving average in order to form a hammer. I believe that this market is going to continue to find buyers, and therefore every time it pulls back you have to suggest that their perhaps is going to be some value to be found. I think that we will reach towards the 2250 level, and therefore I continue to buy dips as they appear as I look at them as short-term buying opportunities until we get the large move that I feel is coming. In fact, I believe there is massive support all the way down to at least the 2150 handle, and most certainly below there. In other words, I am a “buy only” type of market.

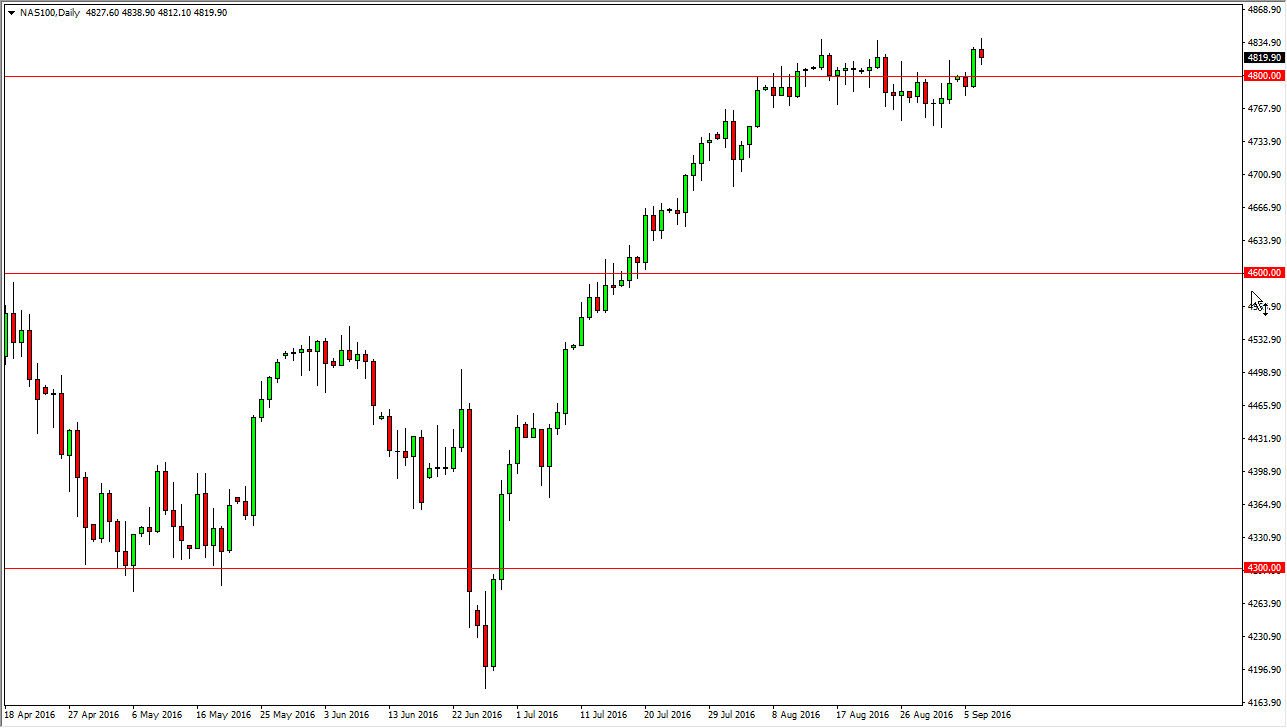

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Wednesday, forming a fairly neutral candle. The neutral candle of course is a fairly benign signal, but I do recognize that if we can break down below the bottom of the candle, the market will more than likely reach towards the 4750 handle. A supportive candle in that general vicinity would be a nice buying opportunity, but I also believe that a break above the top of the candle for the day on Wednesday would also send this market higher. Longer-term, I still have a target of 5000, and therefore I have no interest whatsoever in selling this market. As the Federal Reserve looks very unlikely to raise interest rates too quickly, I believe that the NASDAQ 100 will continue to benefit from a low interest-rate environment as bonds will return was nothing.

With this being said, I don’t really have a scenario in which a willing to sell, and having said that I believe that the buyers will step in and push this market higher and higher.