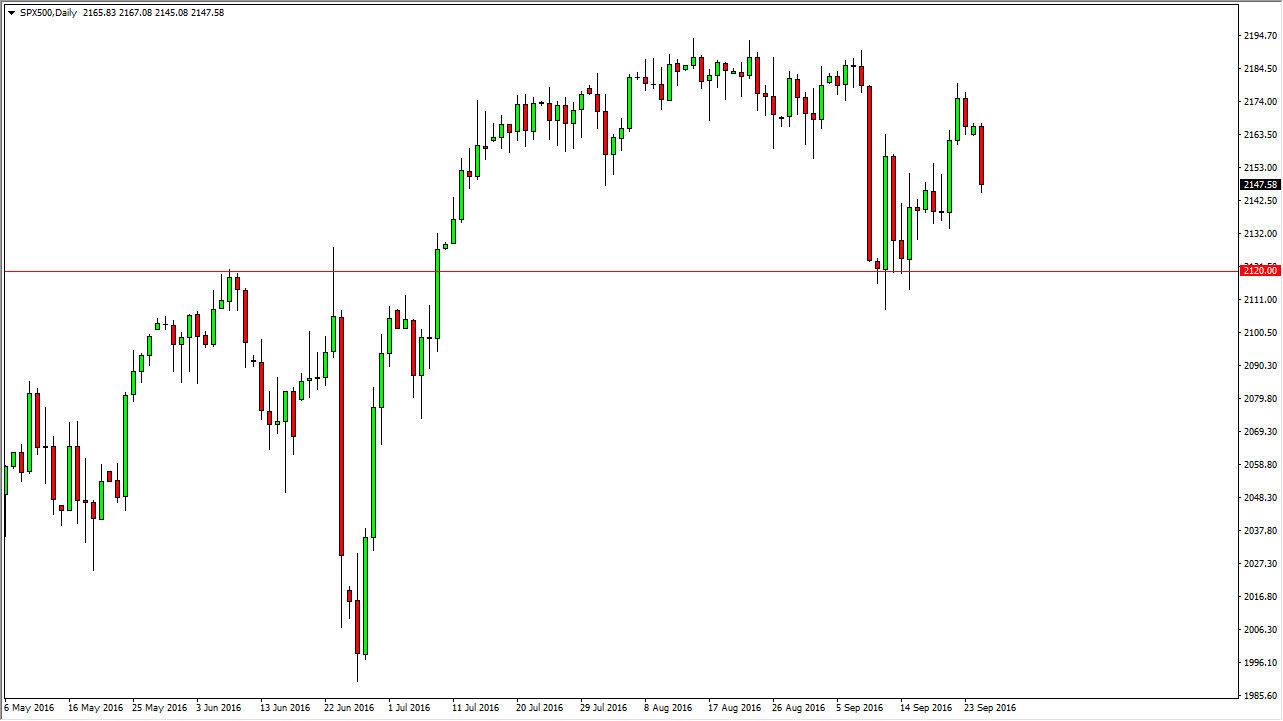

S&P 500

The S&P 500 had a tough session on Monday, dropping down below the 2150 level. However, the negative candle is a sign that we probably will continue to show bearish pressure. With this being the case, there is a significant amount of support below that will continue to eventually push this market to the upside. The 2120 handle below is essentially the “floor” as far as I can see. Any type of supportive candle is probably an invitation to start going long, and with that being the case it’s likely that the market will reach towards the 2200 level given enough time. It’s not until we break down below the 2100 level that I feel you can start selling this market with any type of significance as far as I can see. At this point, I do recognize that we will drop, but it should only offer value before it’s all said and done.

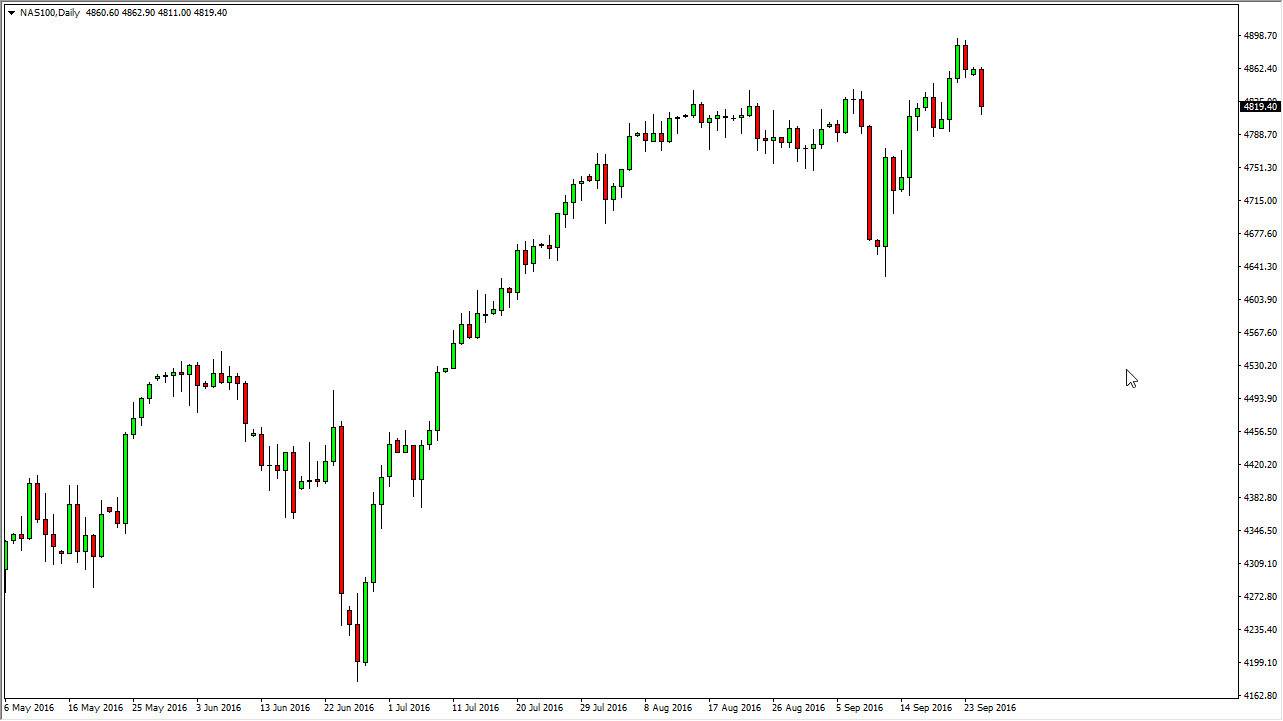

NASDAQ 100

The NASDAQ 100 initially fell during the day but you can see that the 4800 level below is massively supportive, so given enough time there should be buyers that reenter this market and push higher. After all, the interest-rate outlook is very soft, and as a result I feel it’s only a matter of time that the market will continue the upward trend that we’ve seen, because quite frankly there’s no real return being found in bonds, not only in government bonds at this point, but corporate bonds are starting to offer almost nothing in return.

I don’t have the supportive candle yet, but as soon as I get it or a significant bounce, I am more than willing to buy this market as I believe that longer-term we will reach towards the 5000 level above, which is my longer-term target and has been for some time.