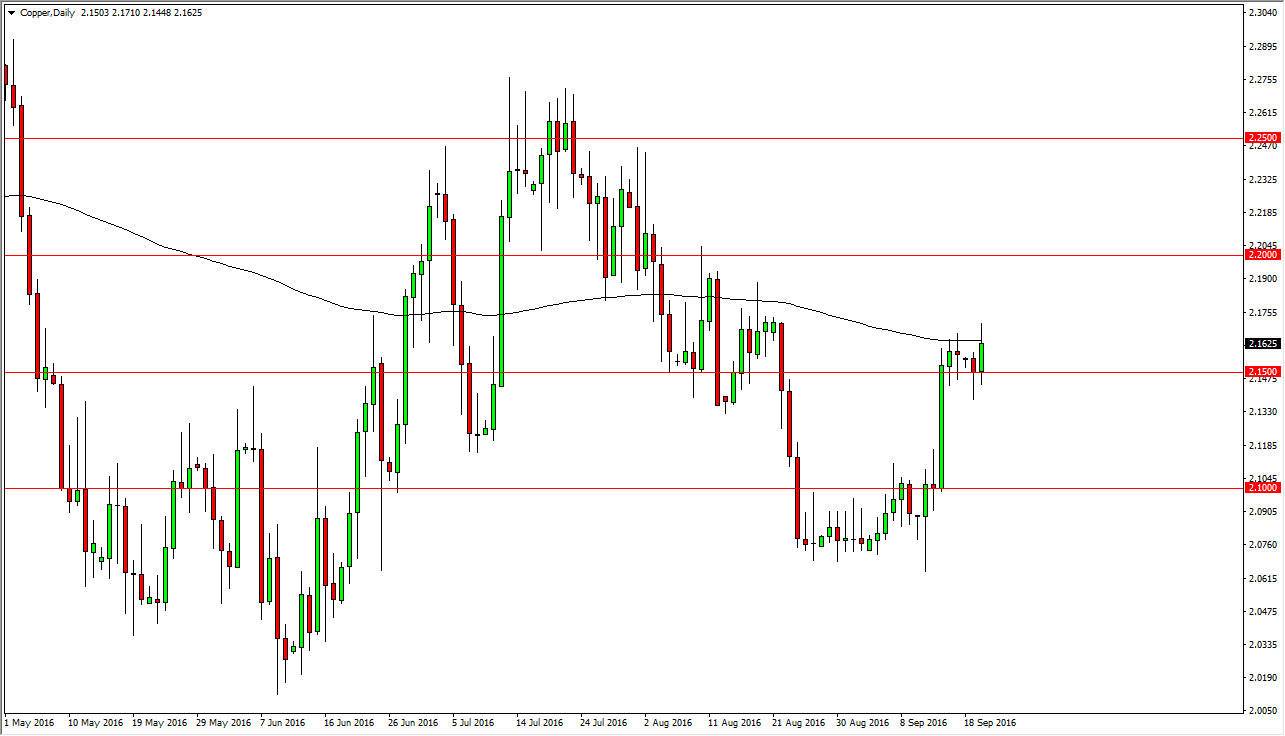

Copper markets got a bit of a jolt to the upside during the day on Tuesday, as we broke above the top of the hammer that formed on Monday. Because of this, I think that there is a buildup of bullish pressure at the moment. What I find interesting is that the hammer that had been broken above formed right at the $2.1500 level, and as a result I think that it makes sense that there’s a lot of psychological support here. On top of that, the market broke above the 200-day exponential moving average during the Tuesday session which of course is bullish as well. However, as we close for the session we are essentially sitting right at that level.

Longer-term signal?

The 200-day exponential moving average is used by longer-term traders quite often in order to figure out where a markets going. This is a long-term type of trading that I’m talking about at the moment, and as a result I think that the next couple of days won’t necessarily be indicative of what’s going to happen. However, I do recognize that a break above the top of the range for the day on Tuesday probably sends this market looking for at least the $2.2000 level over the course of the next couple of weeks.

What I find interesting about this chart is that copper typically signifies how the overall economic growth of the world is going. For example, Copper is used in just about every building project around the world, and tends to be hypersensitive to what goes on in Asia. If there is massive building going on in places like China and Indonesia, typically there is high demand for copper. Because of this, I think this shows that the market participants are starting to feel a little bit more bullish, where the very least are willing to buy “stuff”, as there is no real return as far as interest is concerned. I believe that we are going higher but recognize if we break down below the bottom of the hammer from the Monday session, that would probably send this market looking for support somewhere closer to the $2.1000 level.