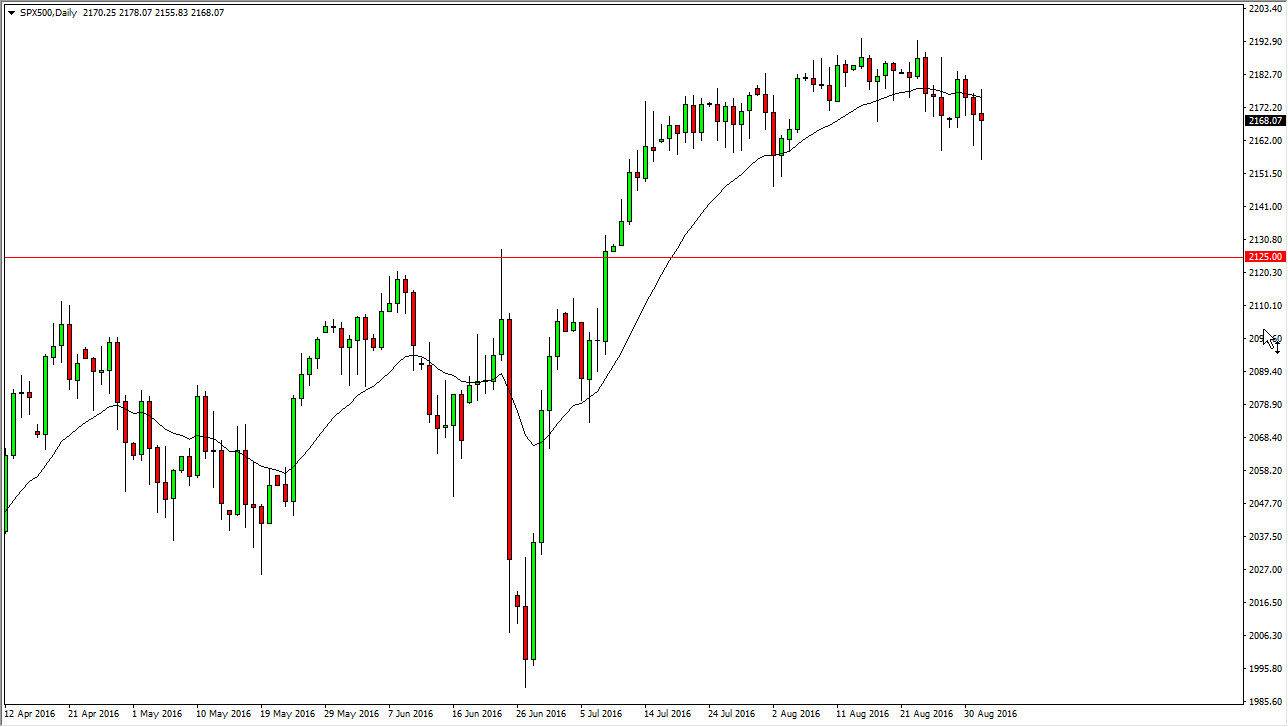

S&P 500

The S&P 500 had a very volatile session on Thursday, as we continue to bounce around in fairly thin markets. On top of that, you have to keep in mind that the jobs number comes out today so that of course has liquidity off a bit as most traders will be willing to put on heavy new positions ahead of that vital announcement. However, I’m the first to admit that a break above the top of the range for the Thursday session is very bullish, and could very well set the tone for the entire month of September as volumes pick back up after the vacation season. A break down below the bottom of the candle could be fairly negative, but I believe that there is essentially a “floor” in this market somewhere near the 2125 handle.

NASDAQ 100

The NASDAQ 100 initially fell during the day on Thursday but as you can see formed a hammer just as it did on Wednesday. I believe this market is trying to build up enough momentum to finally break above the 4800 level, and this could be the day it happens due to the jobs report. That’s a fairly strong jobs report, we will more than likely go higher. However, if it’s a fairly weak jobs report we probably will go higher eventually anyway. That would be because of quantitative easing still being the norm of the day, which of course is typically good for stock markets.

Even if we break down below the bottom of the hammer for the session on Thursday, I feel that there is more than enough support near the 4700 level to keep this market afloat. I believe the 4600 level is more of a floor than anything else, as there will be more than enough buyers just below that area due to the previous breakout. This jobs report is going to be a very significant announcement for the future of the NASDAQ 100.