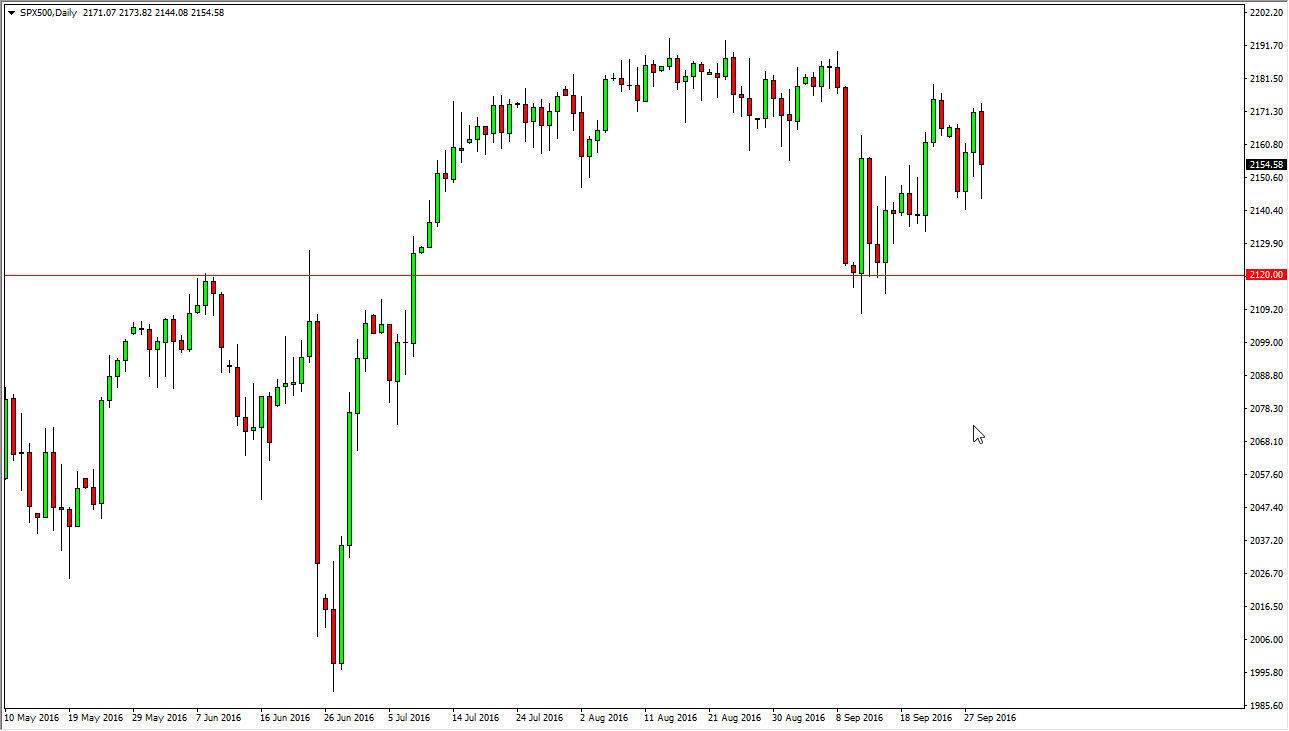

S&P 500

The S&P 500 fell rather drastically during the course of the session on Thursday, as we continue to find quite a bit of volatility. However, we did bounce a bit towards the end of the day, so it is possible that we are simply looking for value that we consider taking advantage of. I think short-term supportive candles may be reason enough to go long, and perhaps reach towards the 2200 level. With this being the case, it’s likely that the market is going to find buyers again and again, and although we see quite a bit of choppiness, I think it’s only a matter time before the bullishness returns. With this, I have no interest in selling this market until we break down below the 2120 level below, which is essentially the “floor” in this market.

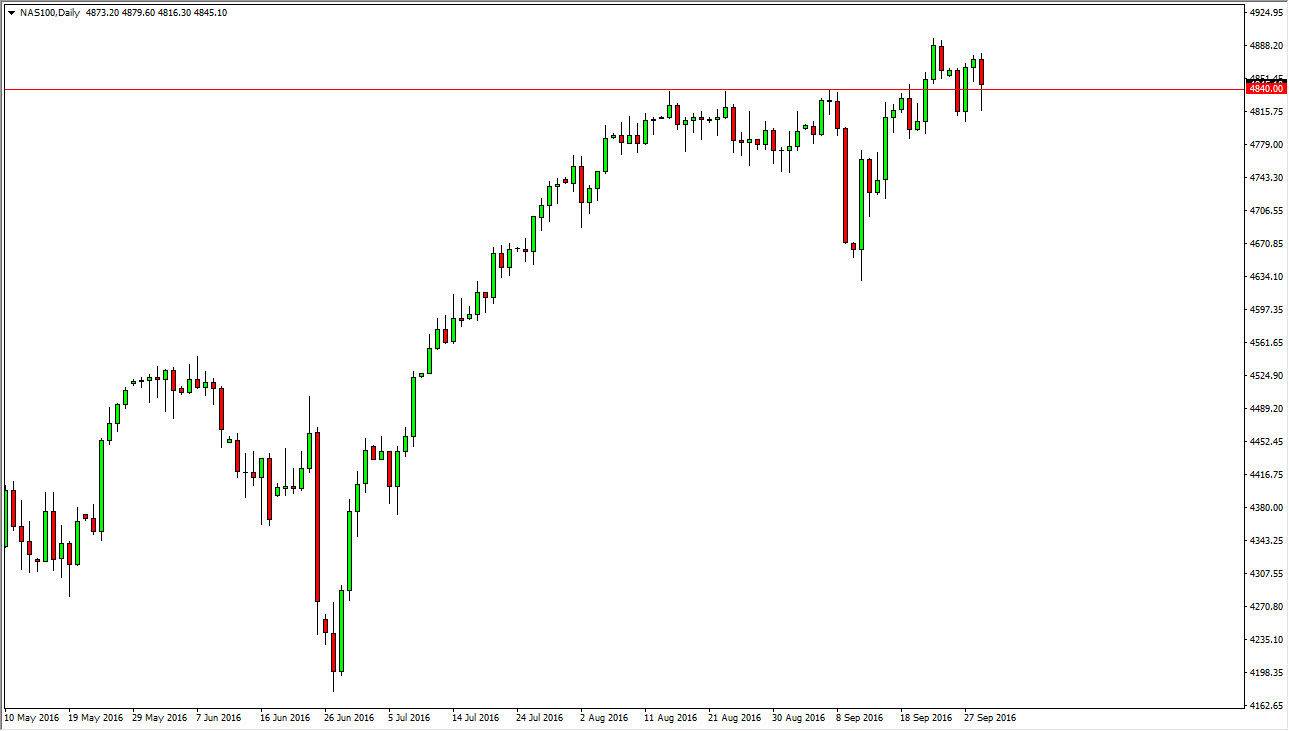

NASDAQ 100

The market fell rather significantly during the course of the session on Thursday as well, but we bounced around to form a bit of a hammer, and that of course is a very bullish sign. That being the case, the 4840 level been broken above and offering support yet again looks very bullish for this market. I think that buying is the only thing that you can do at this point in time, perhaps reaching towards the 5000 level. Ultimately, if we can break above there I think that the market will continue to go much higher and I do expect that to happen given enough time. On the other hand, if we managed to break down below the 4750 level would be a very negative sign. At that point, I would anticipate that the market within drop down to the 4625 level below, and then eventually down to the 4500 level after that as well. Having said that though, with the low interest-rate environment, the NASDAQ 100 could continue to be very bullish.