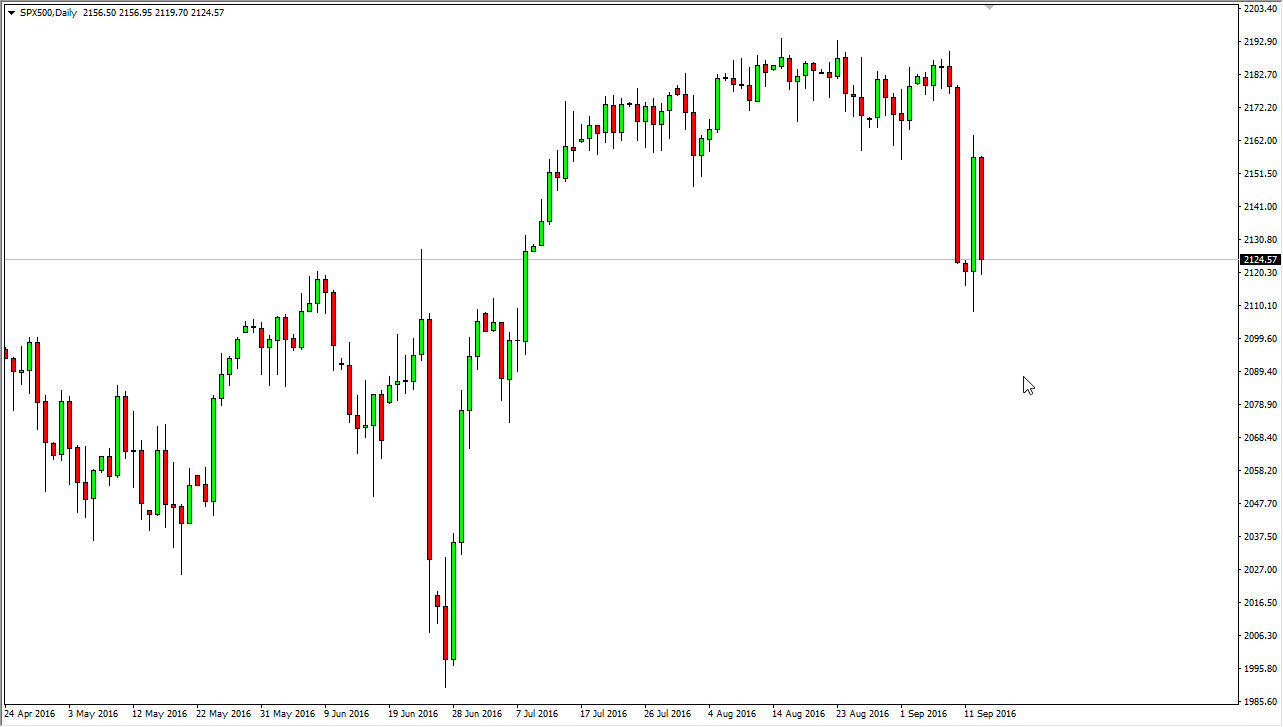

S&P 500

The S&P 500 initially fell during the course of the day but did find a little bit of support near the 2120 handle. Ultimately though it is a market that seems to be consolidating overall, so I believe that there are buyers below that will eventually turn this market back around to some type of supportive candle will present itself, we see that I take advantage of and start buying. Ultimately, this is a market that should continue to go much higher, but there will be a lot of volatility between now and then. That being the case, the market looks as if it is very supported near the 2100 level, and as a result I feel it will act as a “floor” going forward. With this being the case, the market should continue to find buyers again and again.

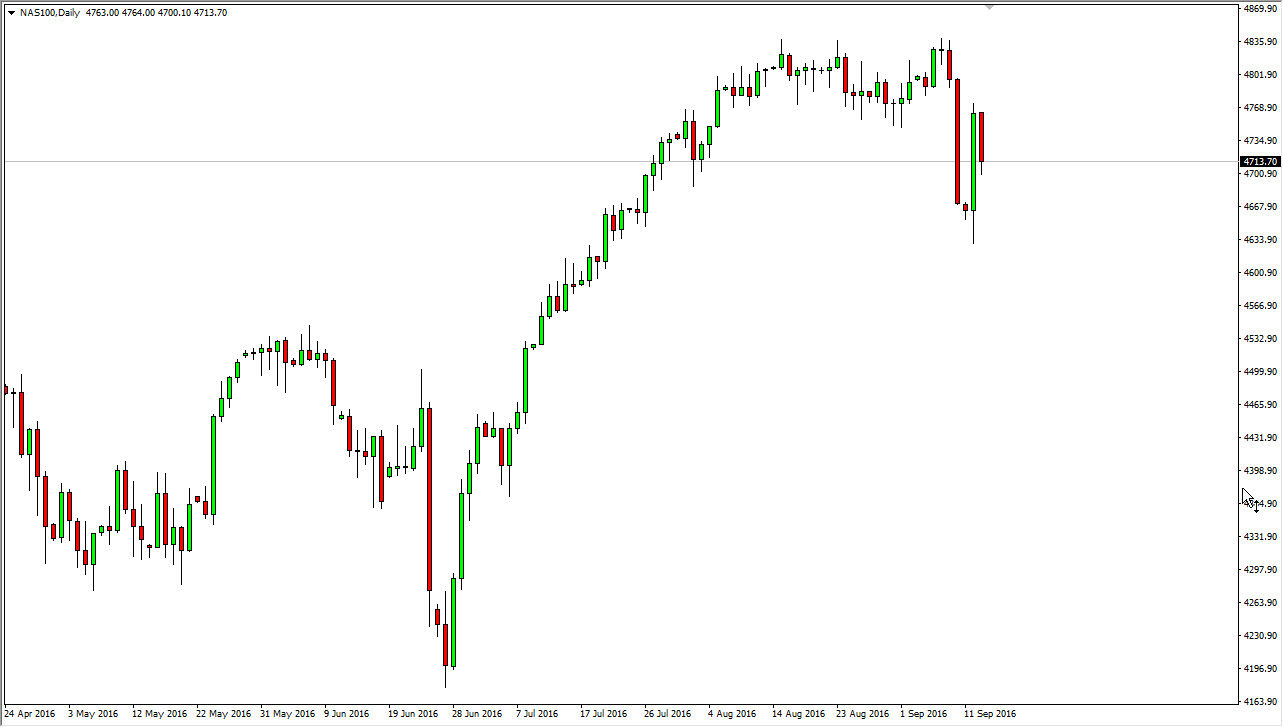

NASDAQ 100

The NASDAQ 100 fell during the course of the session on Tuesday, but found the 4700 level be somewhat supportive. Ultimately, this is a market that should continue to go higher but will probably be very choppy in the meantime. Ultimately, this is a market that should then reach towards the 4800 and as a result it’s likely that we will eventually reach towards the 5000 handle. Ultimately, this is a market that should continue to find buyers entering the market has we have been so bullish lately, and as a result I don’t really have any interest in selling because I believe that the overall attitude still remains the same even though we have a lot of concern when it comes to the central banks.

Ultimately, I do believe that we will possibly break above the 5000 level, as we continue to be very bullish due to the fact that there are no real returns when it comes to the bond markets at the moment.