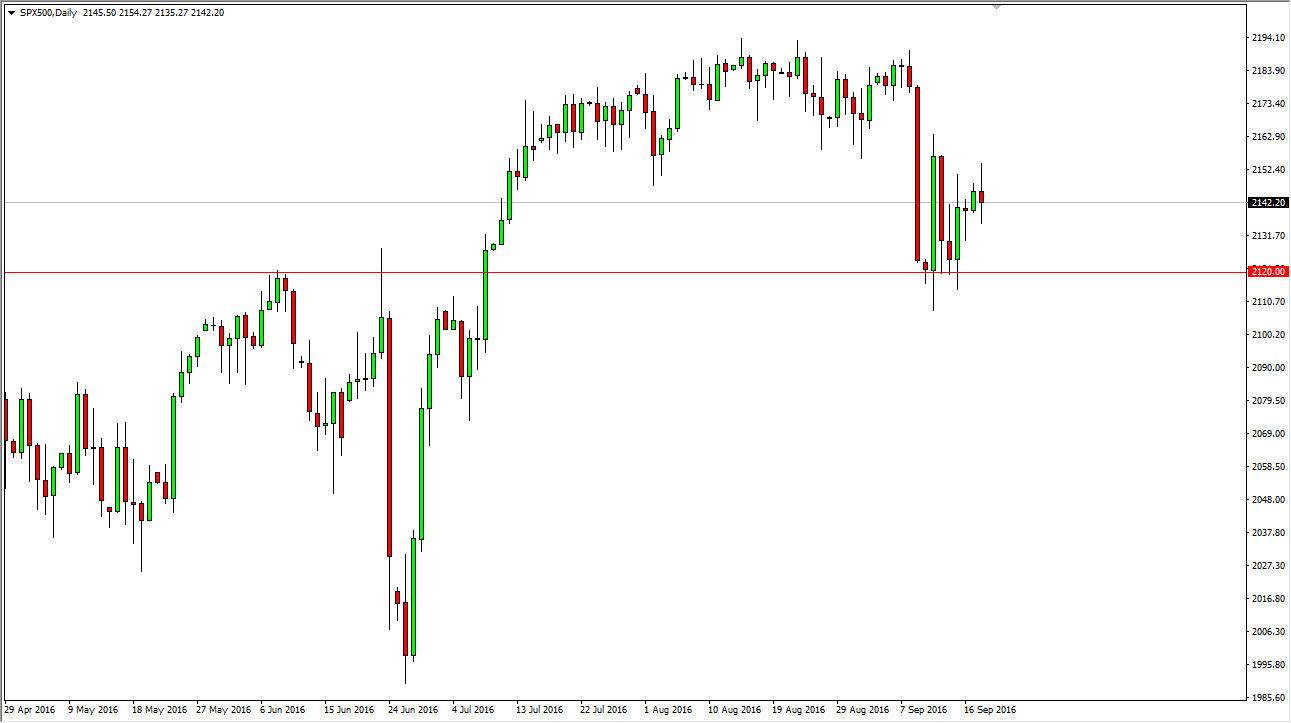

S&P 500

The S&P 500 went back and forth during the day on Monday, as we formed a very neutral looking candle. Ultimately, I believe that this market is consolidating overall but I do see a massive amount of support near the 2120 handle. Because of this, I am more than willing to buy short-term pullbacks to show any signs of support whatsoever. A break above the 2160 handle has us going into the next consolidation area, meaning that we will more than likely target the 2190 handle. With this, I am expecting this market to continue to rise, and given enough time I also think that it will not only break out to the upside to continue to go as high as 2250 given enough time.

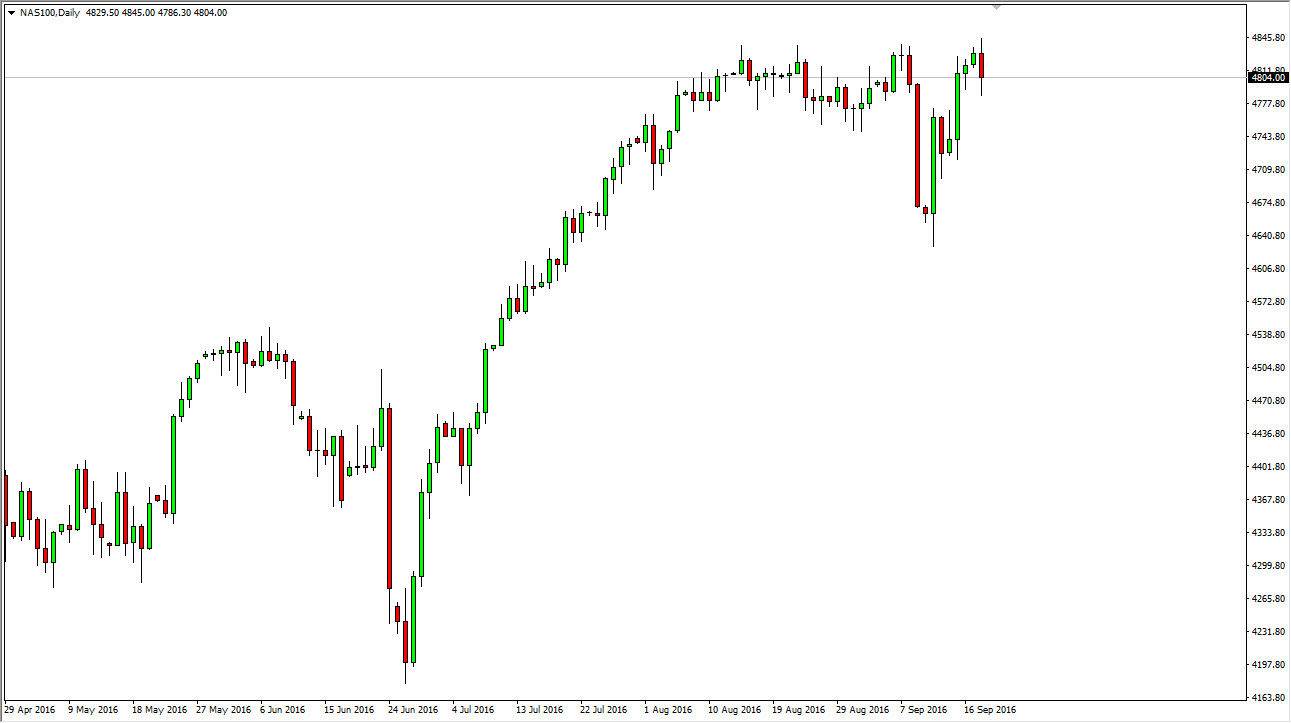

NASDAQ 100

I believe that the NASDAQ 100 has been running into a significant amount of resistance lately, and the candle that form during the day on Monday seems to acknowledge this. If we can break above the top of the range for Monday, I feel we break out and finally go to the 5000 level which is been my longer-term target. I believe that a supportive candle somewhere in this area could be a buying opportunity as well, and I have no interest whatsoever in selling the NASDAQ 100 as I believe that given enough time. It will have to invest in the stock market in this low interest-rate environment.

While it is true that simple bankers may suggests that we will have to see interest-rate rise sooner or later, the reality is that there doesn’t seem to be any political will to do so. With this being the case, I think it’s only a matter of time before the buyers return and that this sell off over the last .4 hours has simply been a buying opportunity once it’s all said and done.