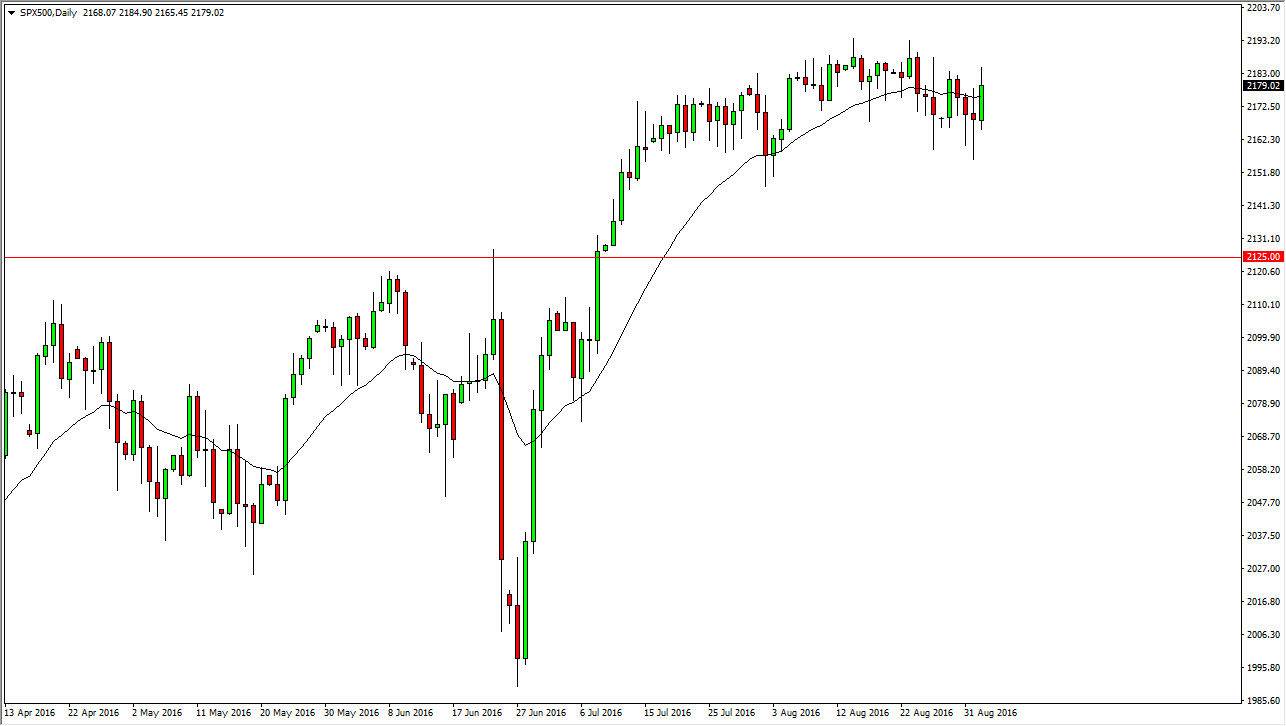

S&P 500

The S&P 500 rallied during the course of the session on Friday, as we continue to see buyers every time this market drops. The less than expected jobs added during the previous month of course also fueled speculation the perhaps interest rates will stay lower for longer than thought, and that of course is good for stocks. Ultimately, any time we pullback I still believe that the buyers will return, because quite frankly the lack of interest-rate hikes coming soon will be a boost for stock markets in general. Ultimately, this is a market that I have no interest in selling, and I still have a target of 2250.

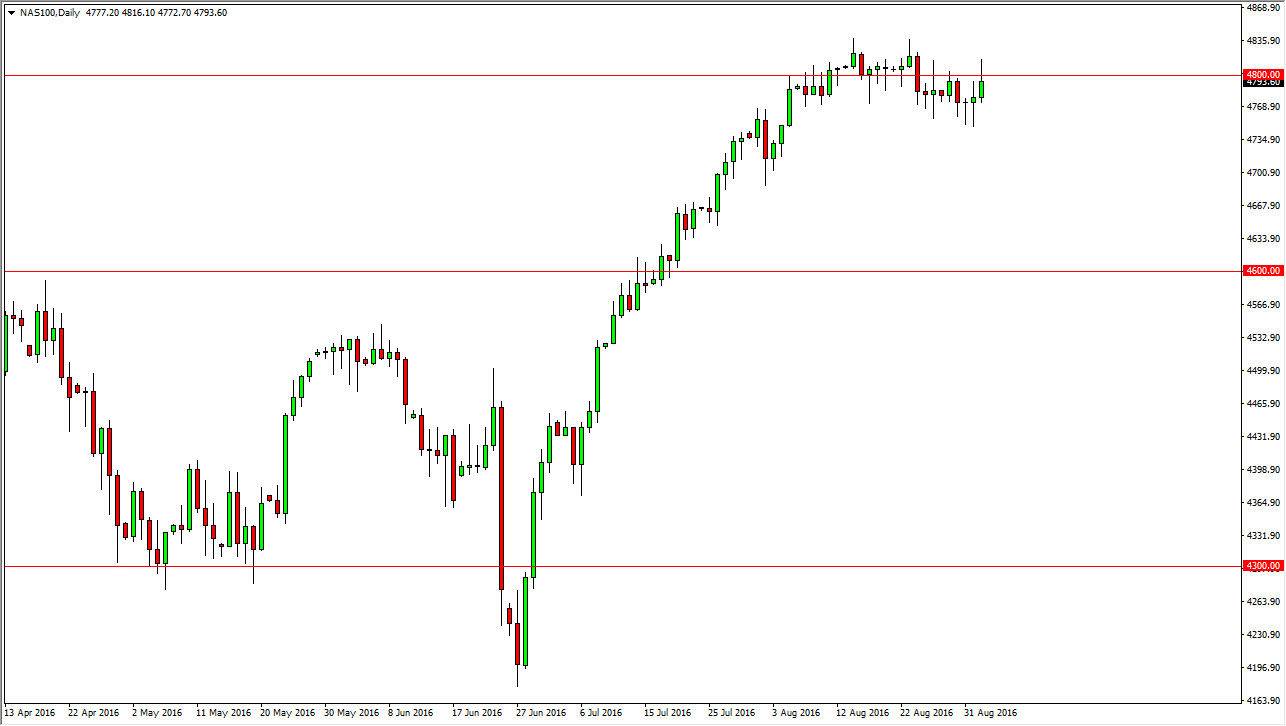

NASDAQ 100

The NASDAQ 100 initially tried to rally during the course of the day on Friday in reaction to the less than anticipated jobs number. However, the area above the 4800 level of course offers resistance, and with that being the case we ended up turning back around to form a shooting star. Ultimately, we have to look at the fact that there is a hammer from the previous couple of sessions, and with that being the case it’s likely that a break above the top of the shooting star would be a very bullish sign. With that, the market should continue to go to the 5000 handle which is my longer-term target. I have no interest in shorting this market, because quite frankly not only does the couple of hammers suggests support, but also the 4700 level below there. In fact, I don’t even have a base case scenario in which I’m willing to start selling at this point in time, and I do believe that we are not only can reach for the 5000 handle, but I think we are going to broke above that level given enough time as the market certainly has quite a bit of bullish pressure underneath.